- Japan

- /

- Food and Staples Retail

- /

- TSE:417A

Could Blue Zones Holdings (TSE:417A) Stock Split Hint at a New Shareholder Engagement Strategy?

Reviewed by Sasha Jovanovic

- On November 10, 2025, Blue Zones Holdings Co., Ltd. held a board meeting to consider a stock split, partial amendment of its articles of incorporation, and revisions to its shareholder special benefit plan.

- This event signals potential changes to share structure and benefits that could alter investor perception and engagement moving forward.

- We’ll explore how the board’s review of shareholder special benefit adjustments could influence Blue Zones Holdings’ investment narrative.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Blue Zones HoldingsLtd's Investment Narrative?

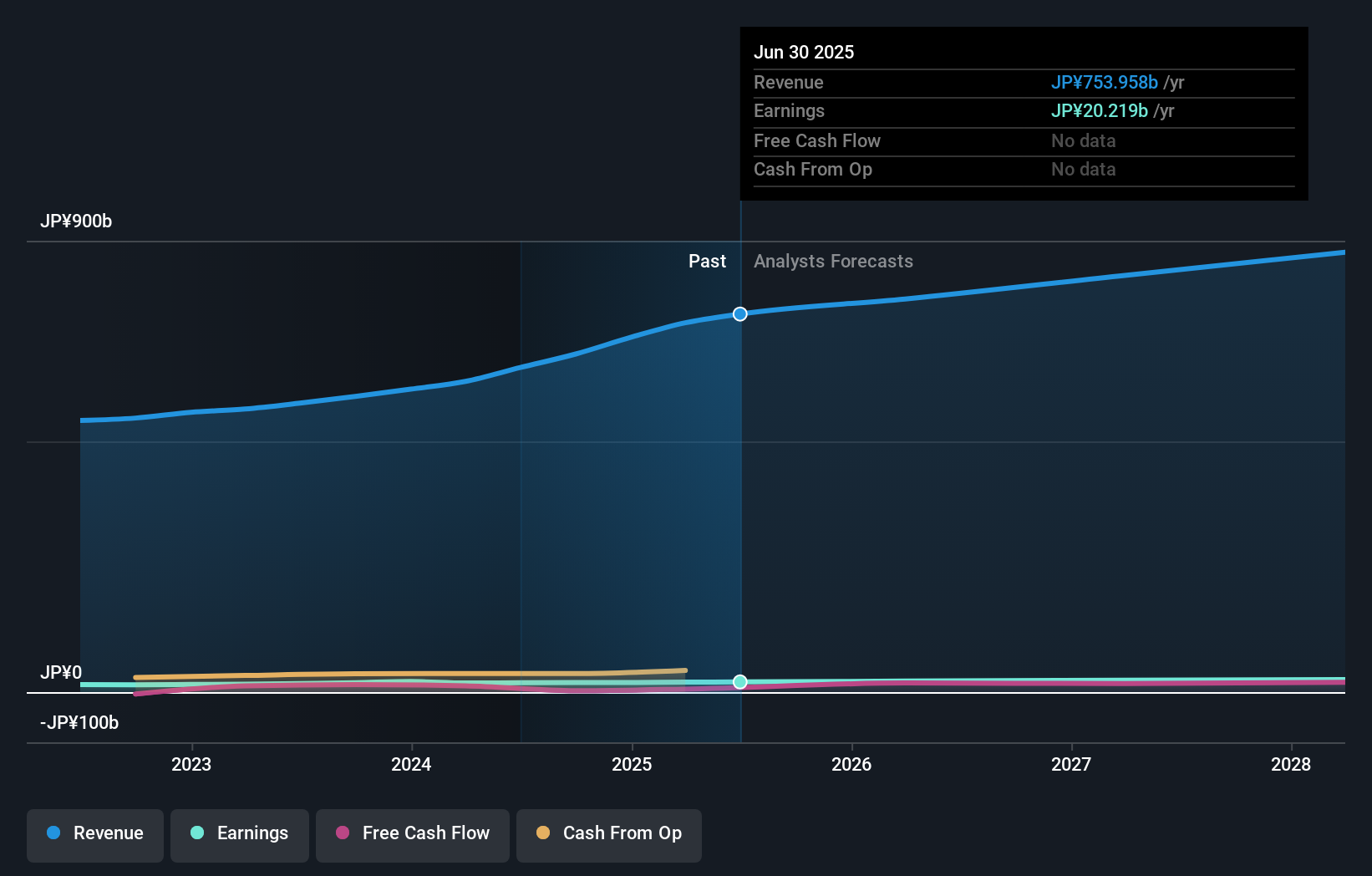

Investors looking at Blue Zones Holdings right now need to have confidence in its ability to deliver value from its recent structural changes, particularly as the company transitions to a holding company model and integrates subsidiaries like Yaoko. The latest board meeting to review a possible stock split and changes to the shareholder benefit plan could have near-term implications for liquidity and how existing shareholders perceive value, especially if the benefit changes are meaningful. However, based on current analysis and price movements, the immediate impact on the most important short-term catalysts, such as earnings growth and dividend policy, does not appear material just yet. Still, with modest growth forecasts, a low return on equity, and recent underperformance against both peers and the broader market, the biggest risk remains whether these ongoing restructurings can translate into real operational improvements or simply distract from growth priorities.

But with board independence still below optimal levels, governance risks shouldn’t be overlooked.

Blue Zones HoldingsLtd's shares have been on the rise but are still potentially undervalued by 47%. Find out what it's worth.

Build Your Own Blue Zones HoldingsLtd Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Blue Zones HoldingsLtd research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Blue Zones HoldingsLtd research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Blue Zones HoldingsLtd's overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Blue Zones HoldingsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:417A

Blue Zones HoldingsLtd

Engages in the operation of supermarkets in Japan.

Excellent balance sheet, good value and pays a dividend.

Market Insights

Community Narratives