Identifying January 2025's Undiscovered Gems With Strong Potential

Reviewed by Simply Wall St

As global markets continue to reach new heights, fueled by optimism surrounding potential trade deals and the burgeoning AI sector, investors are increasingly turning their attention to small-cap stocks. These often overlooked gems can offer unique opportunities for growth, especially in an environment where manufacturing is rebounding and economic policies are shifting. Identifying promising small-cap stocks involves looking for companies with strong fundamentals that align well with current market trends and economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Resource Alam Indonesia | 2.66% | 30.36% | 43.87% | ★★★★★★ |

| Eagle Financial Services | 125.65% | 12.07% | 2.64% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Woori Technology Investment | NA | 25.42% | -1.59% | ★★★★★★ |

| Citra Tubindo | NA | 11.06% | 31.01% | ★★★★★★ |

| Oriental Precision & EngineeringLtd | 45.47% | 3.47% | -1.67% | ★★★★★☆ |

| Danang Port | 23.72% | 10.58% | 9.22% | ★★★★★☆ |

| Hansae Yes24 Holdings | 80.77% | 1.28% | 9.02% | ★★★★☆☆ |

| Bank MNC Internasional | 18.72% | 4.80% | 43.63% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Matrix IT (TASE:MTRX)

Simply Wall St Value Rating: ★★★★★★

Overview: Matrix IT Ltd., along with its subsidiaries, offers information technology solutions and services across Israel, the United States, Europe, and internationally, with a market cap of ₪5.60 billion.

Operations: Matrix IT generates revenue primarily from its Information Technology Solutions and Services in Israel, contributing ₪3.14 billion, followed by Cloud and Computing Infrastructure at ₪1.53 billion. The company's cost structure significantly impacts its net profit margin, which stands at 3.5%.

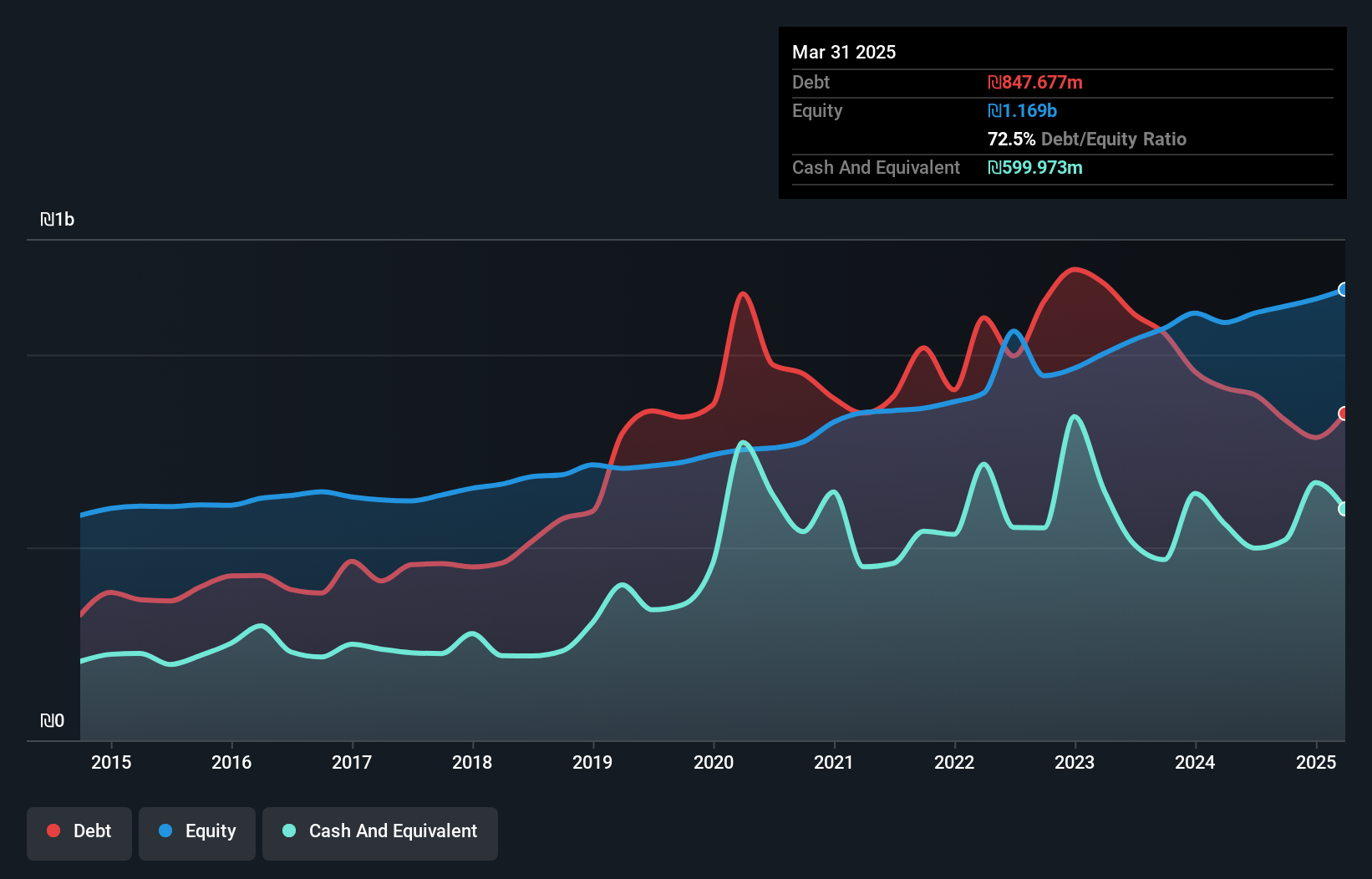

Matrix IT, a promising player in the tech industry, has shown consistent earnings growth of 11% annually over the past five years. The company's net debt to equity ratio stands at a satisfactory 27.6%, reflecting prudent financial management. EBIT covers interest payments by 11 times, indicating strong profitability. Recent results for Q3 2024 reveal sales of ILS 1.42 billion and net income of ILS 64 million, both higher than last year’s figures. Basic earnings per share increased to ILS 1.01 from ILS 0.81, showcasing robust performance despite not outpacing the broader IT sector's growth rate.

- Take a closer look at Matrix IT's potential here in our health report.

Assess Matrix IT's past performance with our detailed historical performance reports.

ITOCHU-SHOKUHIN (TSE:2692)

Simply Wall St Value Rating: ★★★★★★

Overview: ITOCHU-SHOKUHIN Co., Ltd. operates as a wholesaler of food products and alcoholic beverages in Japan, with a market capitalization of ¥92.87 billion.

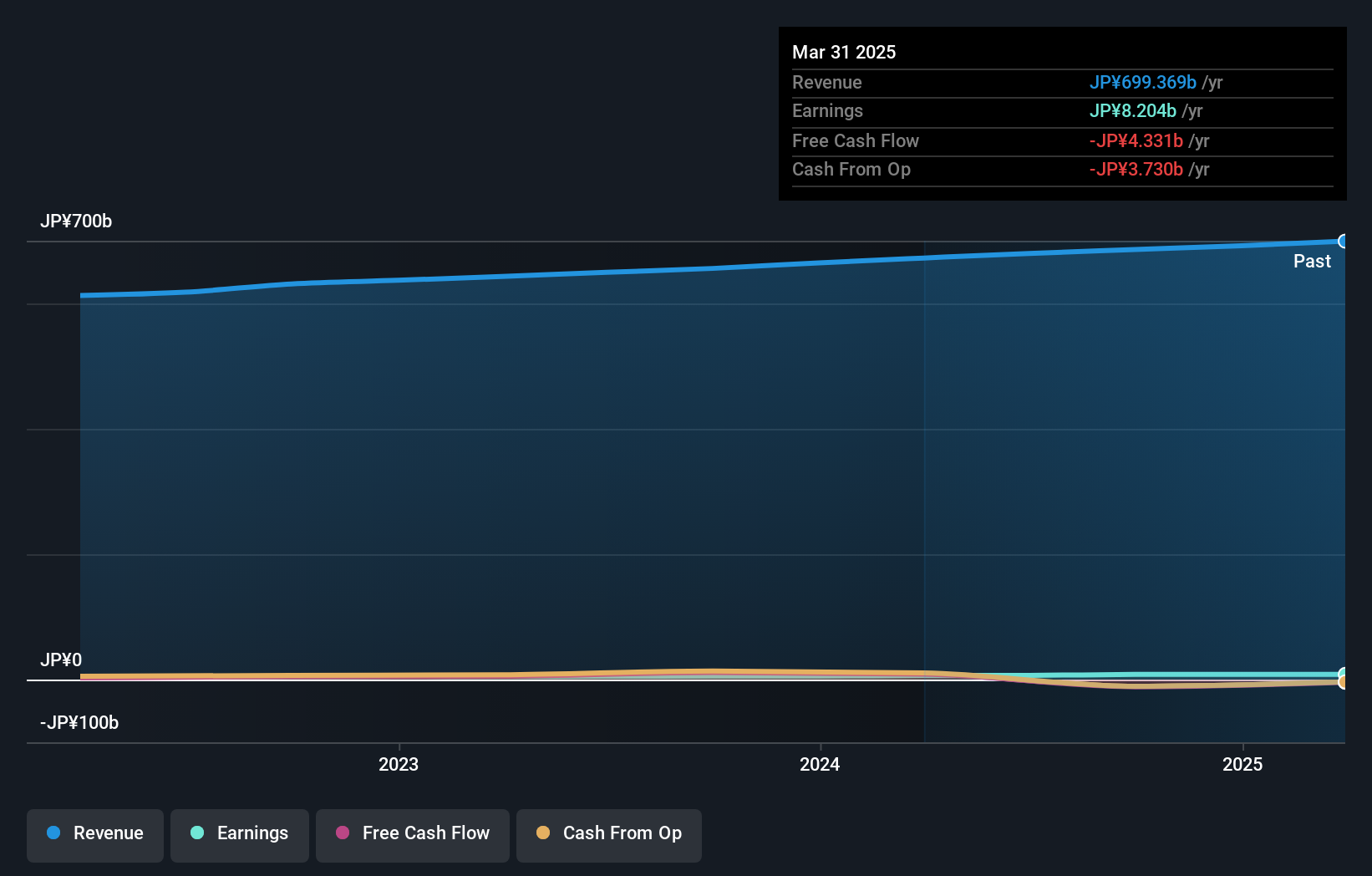

Operations: The company's primary revenue stream is from its Food Wholesale Business, generating ¥685.96 billion. The net profit margin reflects the efficiency of its operations in converting revenue into actual profit.

With no debt and a price-to-earnings ratio of 11.3x, ITOCHU-SHOKUHIN stands out in the Consumer Retailing sector. Its earnings growth of 49% over the past year surpasses the industry average of 11%, highlighting robust performance. The company has transitioned from a debt-to-equity ratio of 1.7 five years ago to being completely debt-free today, reflecting strong financial management. Additionally, it boasts high-quality non-cash earnings, adding another layer of confidence for investors evaluating its potential as an undiscovered gem in the market landscape.

- Click here and access our complete health analysis report to understand the dynamics of ITOCHU-SHOKUHIN.

Evaluate ITOCHU-SHOKUHIN's historical performance by accessing our past performance report.

Global Security Experts (TSE:4417)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Global Security Experts Inc. is a cybersecurity education company based in Japan with a market capitalization of ¥40.29 billion.

Operations: Global Security Experts derives its revenue primarily from cybersecurity education services in Japan. The company has a market capitalization of ¥40.29 billion, reflecting its position in the industry.

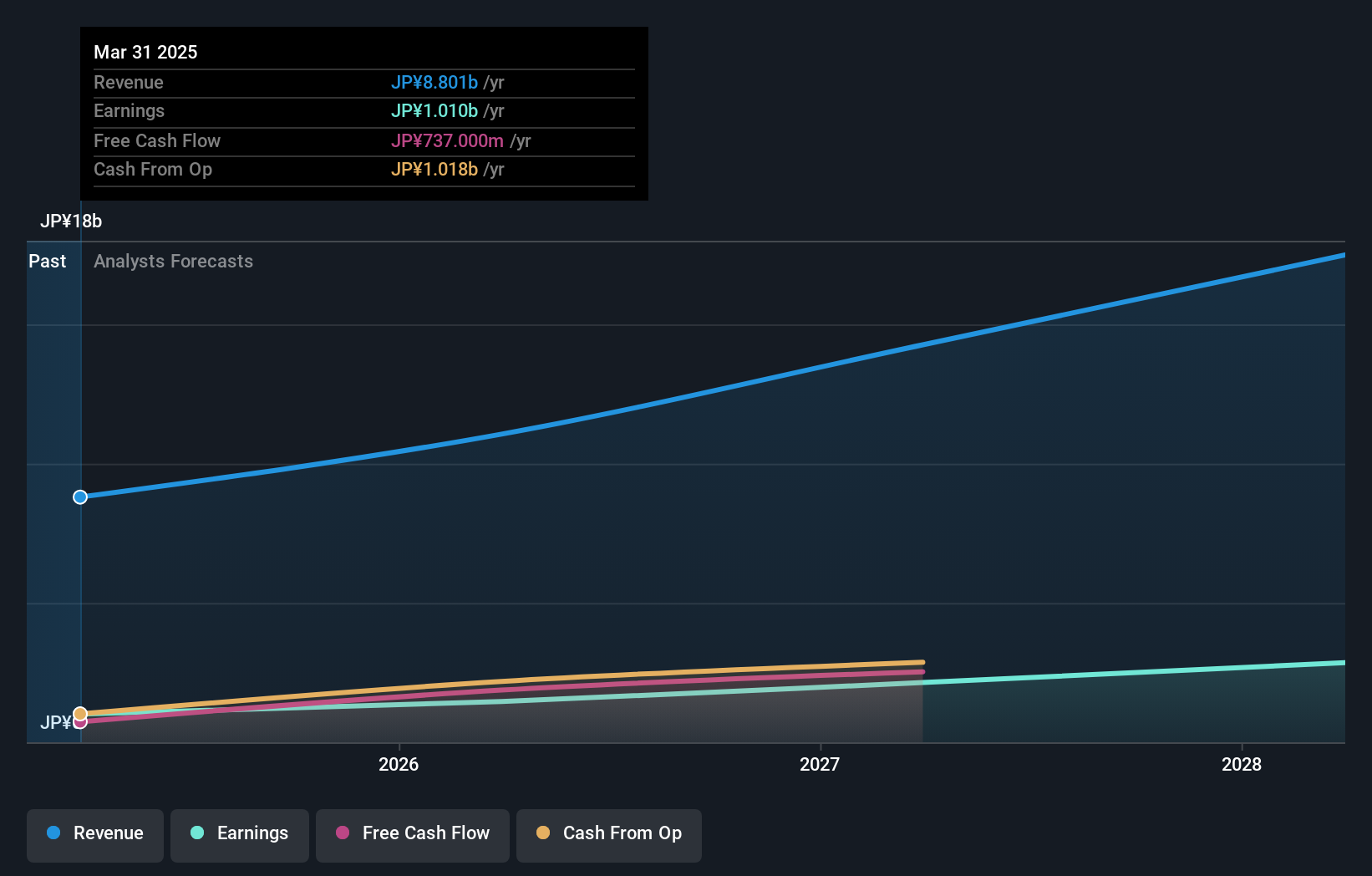

With a reputation for high-quality earnings, Global Security Experts has shown impressive growth, with earnings rising 40% last year, outpacing the IT industry's 11%. Despite this growth, the company trades at a significant discount of 38% below its estimated fair value. However, it carries a high net debt to equity ratio of 45%, which could be concerning for some investors. Their ability to cover interest payments is robust at an impressive 184 times coverage by EBIT. Upcoming Q3 results on January 30th may provide further insights into its financial health and future trajectory.

- Delve into the full analysis health report here for a deeper understanding of Global Security Experts.

Explore historical data to track Global Security Experts' performance over time in our Past section.

Key Takeaways

- Investigate our full lineup of 4677 Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4417

Global Security Experts

Operates as a cybersecurity education company in Japan.

Exceptional growth potential with excellent balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion