Stock Analysis

- Japan

- /

- Food and Staples Retail

- /

- TSE:3349

The total return for COSMOS Pharmaceutical (TSE:3349) investors has risen faster than earnings growth over the last five years

The main point of investing for the long term is to make money. But more than that, you probably want to see it rise more than the market average. But COSMOS Pharmaceutical Corporation (TSE:3349) has fallen short of that second goal, with a share price rise of 53% over five years, which is below the market return. The last year has been disappointing, with the stock price down 3.5% in that time.

In light of the stock dropping 5.9% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive five-year return.

View our latest analysis for COSMOS Pharmaceutical

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

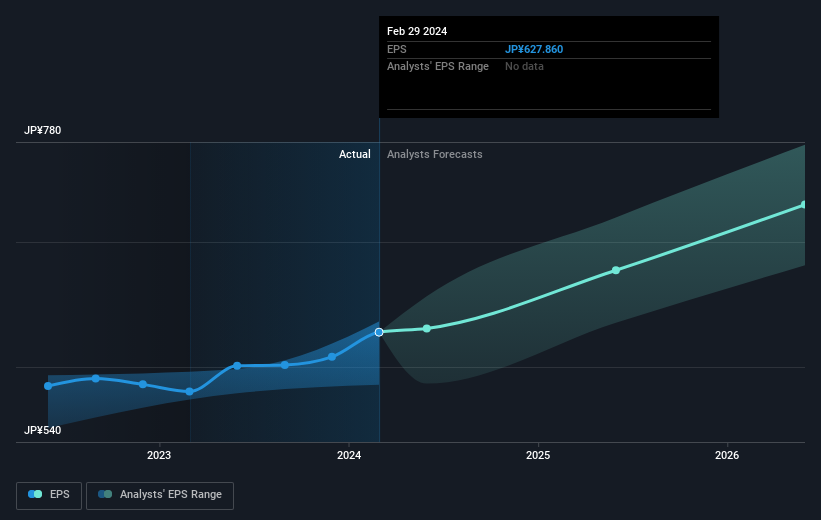

During five years of share price growth, COSMOS Pharmaceutical achieved compound earnings per share (EPS) growth of 5.6% per year. This EPS growth is lower than the 9% average annual increase in the share price. So it's fair to assume the market has a higher opinion of the business than it did five years ago. That's not necessarily surprising considering the five-year track record of earnings growth.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It might be well worthwhile taking a look at our free report on COSMOS Pharmaceutical's earnings, revenue and cash flow.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for COSMOS Pharmaceutical the TSR over the last 5 years was 56%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

Investors in COSMOS Pharmaceutical had a tough year, with a total loss of 2.7% (including dividends), against a market gain of about 28%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 9% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. Before deciding if you like the current share price, check how COSMOS Pharmaceutical scores on these 3 valuation metrics.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Japanese exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether COSMOS Pharmaceutical is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:3349

COSMOS Pharmaceutical

Engages in the retail sale of pharmaceuticals, cosmetics, daily necessities, food, etc.

Excellent balance sheet with acceptable track record.