- Saudi Arabia

- /

- Food and Staples Retail

- /

- SASE:4162

Undiscovered Gems Three Hidden Stocks With Potential In December 2024

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by interest rate adjustments and mixed economic indicators, small-cap stocks have faced particular challenges, with the Russell 2000 Index underperforming against larger counterparts. Amidst this backdrop of cautious optimism and strategic recalibration, identifying promising stocks requires a keen eye for companies that demonstrate resilience and potential growth in niche sectors.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Elite Color Environmental Resources Science & Technology | 30.80% | 12.99% | 1.83% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Almunajem Foods (SASE:4162)

Simply Wall St Value Rating: ★★★★★★

Overview: Almunajem Foods Company operates in Saudi Arabia, focusing on the import, marketing, and distribution of frozen, chilled, and dry foodstuffs with a market capitalization of SAR5.78 billion.

Operations: Almunajem Foods generates revenue primarily from its operations across three regions in Saudi Arabia, with the Central Region contributing SAR1.41 billion, followed by the Western & Southern Regions at SAR1.27 billion, and the Eastern & Northern Regions at SAR0.68 billion.

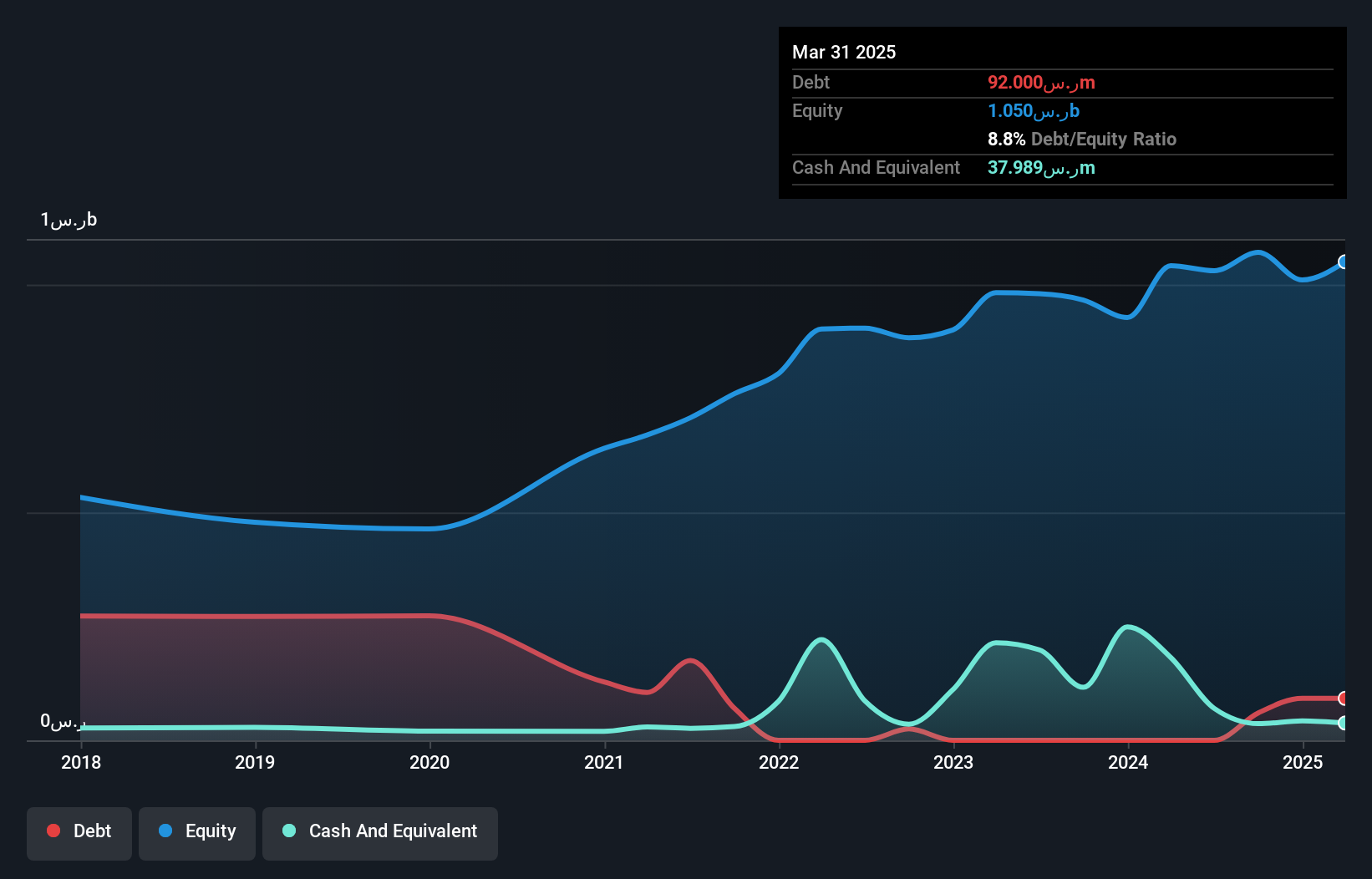

Almunajem Foods, a smaller player in the food industry, showcases a mix of strengths and challenges. Recent earnings reveal net income for Q3 at SAR 40.51 million, down from SAR 61.14 million last year, while nine-month figures show improvement to SAR 218.33 million from SAR 200.59 million previously. Despite a dip in quarterly sales to SAR 798.69 million from SAR 810.87 million, the company maintains high-quality earnings and trades at nearly 30% below estimated fair value, suggesting potential undervaluation. Its debt-to-equity ratio has impressively dropped to just over 5% over five years, reflecting prudent financial management.

- Unlock comprehensive insights into our analysis of Almunajem Foods stock in this health report.

Explore historical data to track Almunajem Foods' performance over time in our Past section.

Zhejiang Haisen Pharmaceutical (SZSE:001367)

Simply Wall St Value Rating: ★★★★★★

Overview: Zhejiang Haisen Pharmaceutical Co., Ltd. focuses on the research, development, production, and sale of chemical active pharmaceutical ingredients and intermediates in China with a market capitalization of CN¥3.10 billion.

Operations: Haisen Pharmaceutical generates revenue through the sale of chemical active pharmaceutical ingredients and intermediates. The company's financial performance is highlighted by a market capitalization of CN¥3.10 billion.

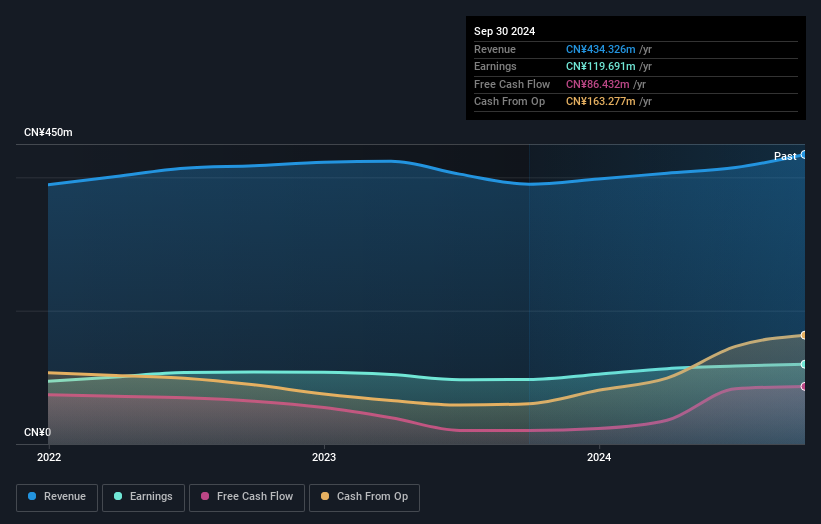

Zhejiang Haisen Pharmaceutical, a nimble player in its field, has shown robust growth with earnings climbing 23.7% over the past year, outpacing the industry's -2.5%. The company reported sales of CNY 320.04 million for the nine months ending September 2024, up from CNY 283.17 million a year prior, while net income rose to CNY 86.95 million from CNY 71.93 million. Despite shareholder dilution this year, it remains debt-free and trades at an attractive valuation—65.9% below estimated fair value—suggesting potential upside for investors seeking opportunities in under-the-radar stocks within pharmaceuticals.

NAGAWA (TSE:9663)

Simply Wall St Value Rating: ★★★★★★

Overview: NAGAWA Co., Ltd. is engaged in the planning, design, manufacturing, and sale of system and modular buildings and unit houses under the Super House brand in Japan with a market cap of ¥101.33 billion.

Operations: NAGAWA generates revenue primarily from its Unit House Business, contributing ¥28.21 billion, followed by the Module System Construction Business at ¥4.73 billion and the Construction Machinery Rental Business at ¥1.02 billion. The company's gross profit margin stands out as a key financial metric to consider when evaluating its performance over time.

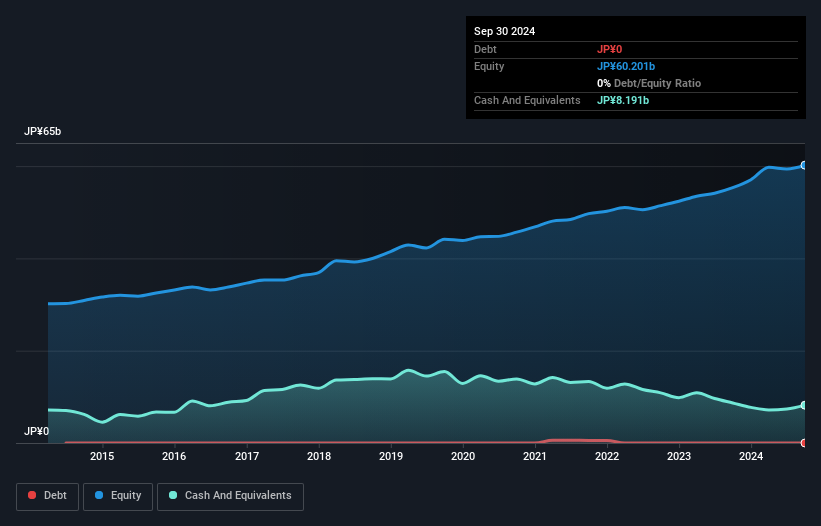

NAGAWA, a promising player in the consumer durables sector, has showcased impressive earnings growth of 13.6% over the past year, surpassing the industry's -6.4%. This debt-free company is trading at 41.6% below its estimated fair value, suggesting potential undervaluation in the market. Its high-quality earnings further highlight its robust financial health and operational efficiency. With no debt to worry about, interest coverage isn't a concern for NAGAWA either. The company's positive free cash flow reinforces its ability to sustain operations without external financing pressures, positioning it well for future opportunities and challenges in its industry landscape.

- Click here to discover the nuances of NAGAWA with our detailed analytical health report.

Assess NAGAWA's past performance with our detailed historical performance reports.

Make It Happen

- Navigate through the entire inventory of 4502 Undiscovered Gems With Strong Fundamentals here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:4162

Almunajem Foods

Together with its subsidiary, engages in the wholesale and retail trade of fruits, vegetables, cold and frozen poultry and meat, bottled, and food stuff in Saudi Arabia.

Flawless balance sheet with limited growth.

Market Insights

Community Narratives