- Japan

- /

- Consumer Durables

- /

- TSE:6758

Sony (TSE:6758) Valuation: Is Recent Momentum Creating New Opportunities for Investors?

Reviewed by Simply Wall St

See our latest analysis for Sony Group.

Sony’s share price has gained noticeable ground lately, up 2.97% in a single day and boosting its year-to-date return to 32.38%. What really stands out, though, is the remarkable 66.27% total shareholder return over the past year. This suggests momentum is clearly building both in the stock and investor optimism about Sony’s strategy and growth prospects.

If solid performance and fresh momentum have you curious about what else is taking off, now’s a great time to explore See the full list for free.

But with Sony’s impressive run and high expectations for future growth, investors are now left to wonder whether the stock is still undervalued or if the market has already priced in what comes next.

Most Popular Narrative: 10.2% Undervalued

With Sony Group's fair value estimated at ¥4,867.50 and the last share price at ¥4,370.00, the leading narrative suggests potential upside if the company's profit momentum and revenue improvements play out as forecast.

Ongoing expansion and robust engagement in Sony's PlayStation ecosystem, including increased monthly active users and growth in network service revenue, indicate a shift toward more stable, high-margin, recurring digital income streams. This supports sustained revenue and operating margin expansion.

How does Sony earn such a premium over rivals? The full narrative unpacks why recurring revenue, content innovation, and higher profitability are all driving forces, plus the bold assumptions powering this valuation.

Result: Fair Value of ¥4,867.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying global competition and ongoing supply chain disruptions could pressure Sony’s profitability and challenge the bullish outlook highlighted by analysts.

Find out about the key risks to this Sony Group narrative.

Another View: Multiples Tell a Different Story

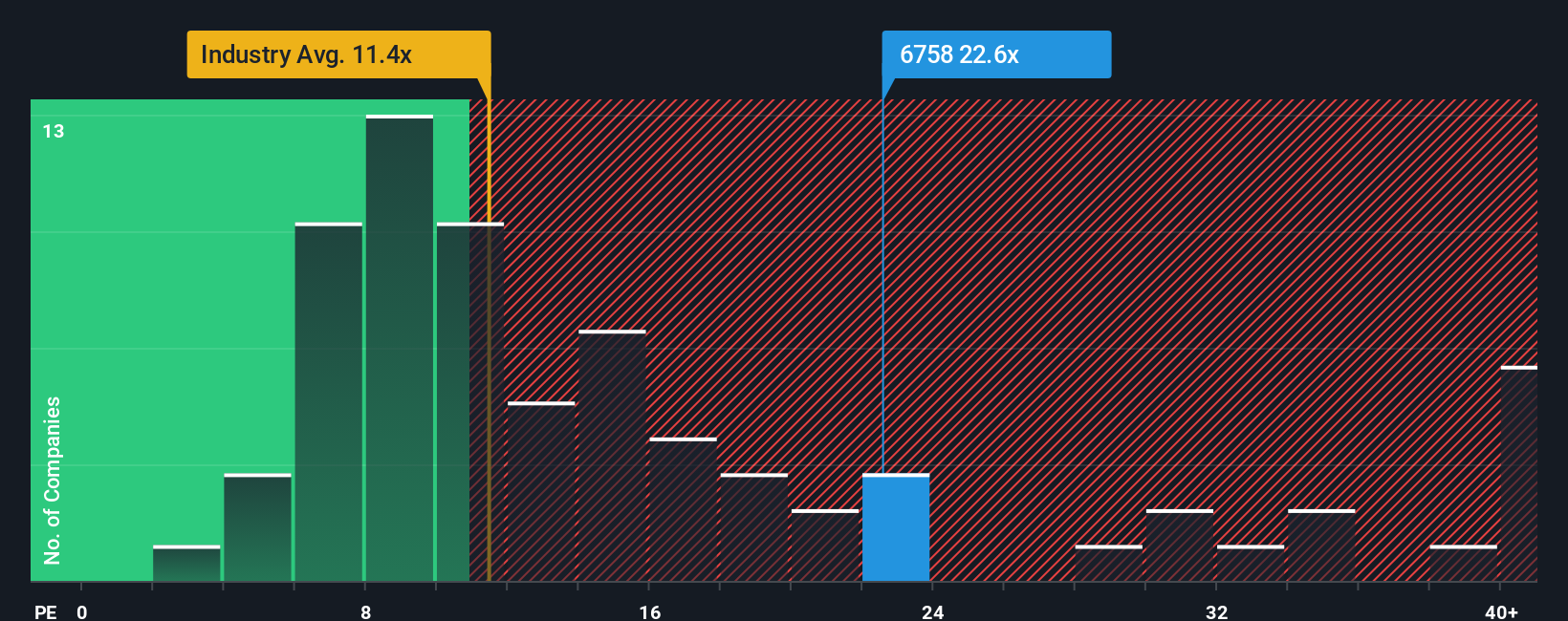

Looking at Sony’s valuation through its price-to-earnings ratio, the picture changes. The company trades at 21.9 times earnings, which is much higher than the JP Consumer Durables industry average of 11.8 but below the peer average of 29.1. Interestingly, this is also under the fair ratio of 25.8, suggesting the market is not getting overly optimistic despite strong returns. Does this gap signal an overlooked value, or does it hint at hidden risks that multiples might miss?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sony Group Narrative

If you see things differently or want to question the numbers for yourself, you can dive in and craft your own informed view in minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Sony Group.

Looking for more investment ideas?

Smart investors never settle for just one opportunity. Right now, some of the most exciting stock ideas are just a click away. Don’t leave gains on the table when you could be moving ahead of the crowd.

- Capitalize on unstoppable cash flow growth by tracking these 849 undervalued stocks based on cash flows that the market may be overlooking right now.

- Fuel your portfolio with future health breakthroughs by targeting these 33 healthcare AI stocks driving advancements in AI-powered medicine and patient care.

- Sharpen your edge in tomorrow’s tech race by following these 26 AI penny stocks poised to redefine everything from automation to intelligent devices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6758

Sony Group

Designs, develops, produces, and sells electronic equipment, instruments, and devices for the consumer, professional, and industrial markets in Japan, the United States, Europe, China, the Asia-Pacific, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives