- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:5340

Exploring None's 3 Undiscovered Gems with Strong Foundations

Reviewed by Simply Wall St

As global markets navigate the uncertainties surrounding the incoming administration's policies and fluctuating interest rates, small-cap stocks have faced their own set of challenges, as evidenced by recent declines in indices like the Russell 2000. Despite these headwinds, investors continue to seek out opportunities with strong fundamentals that can weather economic shifts and policy changes. In this environment, identifying stocks with solid foundations becomes crucial for those looking to uncover potential growth stories amidst broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.08% | 22.33% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Compañía Electro Metalúrgica | 71.27% | 12.50% | 19.90% | ★★★★☆☆ |

| La Positiva Seguros y Reaseguros | 0.04% | 8.59% | 27.31% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Phoenix Mecano (SWX:PMN)

Simply Wall St Value Rating: ★★★★★★

Overview: Phoenix Mecano AG, with a market cap of CHF437.41 million, manufactures and sells components for industrial customers globally through its subsidiaries.

Operations: Phoenix Mecano generates its revenue primarily from three segments: Enclosure Systems (€218.16 million), Industrial Components (€197.28 million), and Dewertokin Technology Group (€348.00 million).

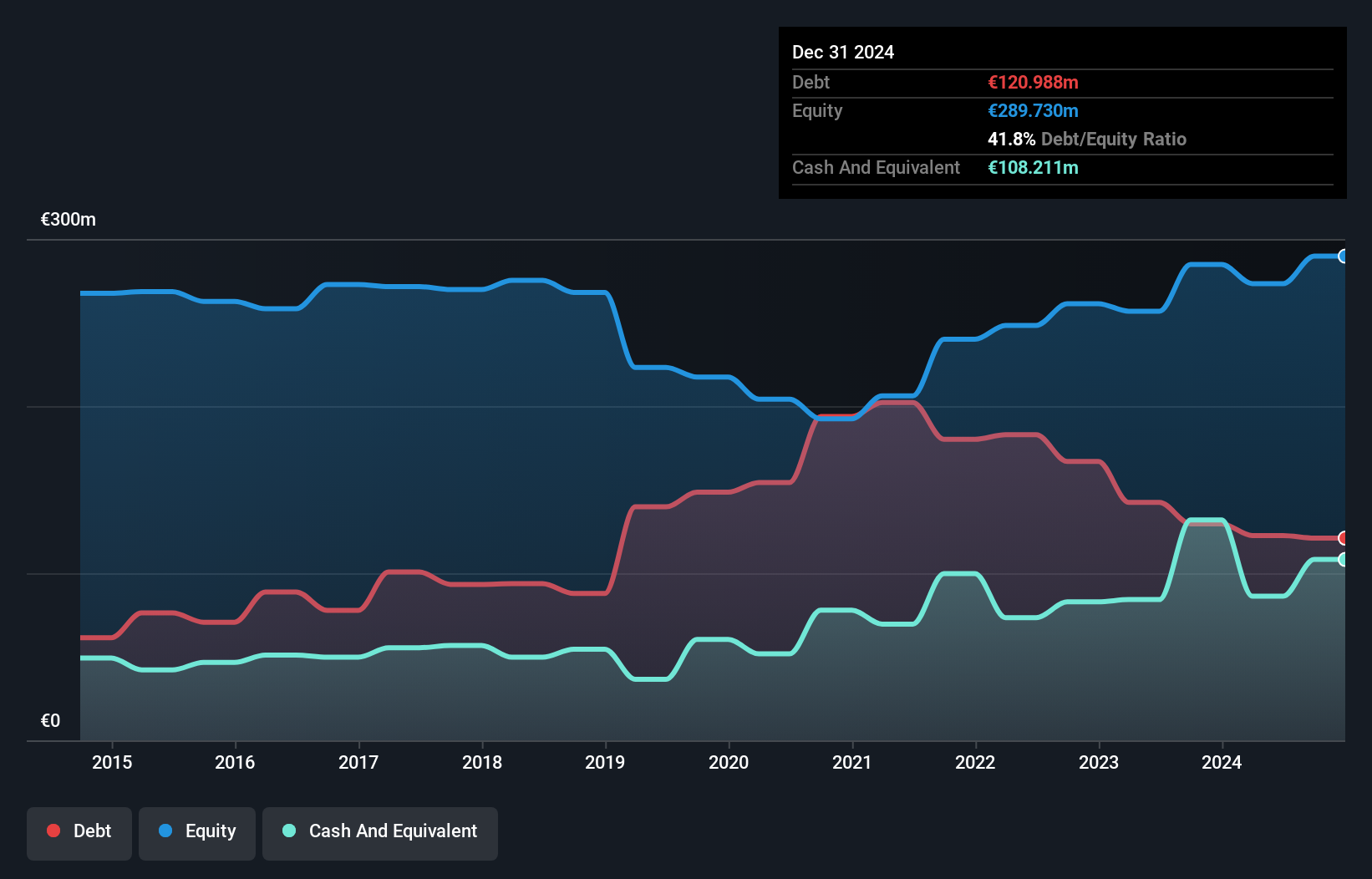

Phoenix Mecano, a nimble player in the electrical sector, has demonstrated resilience with earnings growth of 0.7% over the past year, outpacing the industry's -12.7%. Its price-to-earnings ratio stands at 11.1x, considerably lower than the Swiss market average of 19.7x, suggesting it trades at a favorable valuation compared to peers. The company has successfully reduced its debt-to-equity ratio from 62.6% to 44.8% over five years and maintains satisfactory net debt levels at 13.3%. With interest payments well-covered by EBIT (28.8x), Phoenix Mecano appears financially robust and poised for potential growth opportunities ahead.

- Unlock comprehensive insights into our analysis of Phoenix Mecano stock in this health report.

Gain insights into Phoenix Mecano's historical performance by reviewing our past performance report.

Baotek Industrial Materials (TPEX:5340)

Simply Wall St Value Rating: ★★★★★★

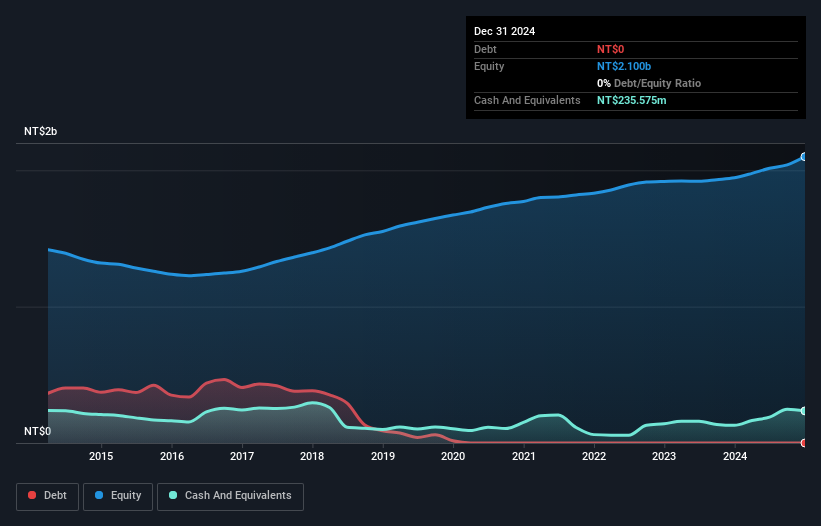

Overview: Baotek Industrial Materials Ltd. focuses on the R&D, manufacturing, and sales of electronic and industrial glass fiber products across Taiwan, China, Japan, the United States, and other international markets with a market cap of NT$8.15 billion.

Operations: Baotek Industrial Materials generates revenue from the sale of electronic and industrial glass fiber products across various international markets. The company's cost structure includes expenses related to research, development, and manufacturing processes. Its net profit margin has shown variability over recent periods, reflecting changes in operational efficiency and market conditions.

Baotek Industrial Materials, a small player in the electronic industry, has shown impressive earnings growth of 589.4% over the past year, significantly outpacing the industry's 9%. The company reported third-quarter sales of TWD 551.52 million, up from TWD 308.95 million last year, with net income reaching TWD 24.98 million compared to TWD 12.12 million previously. Earnings per share doubled to TWD 0.13 from TWD 0.06 a year ago for this quarter alone and for nine months reached an impressive TWD 0.49 from just TWD 0.06 last year, indicating strong operational performance despite recent share price volatility.

Genky DrugStores (TSE:9267)

Simply Wall St Value Rating: ★★★★★☆

Overview: Genky DrugStores Co., Ltd. operates a chain of drug stores and has a market capitalization of ¥94.52 billion.

Operations: Genky DrugStores generates revenue primarily through its chain of drug stores. The company has a market capitalization of ¥94.52 billion.

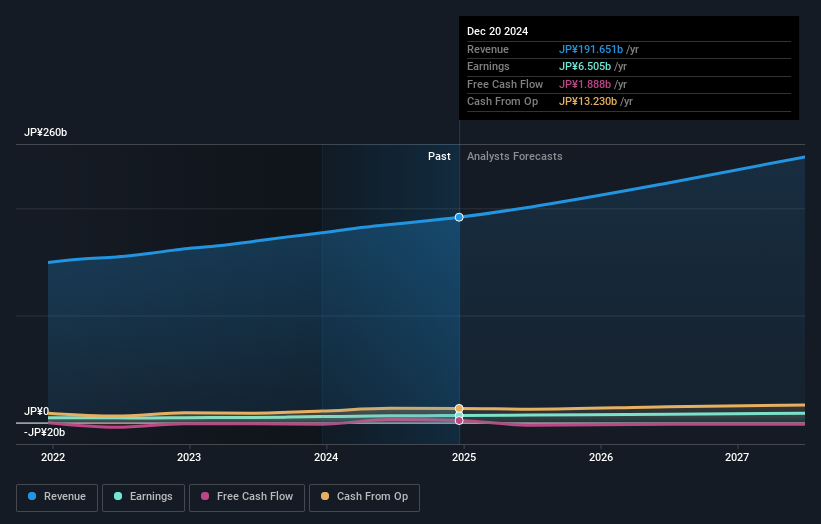

Genky DrugStores, a nimble player in the retail sector, has demonstrated impressive growth with earnings rising 26.6% over the past year, outpacing the Consumer Retailing industry average of 14.1%. The company's debt to equity ratio improved significantly from 95.3% to 72.3% in five years, showcasing better financial management despite a still high net debt to equity ratio of 54.1%. Its interest payments are comfortably covered by EBIT at a robust 59.8x coverage, indicating solid operational efficiency. Recent sales figures reflect steady momentum with all store net sales increasing by approximately 110% in October compared to last year’s figures.

- Take a closer look at Genky DrugStores' potential here in our health report.

Explore historical data to track Genky DrugStores' performance over time in our Past section.

Next Steps

- Discover the full array of 4627 Undiscovered Gems With Strong Fundamentals right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Baotek Industrial Materials might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:5340

Baotek Industrial Materials

Manufactures and sells fiberglass fabrics for copper clad laminates of various electronic applications in Taiwan, China, Japan, America, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives