- Japan

- /

- Food and Staples Retail

- /

- TSE:8278

Fuji (TSE:8278) Valuation in Focus Following Divestment Move to Boost Capital Efficiency

Reviewed by Simply Wall St

Fuji (TSE:8278) announced plans to sell its entire stake in Aeon Kyushu. This move is specifically aimed at boosting capital efficiency and reinforcing its financial base. The company will share financial details once pricing is confirmed.

See our latest analysis for Fuji.

While the upcoming divestment marks a notable shift for Fuji, the market has taken a cautious stance lately. The company’s share price has slipped 4.8% since the start of the year and delivered a modest 1-year total shareholder return of -1.6%. Three-year returns remain positive. Investors appear to be weighing this new move as a potential turning point for future momentum.

If this kind of strategic shakeup has you curious about fresh opportunities, now is a perfect time to see what’s happening among fast growing stocks with high insider ownership.

With shares trading below intrinsic value, the big question now is whether Fuji is being overlooked by the market or if investors are already factoring in future growth prospects, which could leave little room for a bargain opportunity.

Price-to-Earnings of 43.3x: Is it justified?

Fuji's current share price reflects a price-to-earnings (P/E) ratio of 43.3x, which is notably higher than that of its selected peers. This steep valuation raises the question of whether investors are paying a premium for additional growth or stability that may not be immediately apparent in financial results.

The price-to-earnings ratio measures how much investors are willing to pay for each yen of earnings. In consumer retail, a higher ratio could indicate expectations for strong profit growth, superior business quality, or confidence in management's ability to drive future returns.

However, Fuji's P/E ratio is expensive not only compared to the peer average of 32.9x, but also when set against the broader Japanese Consumer Retailing industry average of just 13.4x. The current multiple could reflect optimism about an inflection point following the company’s recent divestment. In market terms, the valuation stands at a substantial premium to sector norms and may require significant outperformance or a clear narrative for continued support.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 43.3x (OVERVALUED)

However, sustained weak share price momentum or lackluster net income growth could undermine optimism and challenge the current valuation story for Fuji.

Find out about the key risks to this Fuji narrative.

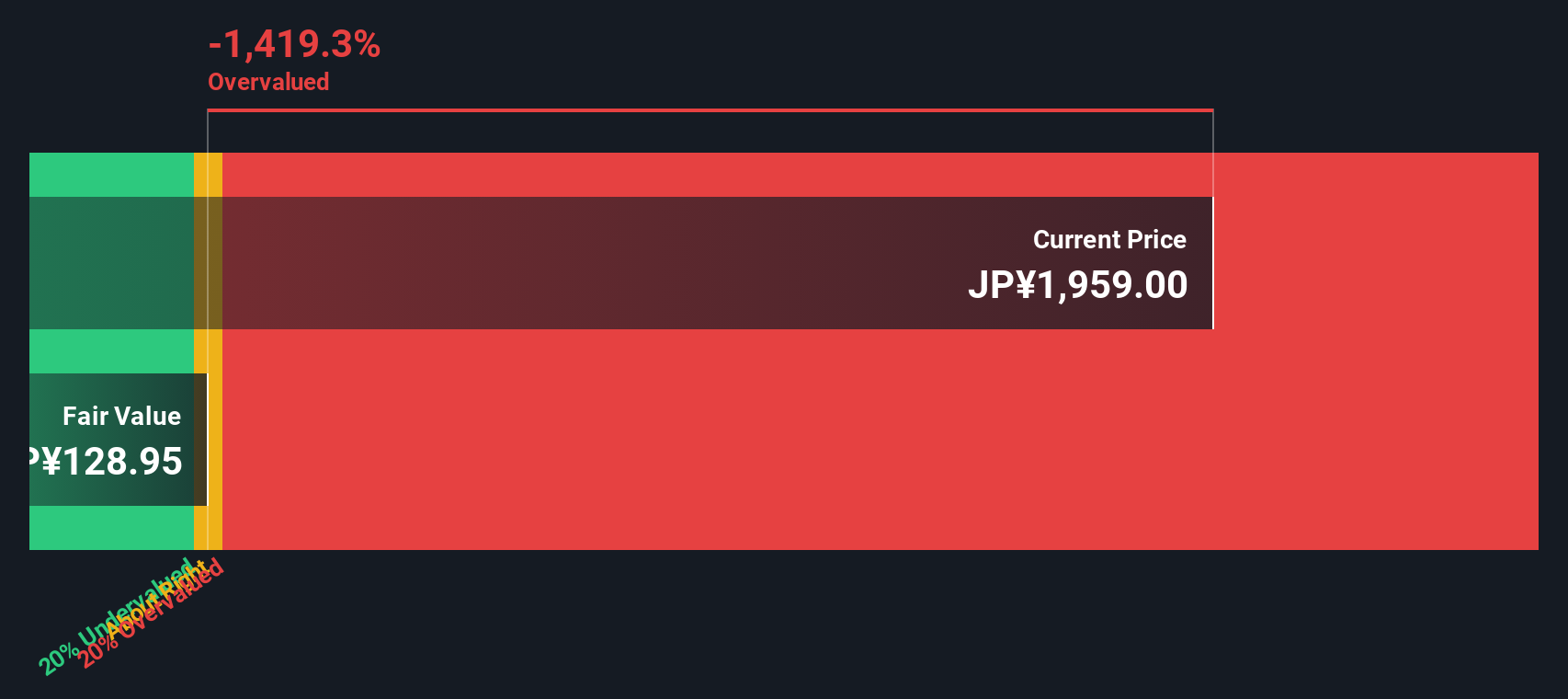

Another View: Discounted Cash Flow Signals Overvaluation

Taking a step back from earnings multiples, our DCF model suggests a sharply different story for Fuji. According to this calculation, the current share price is well above the estimated fair value. This indicates the stock may actually be overvalued. Could the optimism already be more than priced in?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Fuji for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 833 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Fuji Narrative

If you see Fuji’s story unfolding differently or want to take a hands-on approach, you can create your own analysis in just a few minutes. Do it your way.

A great starting point for your Fuji research is our analysis highlighting 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don't miss your shot at new opportunities; now is the ideal moment to find a stock that suits your unique strategy using the Simply Wall Street Screener.

- Accelerate your search for reliable income by checking out these 22 dividend stocks with yields > 3% with yields above 3% and a track record of payouts.

- Uncover early-stage innovation plays by analyzing these 26 AI penny stocks at the crossroads of artificial intelligence and exceptional growth potential.

- Strengthen your portfolio with value by reviewing these 833 undervalued stocks based on cash flows based on forward-looking cash flows and standout fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8278

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives