- China

- /

- Auto Components

- /

- SHSE:601163

Triangle TyreLtd And 2 More Reliable Dividend Stocks For Your Portfolio

Reviewed by Simply Wall St

As global markets navigate the complexities of shifting trade policies and technological advancements, major indices like the S&P 500 have reached new heights, buoyed by optimism over potential tariff reductions and AI investments. Amidst this backdrop of economic activity and investor sentiment, dividend stocks remain a cornerstone for those seeking stable income in their portfolios. A good dividend stock often combines consistent payouts with resilience to market fluctuations, making them attractive options in today's dynamic environment.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.67% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.63% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.07% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.01% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.46% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.95% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.63% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.05% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.80% | ★★★★★★ |

Click here to see the full list of 1964 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Triangle TyreLtd (SHSE:601163)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Triangle Tyre Co., Ltd is involved in the research, development, design, manufacture, and marketing of tire products in China with a market cap of CN¥12.28 billion.

Operations: Triangle Tyre Co., Ltd generates revenue primarily from its tire industry segment, amounting to CN¥10.16 billion.

Dividend Yield: 4.4%

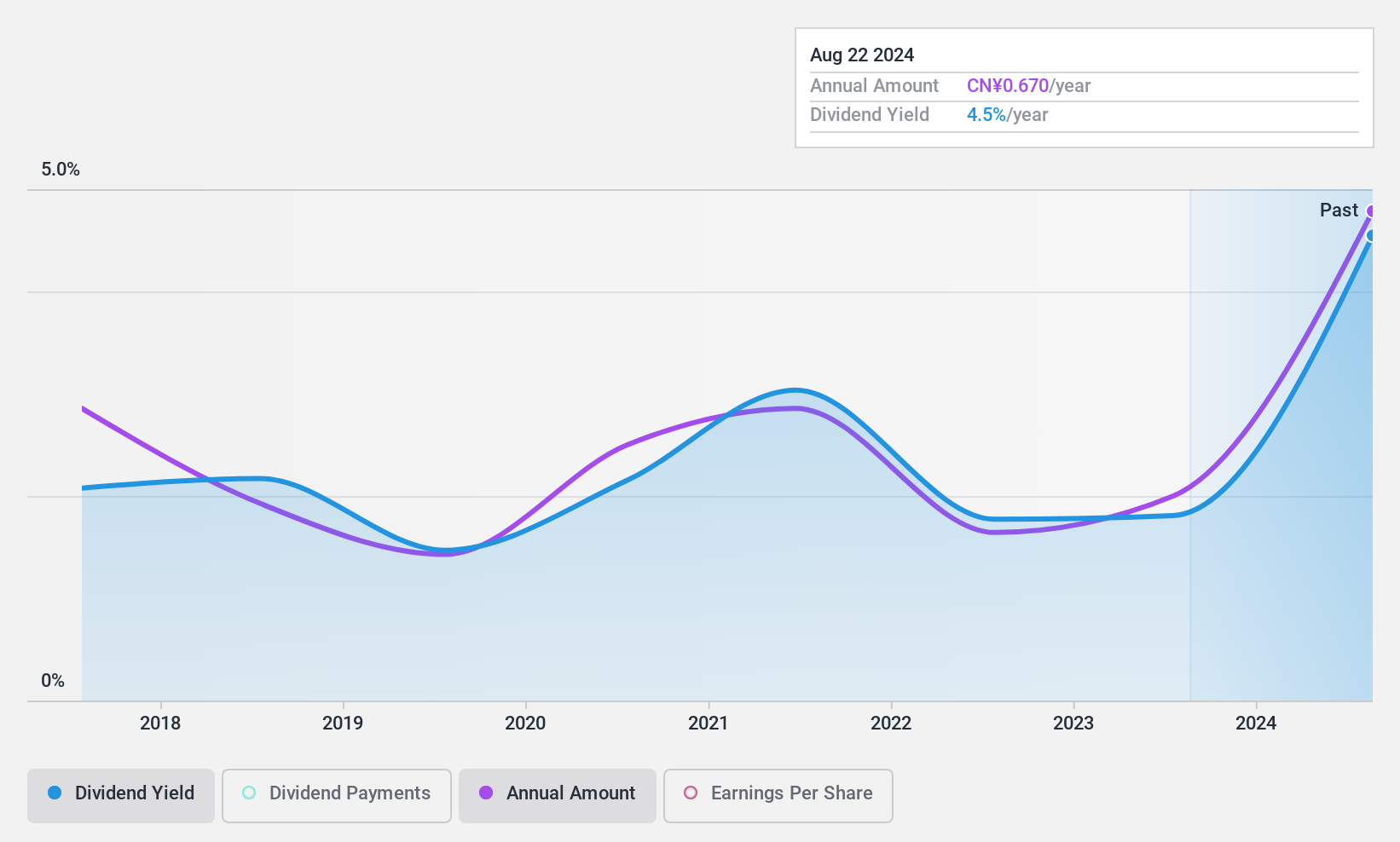

Triangle Tyre Ltd offers a dividend yield of 4.36%, placing it in the top 25% of dividend payers in China. Its dividends are well-covered by earnings and cash flows, with payout ratios of 43.8% and 55.6%, respectively, suggesting sustainability. However, the company's dividend history is less reliable, having been volatile over its eight-year payment period. Recent earnings show a decline in net income to CNY 883.56 million for nine months ending September 2024 from CNY 1,057.45 million previously.

- Click here and access our complete dividend analysis report to understand the dynamics of Triangle TyreLtd.

- Upon reviewing our latest valuation report, Triangle TyreLtd's share price might be too pessimistic.

GSI Creos (TSE:8101)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: GSI Creos Corporation operates globally, providing textiles and industrial products, with a market cap of ¥26.79 billion.

Operations: GSI Creos Corporation's revenue is primarily derived from its Fiber segment at ¥90.86 billion, followed by Outer at ¥19.72 billion, Chemical at ¥12.89 billion, Underwear at ¥12.03 billion, Hobby & Life at ¥5.52 billion, Semiconductor at ¥9.24 billion, and Machinery & Equipment contributing ¥4.83 billion.

