- Japan

- /

- Food and Staples Retail

- /

- TSE:9956

Valor Holdings (TSE:9956): Assessing Valuation After Strong Half-Year Results and Operational Gains

Reviewed by Simply Wall St

Valor Holdings (TSE:9956) reported financial results for the six months ending September, surprising the market with higher revenue and profit. The gains came from strong fresh food sales and improved cost efficiency.

See our latest analysis for Valor Holdings.

Shares of Valor Holdings have been gathering steam, jumping 3% in a single day and up over 40% year-to-date. This clear sign suggests that investors have taken notice of the company’s robust half-year results and its improved operating efficiency. The one-year total shareholder return is an impressive 51%, capping off a period of accelerating momentum driven by these operational gains.

If Valor’s recent surge got your attention, it’s a perfect moment to broaden your search and discover fast growing stocks with high insider ownership

But with Valor’s shares climbing over 40% this year and already trading close to analyst targets, investors may be wondering if there is still real value left to unlock or if the stock is already pricing in future growth.

Price-to-Earnings of 11.4x: Is it justified?

With Valor Holdings trading at a price-to-earnings ratio of 11.4x, investors may be paying less for each unit of earnings compared to both direct industry peers and broader sector averages. At the last close price of ¥3,090, the stock aligns with good value territory.

The price-to-earnings (P/E) ratio indicates how much investors are willing to pay for every yen of net income generated by Valor Holdings. It is a widely watched metric for consumer retailing businesses, where steady profits and predictable growth can support higher multiples. A lower P/E may imply the market expects modest growth, or is underestimating the company’s recent performance surge.

Compared to its direct peers, which on average trade at a P/E of 36.1x, and the broader consumer retailing industry at 13.1x, Valor Holdings stands out as attractively valued. The market is offering the company at a significant discount to both its fair P/E (16.3x) and sector norms. This suggests room for re-rating if recent earnings momentum continues.

Explore the SWS fair ratio for Valor Holdings

Result: Price-to-Earnings of 11.4x (UNDERVALUED)

However, slowing revenue growth or intensified competition could leave Valor Holdings vulnerable to a shift in investor sentiment, even with its recent strong performance.

Find out about the key risks to this Valor Holdings narrative.

Another View: SWS DCF Model Perspective

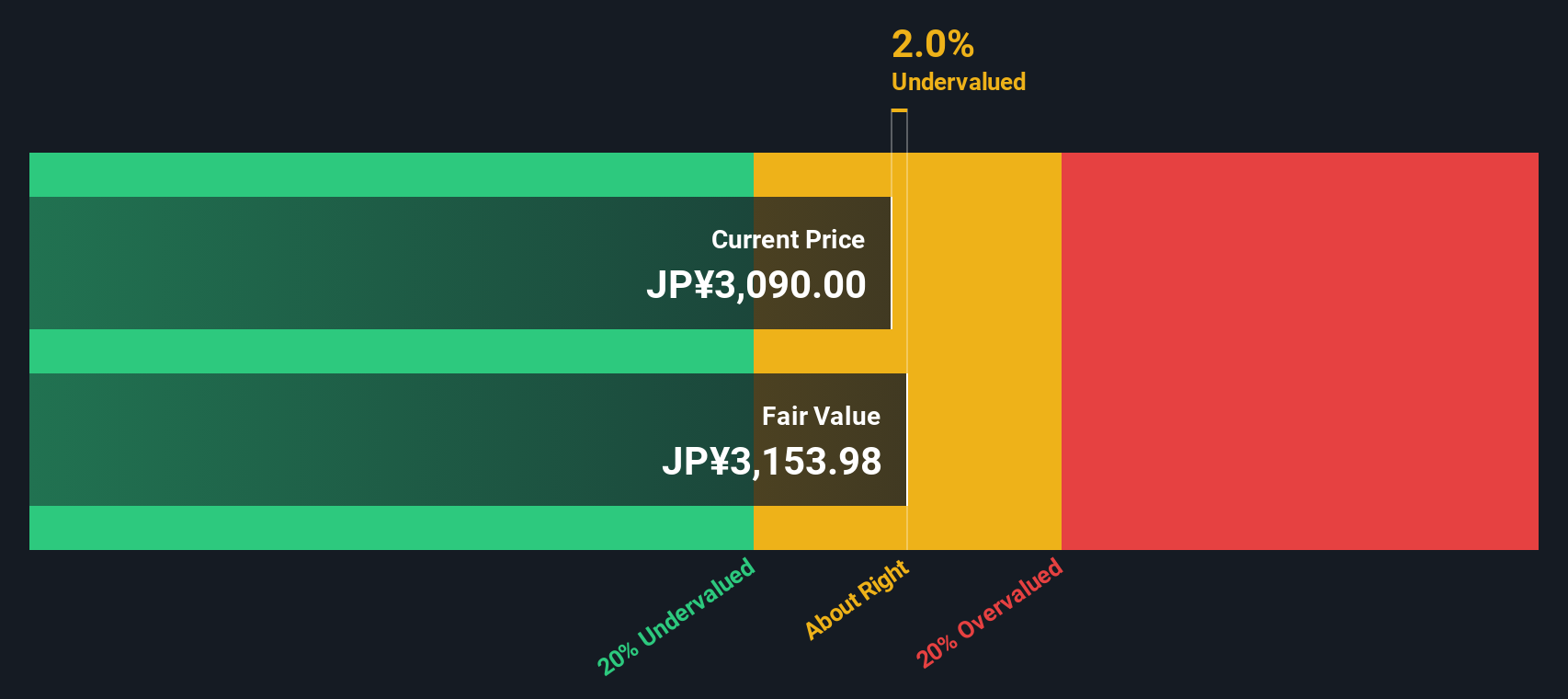

Looking beyond the earnings multiple, our SWS DCF model estimates Valor Holdings' fair value at ¥3,152, just a touch above the recent market price of ¥3,090. This positions the stock as only modestly undervalued, suggesting the market may already be recognizing much of its worth. Could this mean future upside is limited from here, or is this simply a pause before another rally?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Valor Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 879 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Valor Holdings Narrative

If you see the story differently or want to run your own numbers, you can easily build a personalized view in just a few minutes. Do it your way

A great starting point for your Valor Holdings research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

You do not have to settle for just one success story. Use Simply Wall Street’s powerful screener to uncover fresh opportunities you may be missing out on.

- Uncover high-yield opportunities and maximize your income by checking out these 16 dividend stocks with yields > 3% with yields above 3%. This can be a useful approach for building steady returns.

- Catch emerging trends by reviewing these 25 AI penny stocks, which are pioneering innovations in artificial intelligence. Examples include advancements in machine learning and automation leadership.

- Secure your portfolio’s potential growth by scanning these 26 quantum computing stocks and get ahead in the race for quantum technology with companies developing next-level computing solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9956

Solid track record, good value and pays a dividend.

Market Insights

Community Narratives