- Japan

- /

- Consumer Durables

- /

- TSE:6952

Casio (TSE:6952) Valuation: Assessing Value After Launch of the New G-STEEL GST-B1000D G-SHOCK

Reviewed by Simply Wall St

Casio Computer Ltd (TSE:6952) is making headlines with its announcement of the GST-B1000D, the latest G-STEEL G-SHOCK release. The new watch blends minimalist aesthetics, improved comfort, and updated tech to attract a broader audience.

See our latest analysis for Casio ComputerLtd.

The new GST-B1000D announcement comes as Casio ComputerLtd’s share price has seen mixed momentum. Despite a one-year total shareholder return of nearly 12%, signaling longer-term value, the stock is still working to regain ground from its five-year decline. Recent price movement has been modest, but this product launch could re-energize interest and shift perceptions of growth potential going forward.

If Casio’s design evolution caught your interest, it’s the perfect opportunity to broaden your search and uncover fast growing stocks with high insider ownership.

With shares still trading at a discount to intrinsic value and analysts’ targets, the big question is whether Casio is simply undervalued or if the market is already factoring in the company’s future growth prospects. Is there actually a buying opportunity here?

Most Popular Narrative: 6.6% Undervalued

Casio ComputerLtd’s narrative fair value sits slightly above the latest closing share price, raising debate on whether this edge could fuel new upside for investors. The gap is modest but is supported by bold strategic projections and a detailed financial model.

Casio's focused investment in education technology, through new calculator features, enhanced EdTech platforms (ClassPAD.net), and regional school partnerships, directly aligns with accelerating digitalization in education. This enables stable or higher recurring revenue and strengthens long-term earnings resilience.

Want a peek behind the curtain? This narrative hinges on big leaps for margins and earnings, with future numbers that could flip the script. Curious about what underpins this fair value? Unlock the full story to see the projections that could change everything.

Result: Fair Value of ¥1,291.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent declines in profitability and vulnerability to trade disruptions could quickly change this positive outlook for Casio’s long-term potential.

Find out about the key risks to this Casio ComputerLtd narrative.

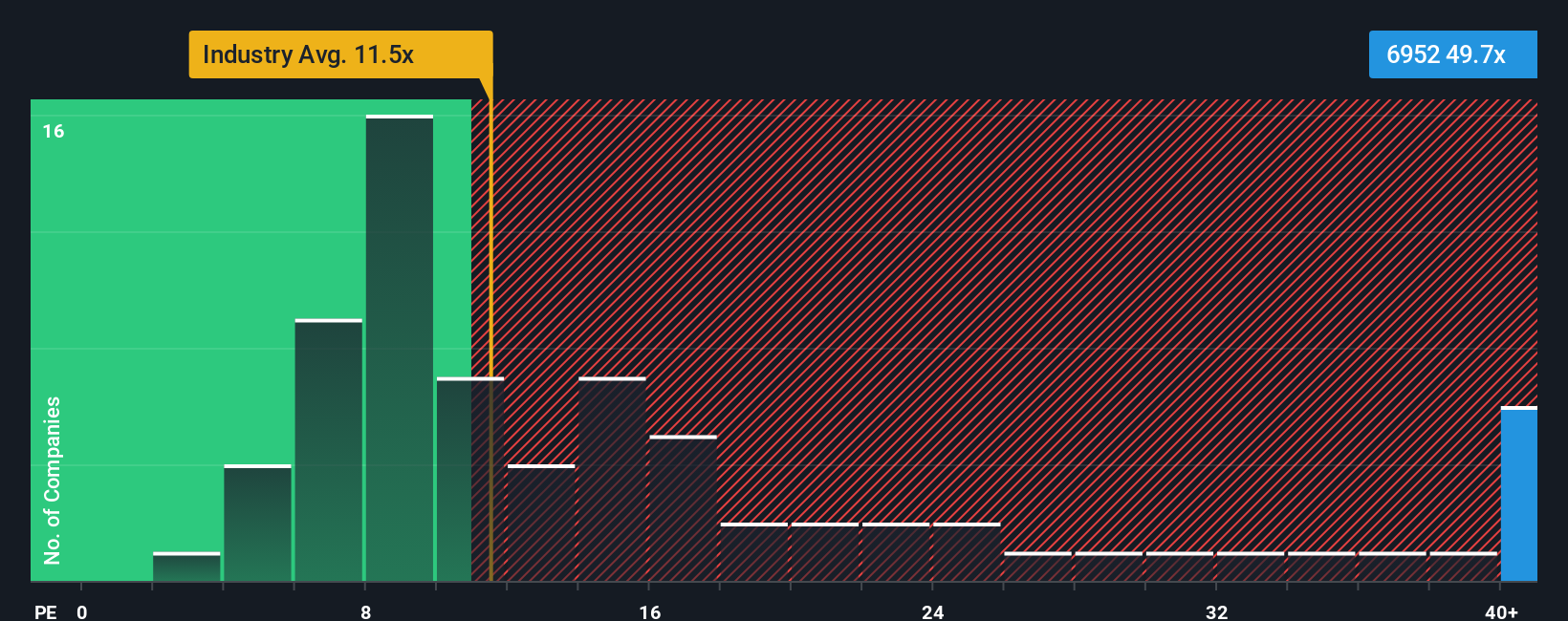

Another View: Multiples Paint a Pricier Picture

While the narrative points to shares trading below fair value, a look at company valuation using earnings reveals a disconnect. Casio is trading at a price-to-earnings ratio of 49x, more than double its peers’ 20.1x and far above a fair ratio of 20.9x. This premium suggests investors may be pricing in optimistic growth and leaves little margin for error if expectations slip.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Casio ComputerLtd Narrative

Prefer a hands-on approach or think there’s more to Casio’s story? You can analyze the numbers and craft your unique outlook in just a few minutes. Do it your way.

A great starting point for your Casio ComputerLtd research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always keep options open. Don’t miss the chance to spot your next big winner before the crowd does with these timely opportunities:

- Spot market disruption by checking out these 25 AI penny stocks that are redefining entire industries through artificial intelligence innovation and future-ready strategies.

- Lock in stable returns by reviewing these 17 dividend stocks with yields > 3% offering generous yields, ideal for building resilient, income-oriented portfolios.

- Get ahead of transformative tech with these 28 quantum computing stocks and see which companies are pioneering quantum breakthroughs for tomorrow’s digital age.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6952

Casio ComputerLtd

Engages in the development, production, sales, and services of watches, consumer products, systems, and other fields.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives