- Japan

- /

- Food and Staples Retail

- /

- TSE:9259

Improved Earnings Required Before TAKAYOSHI Holdings, INC. (TSE:9259) Shares Find Their Feet

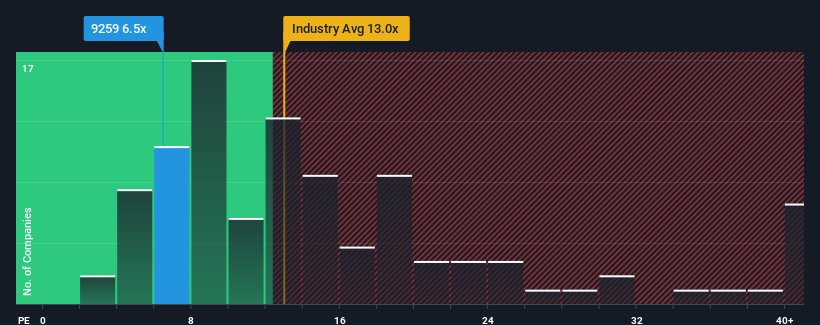

TAKAYOSHI Holdings, INC.'s (TSE:9259) price-to-earnings (or "P/E") ratio of 6.5x might make it look like a strong buy right now compared to the market in Japan, where around half of the companies have P/E ratios above 14x and even P/E's above 21x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

Recent earnings growth for TAKAYOSHI Holdings has been in line with the market. One possibility is that the P/E is low because investors think this modest earnings performance may begin to slide. If not, then existing shareholders have reason to be optimistic about the future direction of the share price.

Check out our latest analysis for TAKAYOSHI Holdings

How Is TAKAYOSHI Holdings' Growth Trending?

The only time you'd be truly comfortable seeing a P/E as depressed as TAKAYOSHI Holdings' is when the company's growth is on track to lag the market decidedly.

Retrospectively, the last year delivered a decent 10% gain to the company's bottom line. However, this wasn't enough as the latest three year period has seen an unpleasant 30% overall drop in EPS. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Looking ahead now, EPS is anticipated to slump, contracting by 13% during the coming year according to the one analyst following the company. Meanwhile, the broader market is forecast to expand by 10%, which paints a poor picture.

With this information, we are not surprised that TAKAYOSHI Holdings is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Final Word

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that TAKAYOSHI Holdings maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It is also worth noting that we have found 2 warning signs for TAKAYOSHI Holdings (1 is significant!) that you need to take into consideration.

If these risks are making you reconsider your opinion on TAKAYOSHI Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if TAKAYOSHI Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:9259

Excellent balance sheet and good value.

Market Insights

Community Narratives