Dividend Yield: 4.1%

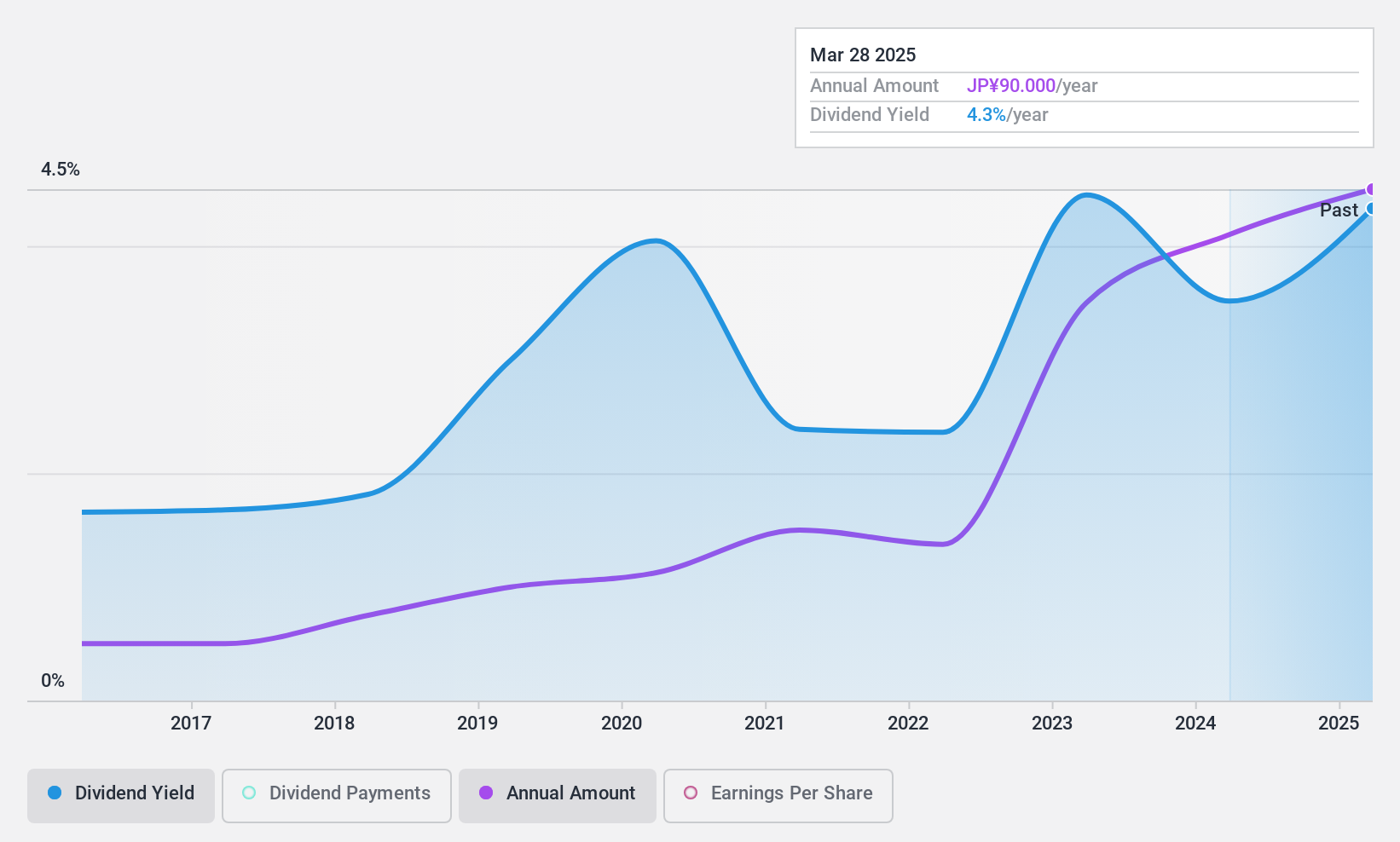

GSI Creos offers a 4.12% dividend yield, ranking in the top 25% of Japanese dividend payers. Despite a stable and growing dividend history over the past decade, sustainability is questionable due to a high cash payout ratio (6903.8%), indicating dividends are not well-covered by free cash flows. However, with a reasonable earnings payout ratio (52%), dividends are covered by earnings, providing some reassurance for investors focused on income stability.

- Click here to discover the nuances of GSI Creos with our detailed analytical dividend report.

- The analysis detailed in our GSI Creos valuation report hints at an inflated share price compared to its estimated value.

Valor Holdings (TSE:9956)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Valor Holdings Co., Ltd. operates supermarkets and home centers in Japan, with a market cap of ¥114.50 billion.

Operations: Valor Holdings Co., Ltd.'s revenue segments include the Supermarket Business at ¥474.33 billion, Drug Store Business at ¥174.80 billion, Home Center Business at ¥128.72 billion, Distribution Related Business at ¥56.23 billion, and Sports Club Business at ¥11.43 billion.

Dividend Yield: 3.1%

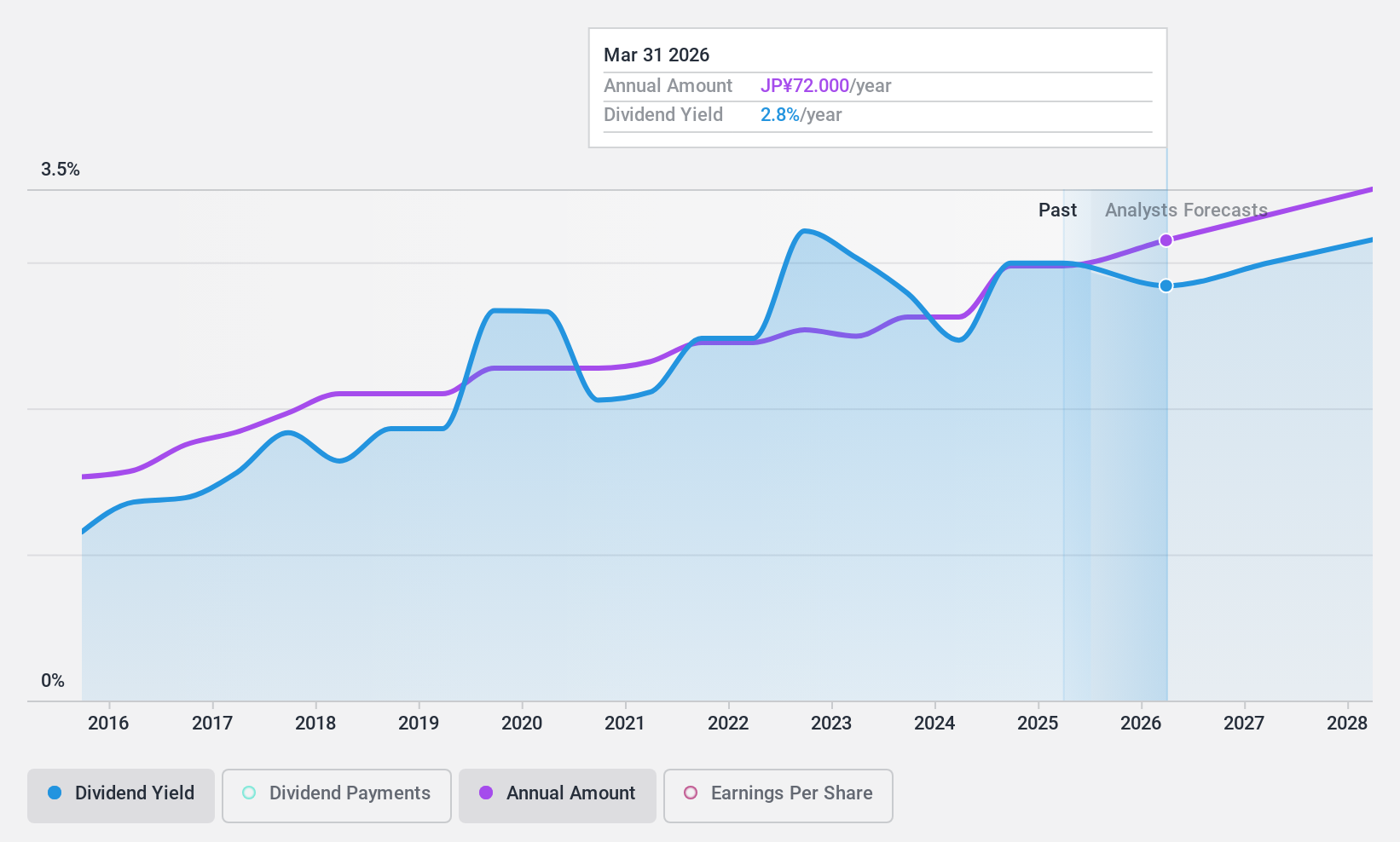

Valor Holdings' dividend payments have been stable and growing over the past decade, supported by a low payout ratio of 29.3%, ensuring coverage by earnings and cash flows. Although its 3.13% yield is below top-tier Japanese payers, it trades at good value relative to peers. Recent announcements indicate an increase in dividends for the fiscal year ending March 2025, reflecting confidence in financial performance despite high debt levels.

- Get an in-depth perspective on Valor Holdings' performance by reading our dividend report here.

- According our valuation report, there's an indication that Valor Holdings' share price might be on the cheaper side.

Taking Advantage

- Unlock more gems! Our Top Dividend Stocks screener has unearthed 1961 more companies for you to explore.Click here to unveil our expertly curated list of 1964 Top Dividend Stocks.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Triangle TyreLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601163

Triangle TyreLtd

Engages in the research and development, design, manufacture, and marketing of tire products in China.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives