Assessing Noritsu Koki (TSE:7744) Valuation After Steady Share Price Gains and Renewed Investor Attention

Reviewed by Simply Wall St

Price-to-Earnings of 15.8x: Is it justified?

Based on the price-to-earnings (P/E) ratio, Noritsu Koki currently trades at 15.8x earnings, which is slightly above the Japanese leisure industry average of 15.2x. This suggests the market sees a premium versus peers, although it is still below their broader peer group average.

The P/E ratio is a useful way to compare what investors are willing to pay for a company’s earnings. For a business in the consumer durables and leisure sector, the P/E ratio gives insight into whether the market expects future growth or sees risk.

The current valuation implies that investors are paying a modest premium for Noritsu Koki’s earnings, likely due to consistent financial results. However, the market is not dramatically overpricing the company and appears to be factoring in moderate growth expectations rather than excessive optimism.

Result: Fair Value of ¥1,774 (ABOUT RIGHT)

See our latest analysis for Noritsu Koki.However, slower revenue growth or a shift in market sentiment could quickly change the outlook and challenge assumptions that underlie today’s valuation.

Find out about the key risks to this Noritsu Koki narrative.Another View: The SWS DCF Model

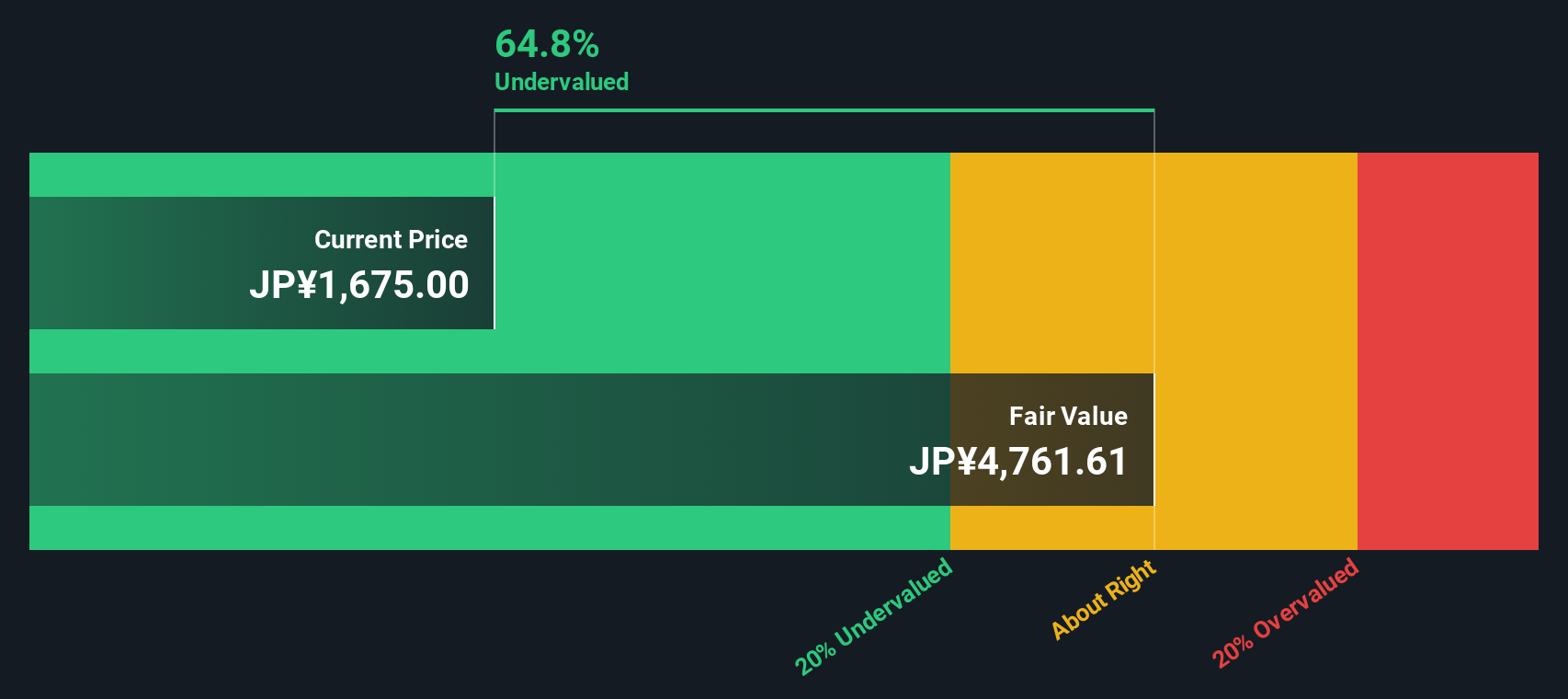

Taking a different approach, the SWS DCF model suggests Noritsu Koki could be undervalued by the market. This challenges the idea that recent gains have fully captured the stock's potential. Could there still be room for upside?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Noritsu Koki Narrative

If you have your own viewpoint or want to dig deeper into the numbers, you can put together your own assessment in just a few minutes with Do it your way.

A great starting point for your Noritsu Koki research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Give yourself a real advantage by checking out other stock opportunities that could raise your portfolio’s potential. Don’t let these high-impact trends and hidden gems pass you by.

- Target long-term returns as you tap into companies paying dividend stocks with yields > 3%. These can boost your income stream and help weather shifting markets.

- Seize the chance to back industry innovators powering tomorrow’s breakthroughs with AI penny stocks. These could be shaping the next big tech wave.

- Uncover promising shares trading below their intrinsic value and position yourself for potential upside with our list of undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Noritsu Koki might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7744

Noritsu Koki

Manufactures and sells audio equipment and peripheral products in Japan, China, the United States, Europe, Central and South America, the Middle East, Africa, and internationally.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives