- Japan

- /

- Consumer Durables

- /

- TSE:6788

With EPS Growth And More, Nihon Trim (TSE:6788) Makes An Interesting Case

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Nihon Trim (TSE:6788). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Nihon Trim with the means to add long-term value to shareholders.

See our latest analysis for Nihon Trim

Nihon Trim's Improving Profits

Nihon Trim has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. Thus, it makes sense to focus on more recent growth rates, instead. Nihon Trim's EPS shot up from JP¥178 to JP¥283; a result that's bound to keep shareholders happy. That's a fantastic gain of 59%.

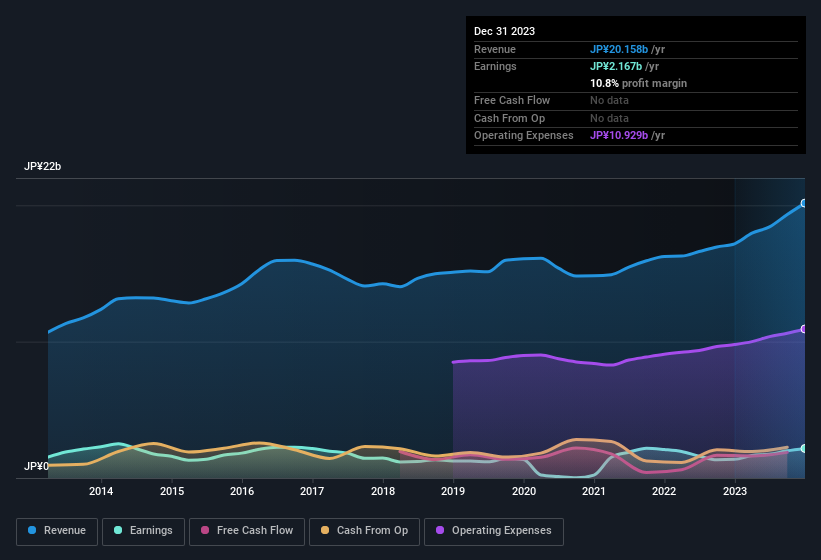

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The good news is that Nihon Trim is growing revenues, and EBIT margins improved by 3.7 percentage points to 15%, over the last year. That's great to see, on both counts.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Nihon Trim isn't a huge company, given its market capitalisation of JP¥28b. That makes it extra important to check on its balance sheet strength.

Are Nihon Trim Insiders Aligned With All Shareholders?

Theory would suggest that it's an encouraging sign to see high insider ownership of a company, since it ties company performance directly to the financial success of its management. So those who are interested in Nihon Trim will be delighted to know that insiders have shown their belief, holding a large proportion of the company's shares. In fact, they own 45% of the shares, making insiders a very influential shareholder group. Shareholders and speculators should be reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. To give you an idea, the value of insiders' holdings in the business are valued at JP¥13b at the current share price. So there's plenty there to keep them focused!

Is Nihon Trim Worth Keeping An Eye On?

You can't deny that Nihon Trim has grown its earnings per share at a very impressive rate. That's attractive. This EPS growth rate is something the company should be proud of, and so it's no surprise that insiders are holding on to a considerable chunk of shares. Fast growth and confident insiders should be enough to warrant further research, so it would seem that it's a good stock to follow. Still, you should learn about the 1 warning sign we've spotted with Nihon Trim.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of Japanese companies which have demonstrated growth backed by recent insider purchases.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Nihon Trim might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6788

Nihon Trim

Develops and sells electrolyzed hydrogen water purifiers in Japan and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives