- Japan

- /

- Food and Staples Retail

- /

- TSE:2664

Cawachi (TSE:2664) Earnings Growth Challenges Years of Decline, Reinforcing Bullish Narratives

Reviewed by Simply Wall St

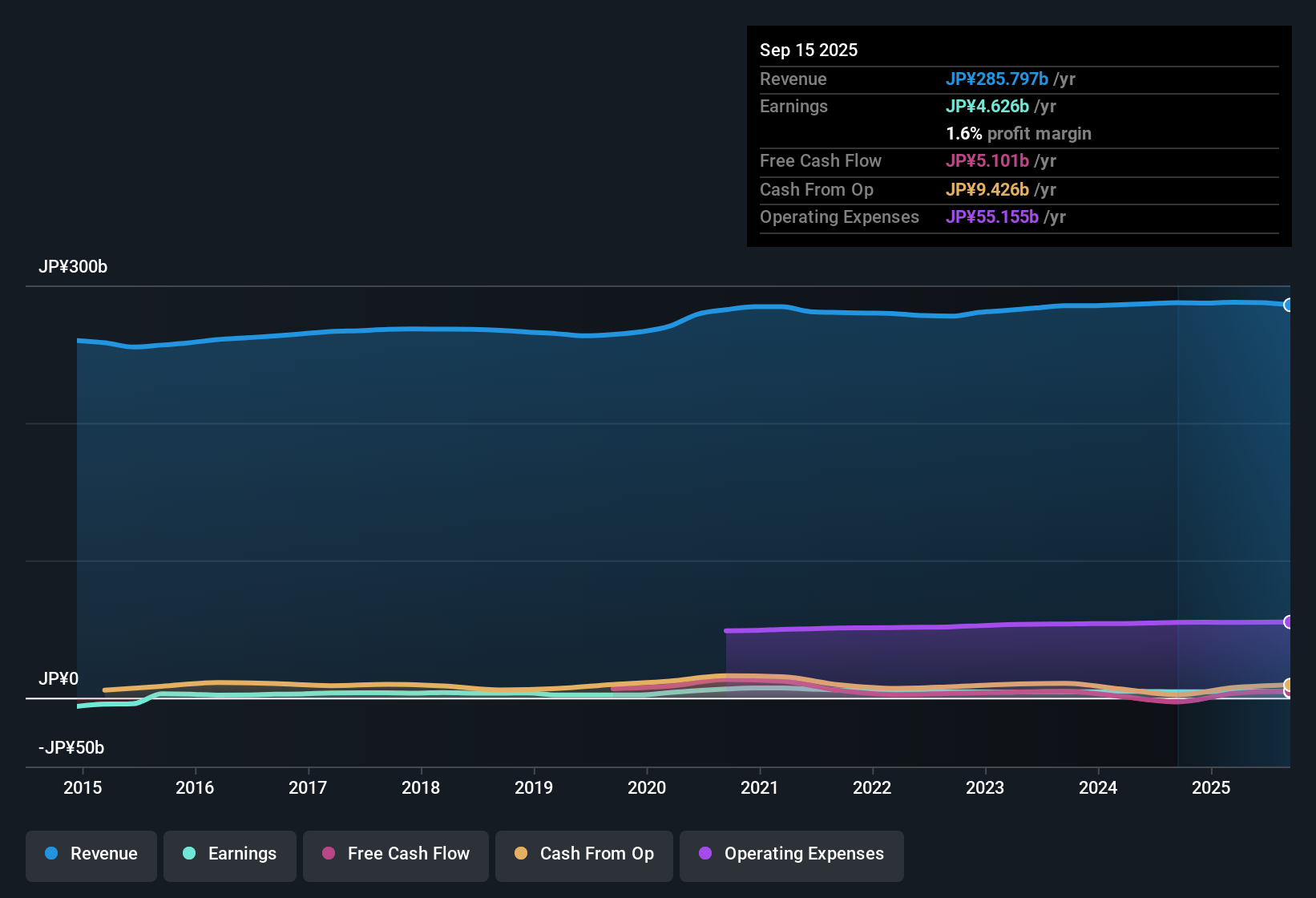

Cawachi (TSE:2664) delivered earnings growth of 5.6% over the past year, reversing its five-year average annual earnings decline of 8.7%. Net profit margins inched up to 1.6% from last year's 1.5%, highlighting a modest improvement in profitability. While the company currently commands a Price-to-Earnings Ratio of 14.1x, trading at a premium to the Japanese consumer retailing sector average, it still appears attractively valued relative to peer companies trading at 21.3x. The share price, at ¥2,928, stands above the estimated fair value of ¥2,436.98, reflecting a market premium. Investors will be weighing these quality earnings against the present risks tied to dividend sustainability and growth expectations.

See our full analysis for Cawachi.The next section digs into how these figures stack up against the most widely followed narratives for Cawachi. We will see where the consensus is reinforced and where the numbers challenge expectations.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Edge Higher, Signal Operational Discipline

- Net profit margins improved slightly to 1.6% from 1.5% the previous year, marking a small but meaningful uptick in underlying profitability.

- A prevailing market view holds that Cawachi’s sector, supported by steady healthcare demand in Japan, typically rewards retailers who can nudge margins upward even in challenging times.

- This modest margin advancement supports the notion that cost control and operational resilience are helping Cawachi stand out from slower-moving peers.

- What is notable is that even a fractional gain in profit margin, when the broader sector faces cost pressures, adds to the company’s reputation for quality earnings.

Long-Term Earnings Decline Pauses for Growth

- The company broke a five-year streak of earnings decline, shifting from an average annual drop of 8.7% to positive 5.6% earnings growth over the last year.

- The recent turnaround heavily supports the idea that Cawachi’s business model is capable of absorbing sector headwinds and reigniting growth, as seen in the latest data.

- While retail rivals have struggled to maintain steady profits, Cawachi’s reversal of a multiyear slide signals potential for longer-term stabilization or even renewed momentum.

- Given the sector’s tailwinds tied to demographics and consumer healthcare needs, the ability to post real growth suggests management’s strategies may be starting to pay off after years of stagnation.

Premium Price Tag Above DCF Fair Value

- Shares currently trade at ¥2,928, which is above the DCF fair value estimate of ¥2,436.98, showing a material market premium.

- Prevailing market perspective recognizes that Cawachi’s 14.1x P/E is high for the Japanese consumer retailing industry (13.3x average) but attractive compared to peers (21.3x), so the premium price may reflect investors’ willingness to pay up for relative quality and stability.

- Bulls might cite the quality earnings and fresh growth as justification for the stock’s premium multiple, while skeptics will flag the fair value gap as a sign of stretched expectations unless future growth accelerates further.

- Either way, the valuation tension underscores that the stock price already incorporates high hopes for operational improvement, leaving less margin for error if results falter.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Cawachi's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Cawachi’s premium share price and stretched valuation leave little room for disappointment if earnings growth and margin gains do not accelerate further.

If you want to focus on opportunities with more attractive pricing, check out these 850 undervalued stocks based on cash flows to find stocks trading below their intrinsic value right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2664

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives