- Japan

- /

- Food and Staples Retail

- /

- TSE:7679

Yakuodo Holdings (TSE:7679) Margin Improvement Reinforces Bullish Narratives as Earnings Grow 14%

Reviewed by Simply Wall St

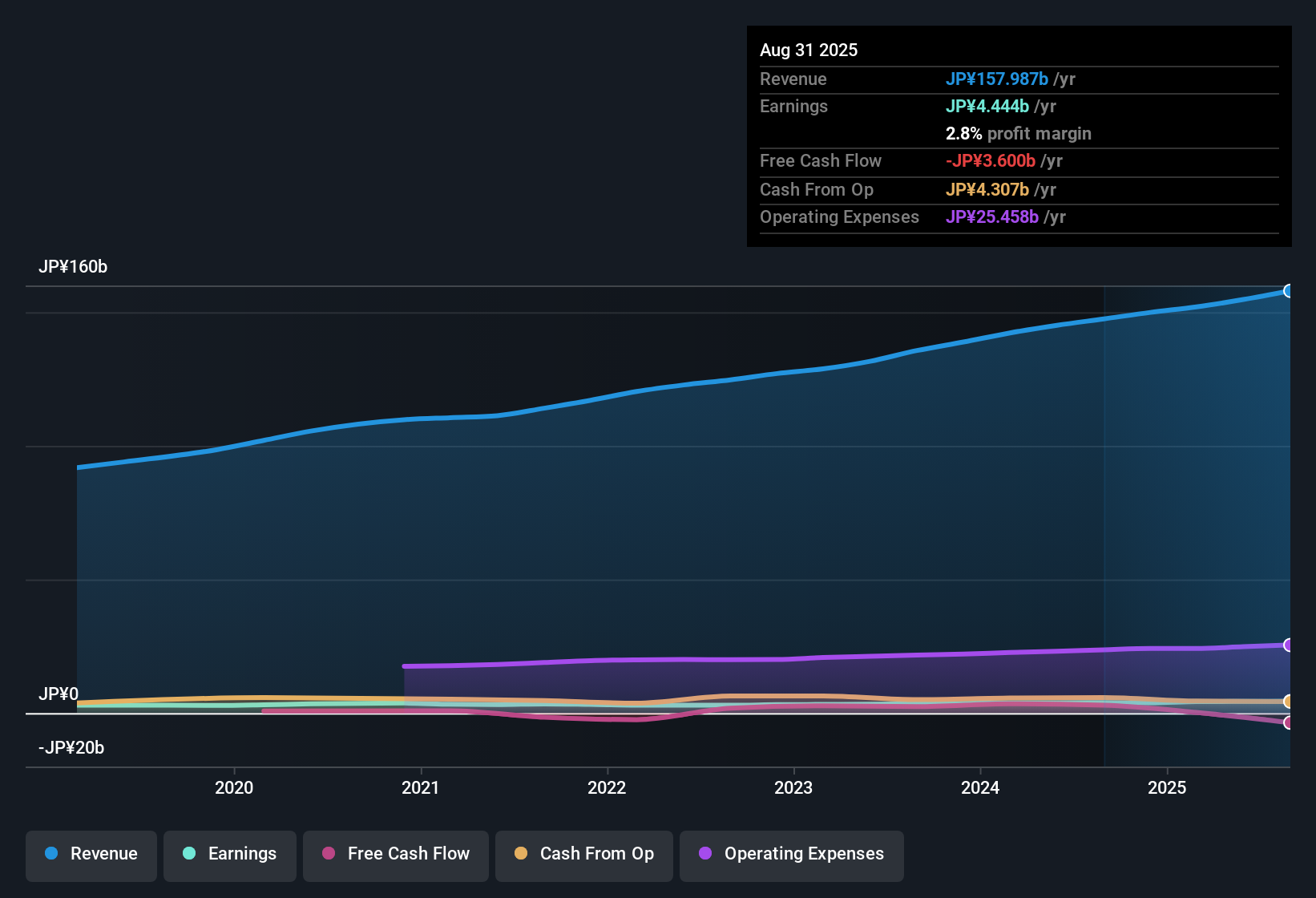

YAKUODO HOLDINGS (TSE:7679) posted earnings growth of 14% over the past year, with a five-year average annual rise of 6.8%. Net profit margin edged up to 2.8% from last year’s 2.6%, signaling a modest boost in profitability. The company’s Price-To-Earnings ratio of 9.5x remains below both the Japanese consumer retailing industry average of 13.7x and the peer group average of 22.5x. Investors are greeted with a profile of continued profit growth and margin improvement, all while the company appears to offer strong relative value and no notable risk warnings at this time.

See our full analysis for YAKUODO HOLDINGS.The numbers are impressive, but the real question is how they stack up against the key narratives investors watch. Let’s see where the consensus stands and what might surprise the market.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Edge Up to 2.8%

- Net profit margin reached 2.8%, a slight improvement from last year’s 2.6%. This underlines a steady climb in profitability even as sector peers have faced tighter margins.

- Momentum in profit margins provides support for the optimistic view that YAKUODO’s cost controls and operational efficiency are beginning to stand out among Japan’s drugstore operators.

- Strong comparative performance suggests management’s focus on profitability is gaining traction against intensifying industry competition.

- An emphasis on higher quality past earnings demonstrates resilience that many bullish observers argue is key to steady returns in retail.

P/E Ratio Undercuts Industry and Peers

- The company trades at a Price-To-Earnings ratio of 9.5x, noticeably below the Japanese consumer retailing industry average of 13.7x and the peer average of 22.5x. This points to a compelling discount for investors focused on value.

- This below-average valuation aligns with the prevailing analysis that YAKUODO’s solid earnings track record is not yet fully appreciated by the broader market.

- Good value status, despite ongoing profit growth, challenges a skeptical stance suggesting that such discounts always signal hidden risks.

- The absence of flagged operational or financial risks in the latest snapshot adds weight to assessments that the market may be overlooking the company’s upward trend.

Earnings Rise Steadily Over Five Years

- Annual earnings growth averaged 6.8% over the past five years and climbed 14% in the latest period, highlighting a consistent trend of expansion rather than a one-off spike.

- These growth rates reinforce confidence that YAKUODO is successfully navigating a maturing sector and adapting to market shifts, supporting views that its strategy yields durable improvement.

- Performance consistency, without corresponding risk warnings, creates an appealing backstory for investors seeking reliability in consumer retailing.

- Such multi-year stability often signals room for continued operational refinement and future upside, according to many sector-watchers.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on YAKUODO HOLDINGS's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While YAKUODO’s steady profit climb and value rating stand out, its margins and earnings expansion, though positive, remain only modest compared to high-growth sector peers.

Set your sights higher by using our high growth potential stocks screener to uncover companies expected to achieve much stronger forward earnings growth and outpace the competition.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7679

YAKUODO HOLDINGS

Through its subsidiaries, engages in drugstore business in Japan.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives