Goldwin (TSE:8111) Valuation in Focus After Buyback Program and Dividend Hikes

Reviewed by Simply Wall St

Goldwin (TSE:8111) just rolled out a fresh share repurchase program and boosted its regular and commemorative dividends. This move clearly shows management is aiming to deliver more value directly back to shareholders.

See our latest analysis for Goldwin.

Goldwin’s share price has been on a strong run lately, racking up a 26.2% return over the past month and gaining more than 33% in the last 90 days. With the buyback and higher dividends making headlines along with a recent earnings correction (which clarified disclosures but did not alter results), momentum appears to be building. Longer-term investors have also seen a solid total shareholder return of 16.8% over twelve months, showing both short-term enthusiasm and sustained value for those holding on.

With so many active names in the consumer landscape right now, this could be a great moment to broaden your search and discover fast growing stocks with high insider ownership

With Goldwin’s stock near all-time highs after recent buybacks and dividend boosts, the key debate now is whether investors are getting in at an attractive entry point or if the market has already priced in all future growth.

Price-to-Earnings of 18.6x: Is it justified?

Goldwin shares are currently trading at a price-to-earnings (P/E) ratio of 18.6x, which is above both the industry average and our estimate of fair value multiples. Despite the perception of market excitement, the stock appears expensive on this basis compared to peers.

The P/E ratio indicates how much investors are paying for one unit of Goldwin’s earnings. This measure is a useful yardstick for mature companies with track records of profitability. In this sector, a higher P/E often signals optimism about future growth, but it could also mean the market is overestimating future performance.

Compared to the Japanese Luxury industry P/E average of 14.6x, Goldwin looks pricey. Our fair P/E estimate is 17.1x, a level the market could gravitate toward if growth expectations fade. These numbers suggest that current valuations already bake in plenty of optimism about the company’s forward trajectory.

Explore the SWS fair ratio for Goldwin

Result: Price-to-Earnings of 18.6x (OVERVALUED)

However, continued earnings growth is not guaranteed. Any slowdown in revenue expansion or profit margins could quickly shift investor sentiment.

Find out about the key risks to this Goldwin narrative.

Another View: What Does Discounted Cash Flow Suggest?

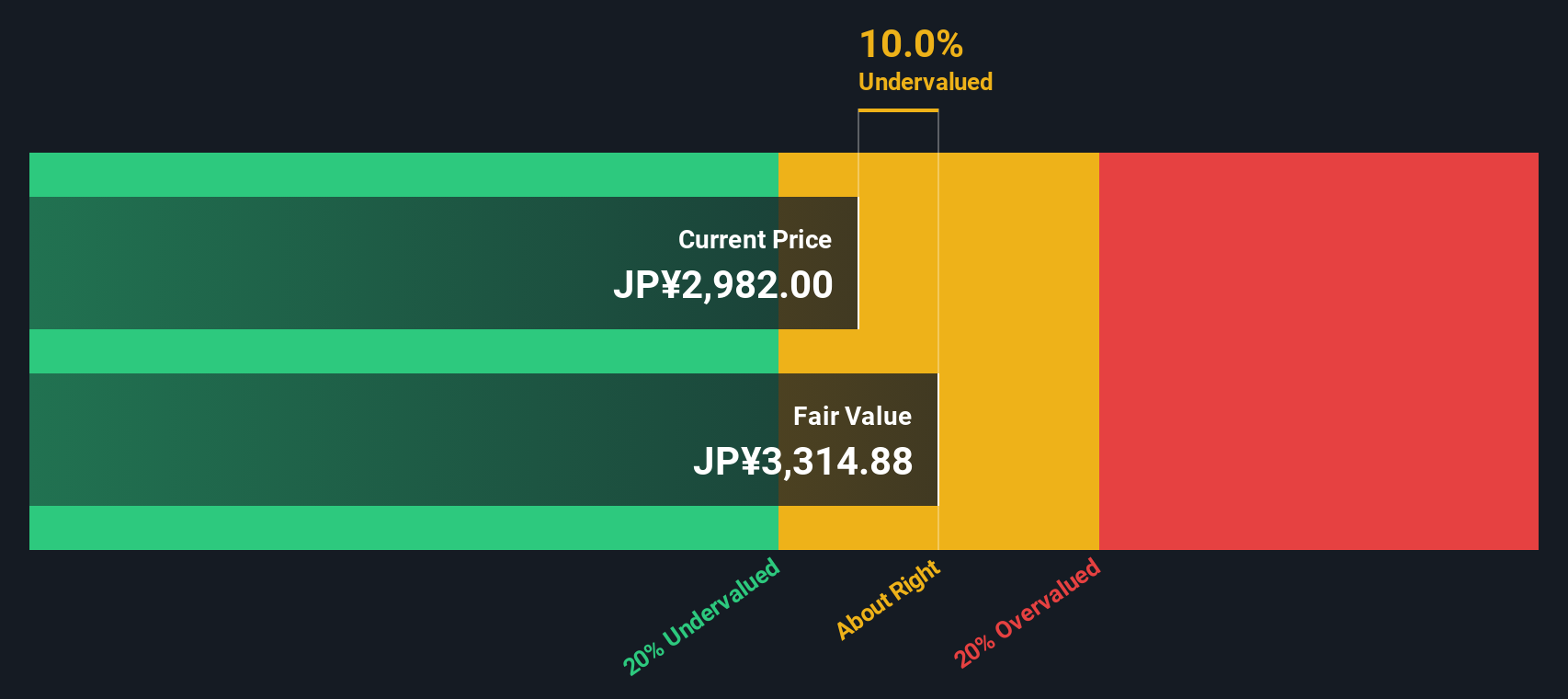

Looking at Goldwin from a different angle, our SWS DCF model paints a slightly more optimistic picture. Based on projected future cash flows, the model estimates a fair value of ¥3,313 per share. This puts the current price about 4.8% below that mark and suggests the stock might actually be undervalued despite what the earnings multiple tells us. Does this shift in perspective change how investors should approach Goldwin?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Goldwin for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 879 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Goldwin Narrative

If you see things a little differently or want to dig deeper into the numbers yourself, you can build your own view in just a few minutes. Do it your way

A great starting point for your Goldwin research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Staying ahead means broadening your options. Don’t let standout opportunities pass you by. Uncover stocks positioned for growth, innovation, and income with these targeted ideas:

- Unlock the power of future technologies by tracking these 25 AI penny stocks that excel in artificial intelligence advancements and automation breakthroughs.

- Capture attractive yields and steady returns by reviewing these 16 dividend stocks with yields > 3% with dividend payouts above 3% to strengthen your income portfolio.

- Position yourself at the frontier of finance by backing innovation in the digital age and analyzing these 82 cryptocurrency and blockchain stocks driving blockchain and cryptocurrency adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8111

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives