- Japan

- /

- Food and Staples Retail

- /

- TSE:2750

S.Ishimitsu & Co.,Ltd. (TSE:2750) Stock Rockets 26% But Many Are Still Ignoring The Company

S.Ishimitsu & Co.,Ltd. (TSE:2750) shareholders have had their patience rewarded with a 26% share price jump in the last month. Taking a wider view, although not as strong as the last month, the full year gain of 22% is also fairly reasonable.

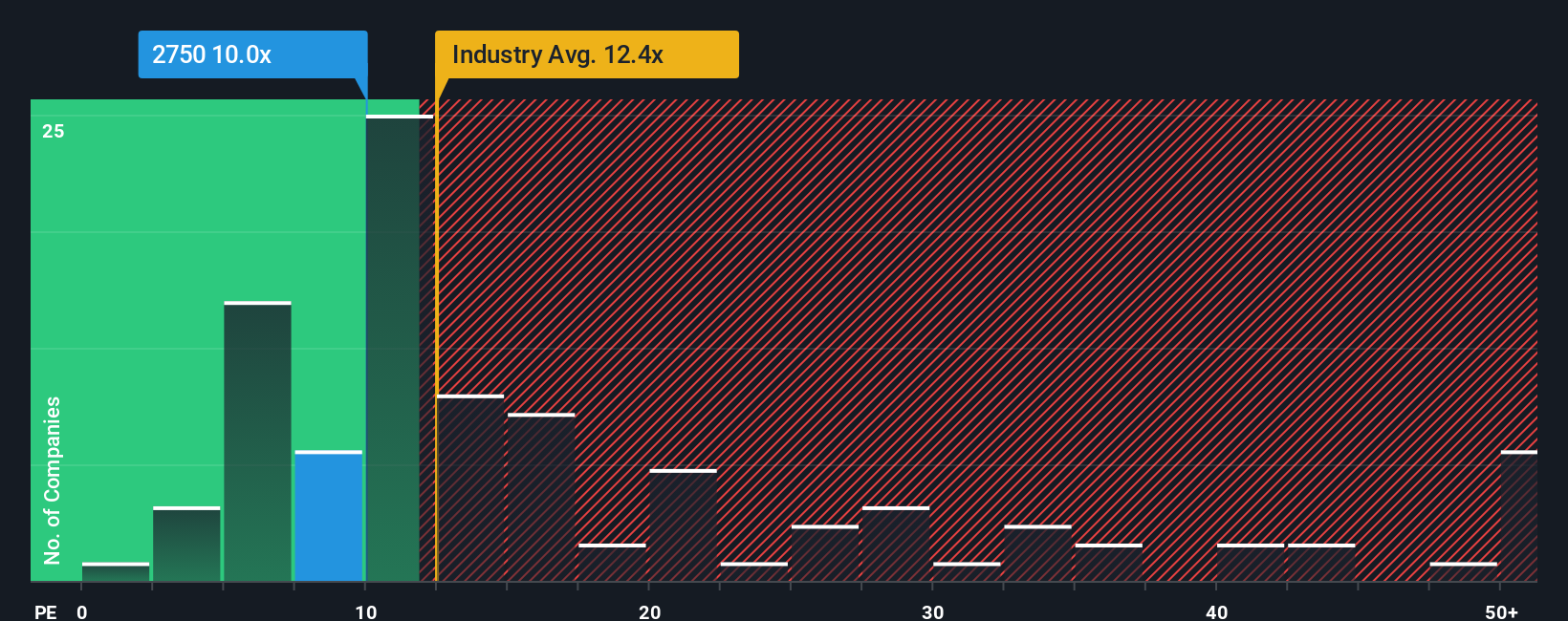

Even after such a large jump in price, S.IshimitsuLtd may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 10x, since almost half of all companies in Japan have P/E ratios greater than 14x and even P/E's higher than 22x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

For instance, S.IshimitsuLtd's receding earnings in recent times would have to be some food for thought. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

See our latest analysis for S.IshimitsuLtd

How Is S.IshimitsuLtd's Growth Trending?

There's an inherent assumption that a company should underperform the market for P/E ratios like S.IshimitsuLtd's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 16% decrease to the company's bottom line. Even so, admirably EPS has lifted 66% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

This is in contrast to the rest of the market, which is expected to grow by 7.7% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we find it odd that S.IshimitsuLtd is trading at a P/E lower than the market. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Bottom Line On S.IshimitsuLtd's P/E

The latest share price surge wasn't enough to lift S.IshimitsuLtd's P/E close to the market median. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of S.IshimitsuLtd revealed its three-year earnings trends aren't contributing to its P/E anywhere near as much as we would have predicted, given they look better than current market expectations. There could be some major unobserved threats to earnings preventing the P/E ratio from matching this positive performance. At least price risks look to be very low if recent medium-term earnings trends continue, but investors seem to think future earnings could see a lot of volatility.

It is also worth noting that we have found 3 warning signs for S.IshimitsuLtd (1 is a bit unpleasant!) that you need to take into consideration.

You might be able to find a better investment than S.IshimitsuLtd. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:2750

S.IshimitsuLtd

Engages in the manufacture, processing, import, and sale of coffee, tea, alcoholic beverages, and foodstuffs in Japan and internationally.

Proven track record average dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success