- Japan

- /

- Food and Staples Retail

- /

- TSE:9948

ARCS (TSE:9948): Valuation Insights as Board Reviews New Growth Investment and Cash Allocation Strategies

Reviewed by Simply Wall St

ARCS (TSE:9948) has caught investor attention following its recent notification of a board meeting scheduled to discuss a growth investment plan and a strategy focused on how the company allocates cash.

See our latest analysis for ARCS.

This focus on future growth has come amid strong momentum for ARCS shares, with a year-to-date share price return of 23.45%. Even more impressive, ARCS has delivered a 30.19% total shareholder return over the past year and 68.92% over three years. This signals that long-term investors have seen substantial gains.

If this renewed push for growth at ARCS has you thinking big, it could be worth exploring fast growing stocks with high insider ownership for more standout opportunities making headlines right now.

Yet with shares already up sharply, investors may be wondering if ARCS is currently undervalued, or if the recent gains mean the market has fully priced in the company's future growth prospects. Could there still be a buying opportunity?

Price-to-Earnings of 14.6x: Is it justified?

ARCS is currently trading at a price-to-earnings (P/E) ratio of 14.6x. This positions the share price above its industry average based on this metric, despite strong recent gains. The company's last close was ¥3,180, with performance supported by rising earnings and solid profitability metrics.

The price-to-earnings ratio gauges how much investors are willing to pay for a unit of current earnings. For ARCS, it reflects the market’s expectation of its near-term profit potential and how investors value its consistent, but moderate, earnings growth in the consumer retailing sector.

While ARCS appears expensive relative to the JP Consumer Retailing industry average P/E of 12.7x, its ratio still sits below the peer group average of 40.6x and well beneath our estimated fair ratio of 16.1x. This level suggests the market could be underestimating the company’s longer-term profit-generating ability, especially given ARCS’s quality earnings track record and recent acceleration in profit growth.

With the current P/E ratio below the fair value level estimated by our model, there may be room for a valuation adjustment if ARCS continues to outperform expectations. Explore the SWS fair ratio for ARCS

Result: Price-to-Earnings of 14.6x (UNDERVALUED)

However, ARCS’s premium may not last if earnings growth slows or if the stock fails to meet its already elevated market expectations.

Find out about the key risks to this ARCS narrative.

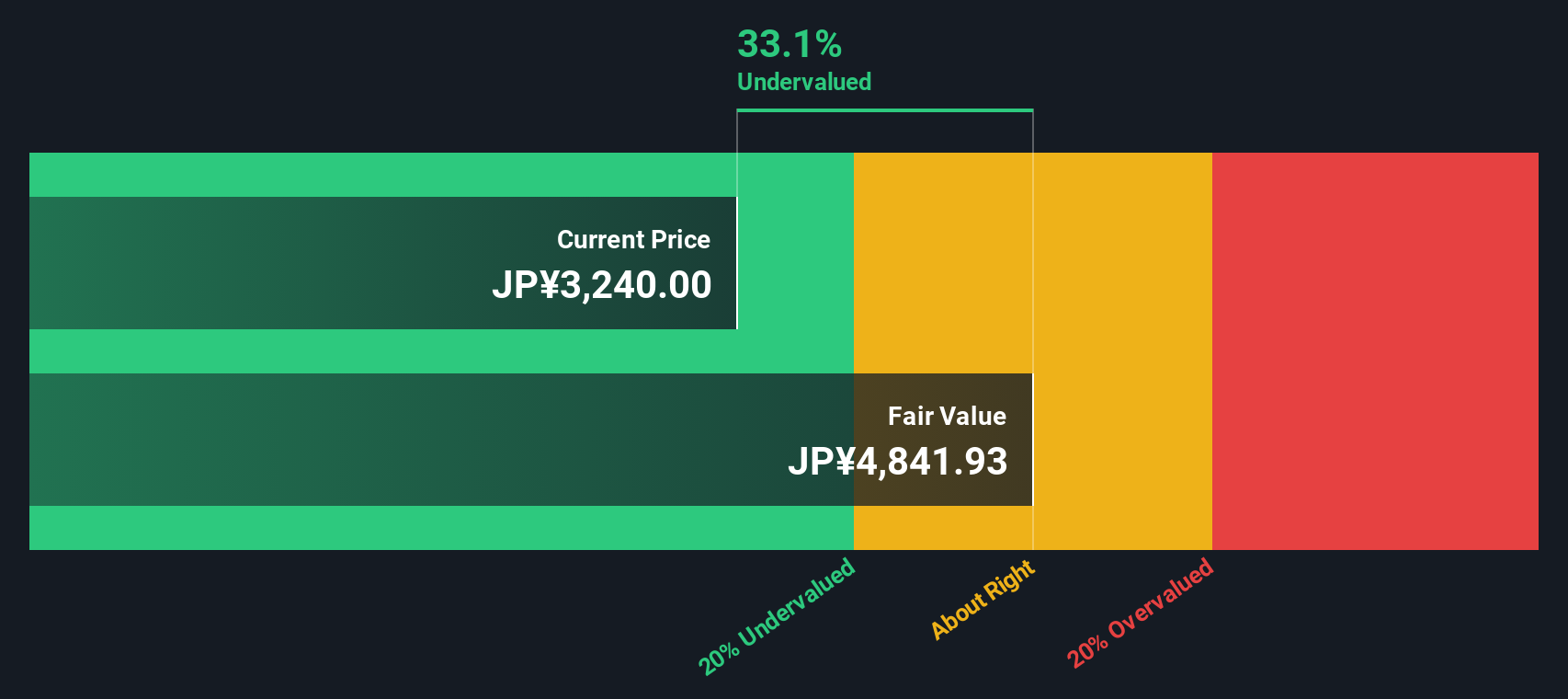

Another View: Discounted Cash Flow Says Shares Look Even Cheaper

While price-to-earnings multiples suggest ARCS could be undervalued, our SWS DCF model points to an even larger potential opportunity. This model estimates ARCS's fair value at ¥4,886.13, about 35% higher than today's share price. Is the market truly missing something here, or is it being cautious for good reason?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out ARCS for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 860 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own ARCS Narrative

Readers who want to dig deeper or shape their own conclusions can put together a unique analysis in under three minutes and discover fresh insights. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding ARCS.

Looking for More Smart Investment Opportunities?

Expand your portfolio with unique stocks that suit your goals. Miss these ideas and you could be overlooking tomorrow’s outperformance across rising sectors.

- Uncover real growth potential by targeting these 860 undervalued stocks based on cash flows, which are poised to rebound on high cash flow and competitive edges.

- Strengthen your passive income by locking in value with these 17 dividend stocks with yields > 3%, offering yields above 3% and attractive financials.

- Step into the future as you access these 24 AI penny stocks, which are shaping industries with artificial intelligence and high-impact innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9948

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives