- Taiwan

- /

- Real Estate

- /

- TWSE:2527

Asian Dividend Stocks To Consider In September 2025

Reviewed by Simply Wall St

As global markets navigate through a period of economic uncertainty, Asia's stock markets present a unique landscape, with China's recent rally and Japan's steady growth contrasting against broader concerns of a slowdown. In this environment, dividend stocks can offer investors potential stability and income, making them an appealing option for those looking to balance risk amid fluctuating market conditions.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 4.91% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 3.63% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 3.70% | ★★★★★★ |

| NCD (TSE:4783) | 4.41% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 3.85% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.10% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| Daicel (TSE:4202) | 4.26% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.25% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.67% | ★★★★★★ |

Click here to see the full list of 996 stocks from our Top Asian Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

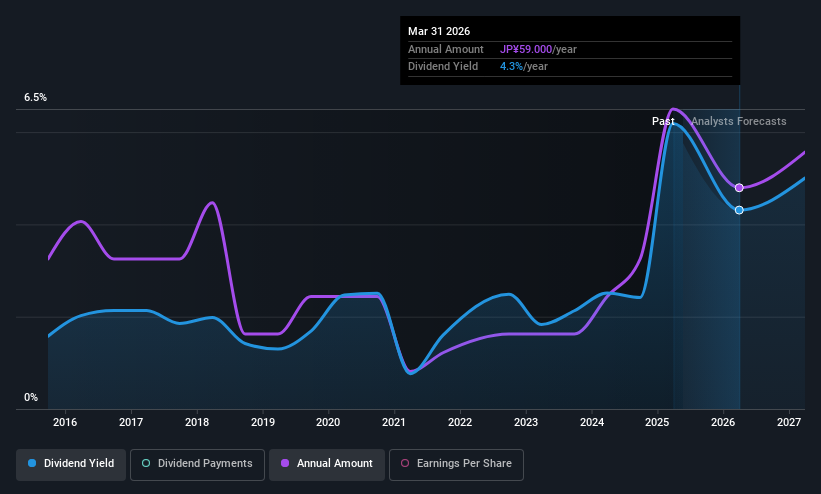

Foster Electric Company (TSE:6794)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Foster Electric Company, Limited specializes in the production and sale of loudspeakers, audio equipment, and electronic equipment both in Japan and internationally, with a market cap of ¥51.87 billion.

Operations: Foster Electric Company, Limited's revenue segments include ¥115.50 billion from speakers and ¥12.22 billion from mobile audio equipment.

Dividend Yield: 3%

Foster Electric Company's dividends are well-covered by earnings and cash flows, with payout ratios of 31.3% and 13.5%, respectively. Despite a low dividend yield of 3.01% compared to the top tier in Japan, its dividends have increased over the past decade but remain volatile, impacting reliability. The company trades at a significant discount to its estimated fair value, potentially offering value despite an unstable dividend history. Recent board decisions include disposing of treasury shares for board benefit trust contributions.

- Click here to discover the nuances of Foster Electric Company with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Foster Electric Company shares in the market.

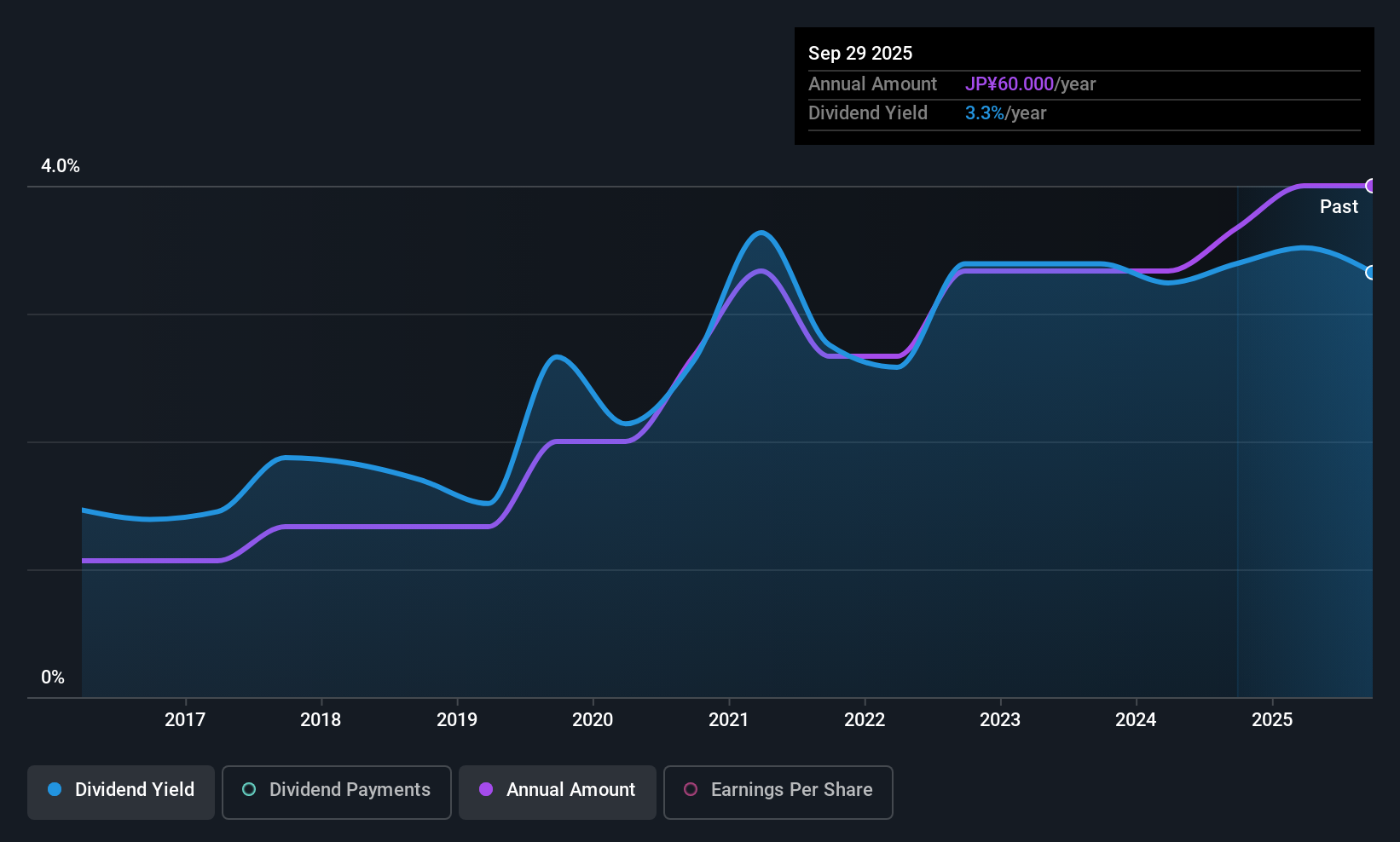

INES (TSE:9742)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: INES Corporation offers information network system services to industrial corporations, financial institutions, and public entities in Japan, with a market capitalization of ¥40.75 billion.

Operations: INES Corporation's revenue segments include information network system services for industrial corporations, financial institutions, and public entities in Japan.

Dividend Yield: 3.1%

INES Corporation plans to increase its annual dividend to ¥60 per share, up from ¥55 last year. While the dividend yield of 3.06% is below Japan's top tier, dividends are supported by a payout ratio of 54.7% and a cash payout ratio of 43.1%. However, past volatility and unreliability in payments raise concerns about sustainability despite recent earnings growth and solid profit forecasts for the fiscal year ending March 2026.

- Click to explore a detailed breakdown of our findings in INES' dividend report.

- Our valuation report unveils the possibility INES' shares may be trading at a premium.

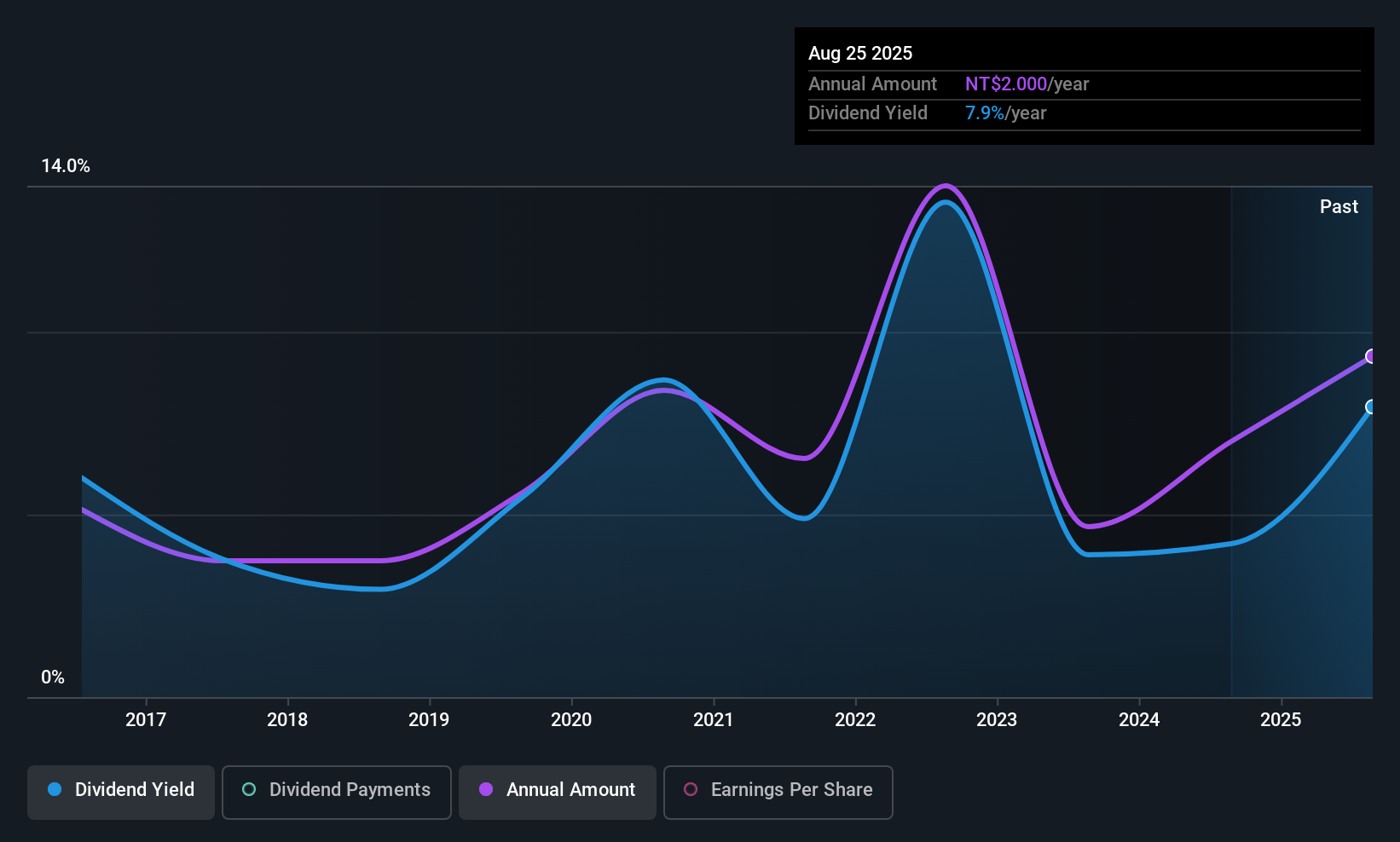

Hung Ching Development & Construction (TWSE:2527)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Hung Ching Development & Construction Co. operates in the real estate development and construction industry, with a market cap of NT$6.73 billion.

Operations: Unfortunately, the revenue segments for Hung Ching Development & Construction Co. are not provided in the text you shared. Please provide additional information if available.

Dividend Yield: 7.8%

Hung Ching Development & Construction's recent dividend increase to TWD 2 per share highlights its attractive yield of 7.78%, ranking in Taiwan's top quartile. Despite a volatile and unreliable dividend history, current payouts are well-covered by earnings and cash flows, with low payout ratios of 48.3% for profits and 14.2% for cash flows. However, recent financials show significant losses, raising concerns about future stability despite past profit growth.

- Delve into the full analysis dividend report here for a deeper understanding of Hung Ching Development & Construction.

- The analysis detailed in our Hung Ching Development & Construction valuation report hints at an deflated share price compared to its estimated value.

Turning Ideas Into Actions

- Access the full spectrum of 996 Top Asian Dividend Stocks by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hung Ching Development & Construction might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2527

Hung Ching Development & Construction

Hung Ching Development & Construction Co.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives