- Japan

- /

- Food and Staples Retail

- /

- TSE:3391

Assessing Tsuruha Holdings (TSE:3391) Valuation Following Strong October 2025 Sales Growth

Reviewed by Simply Wall St

Tsuruha Holdings (TSE:3391) just shared its preliminary sales results for October 2025. All store net sales increased 5% year over year for the month, with a 4% rise for the year to date.

See our latest analysis for Tsuruha Holdings.

Momentum appears to be building fast for Tsuruha Holdings. Its consistent sales growth has caught the market’s eye, with a 9.4% share price return over the past month adding to a remarkable year-to-date gain of 63.3%. Long-term holders have also benefited, with the one-year total shareholder return standing at 76.5%. These numbers suggest investors are reacting positively to both recent performance and the company's longer-term progress.

If you’re looking to spot more opportunities sparked by strong growth trends, now’s a good moment to explore fast growing stocks with high insider ownership.

With momentum and price gains accelerating, the big question becomes whether Tsuruha Holdings remains undervalued at current levels, or whether the market has already priced in all the company’s future growth potential.

Price-to-Earnings of 44x: Is it justified?

With Tsuruha Holdings trading at a price-to-earnings ratio of 44x, the stock’s valuation stands well above its peers and industry benchmarks, raising questions about the growth being priced in versus near-term reality at the recent ¥2,780.5 closing price.

The price-to-earnings (P/E) ratio indicates how much investors are paying for each yen of current earnings, often used to compare valuations across consumer retail companies. Elevated P/E levels can sometimes signal strong future growth expectations, but may also suggest over-optimism if not supported by earnings potential.

In Tsuruha Holdings’ case, the P/E of 44x is more than double the peer average of 21.4x and over three times the JP Consumer Retailing industry average of 13x. Even when compared to the company's own fair price-to-earnings ratio (25.1x), the market price remains significantly higher. This is a level investors could expect to revert toward if growth slows or sentiment shifts.

Explore the SWS fair ratio for Tsuruha Holdings

Result: Price-to-Earnings of 44x (OVERVALUED)

However, risks such as a sharp slowdown in earnings growth or a negative shift in market sentiment could quickly challenge the company's premium valuation.

Find out about the key risks to this Tsuruha Holdings narrative.

Another View: Discounted Cash Flow Tells a Different Story

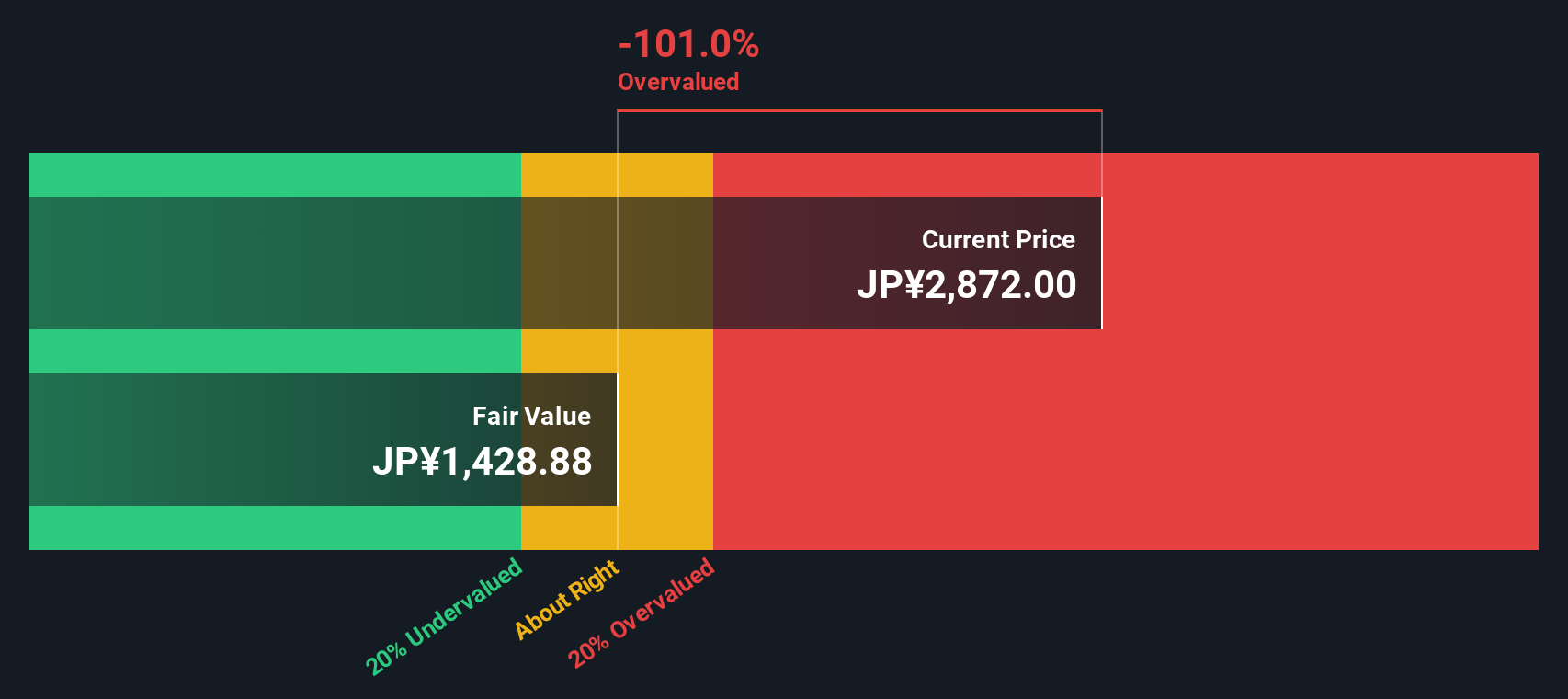

Switching to our DCF model, the result is a sharp contrast. The SWS DCF model values Tsuruha Holdings at ¥1,428.88, which is well below its recent share price. This suggests the market could be overestimating future cash flows. Might the optimism soon meet reality?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Tsuruha Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 900 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Tsuruha Holdings Narrative

Keep in mind, if you see things differently or value your own independent research, it only takes a few minutes to build your perspective. Do it your way.

A great starting point for your Tsuruha Holdings research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors always have an edge by looking beyond the obvious. Use Simply Wall Street’s tools to spot trends and opportunities others might miss.

- Boost your passive income by scanning for companies delivering steady yields with these 18 dividend stocks with yields > 3% and see how they stack up for long-term returns.

- Jump on market innovation by checking out these 27 AI penny stocks that are transforming industries with artificial intelligence and reshaping tomorrow’s economy.

- Uncover hidden value among these 3577 penny stocks with strong financials packed with growth potential, before they hit the wider market radar.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tsuruha Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3391

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives