- Japan

- /

- Consumer Durables

- /

- TSE:6758

Sony (TSE:6758): Valuation Insights Following Earnings Beat, Guidance Update, and New Buyback Announcement

Reviewed by Simply Wall St

Sony Group (TSE:6758) has been making headlines after announcing better than expected earnings, updating its guidance to reflect recent U.S. tariff changes, and rolling out both a share buyback and a dividend hike.

See our latest analysis for Sony Group.

After these upbeat results and the news of a fresh buyback and dividend hike, investor enthusiasm is showing up in Sony Group’s numbers. The share price has climbed 36.5% year-to-date, and the one-year total shareholder return is an impressive 61.2%. With momentum clearly building, Sony’s recent moves are being rewarded as the market factors in both growth potential and the improved outlook.

If the combination of earnings growth and strategic capital returns has you curious about what else is on the move, now is the perfect time to discover See the full list for free.

But with the stock riding major momentum and sitting just 13% below analyst price targets, the key question now is whether Sony is still undervalued or if all this future growth is already reflected in the share price.

Most Popular Narrative: 11% Undervalued

Based on the narrative’s fair value, Sony Group shares appear attractively priced versus the latest closing price. Investor enthusiasm is high, but a deeper look uncovers what’s really driving the difference.

The accelerating monetization of proprietary content IP, including music catalogs, blockbuster anime (e.g., Demon Slayer), and cross-platform franchises, together with strategic partnerships (e.g., Bandai Namco), positions Sony to capitalize on global entertainment demand and improve both revenue growth and margin profile.

Want to know the growth blueprint behind this high valuation? The key element of this narrative is record-breaking earnings and a future profit multiple usually associated with tech leaders. Interested in which bold financial projections support that price target? Dive deeper to see the surprising numbers that drive this fair value calculation.

Result: Fair Value of ¥5,076.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing supply chain pressures and increased competition in imaging and entertainment could easily shift investor sentiment and impact Sony’s growth outlook.

Find out about the key risks to this Sony Group narrative.

Another View: Multiples Suggest a Premium

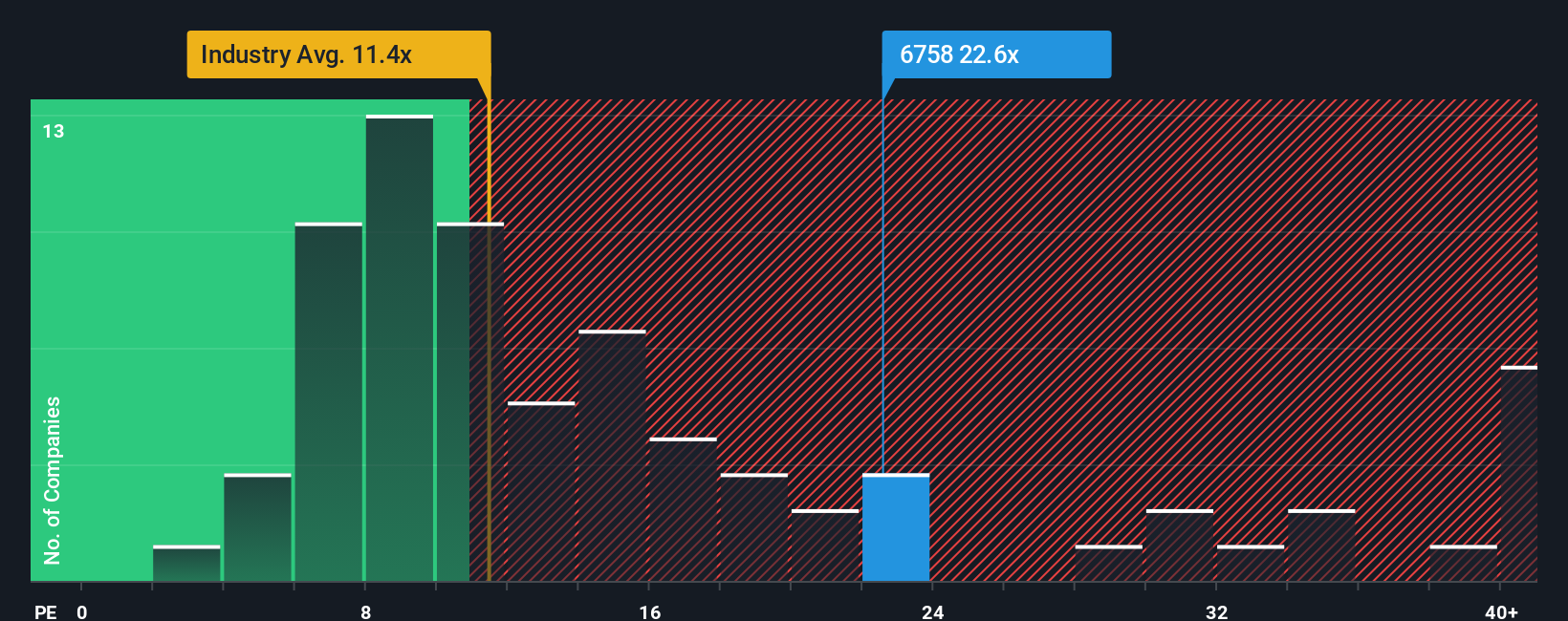

Taking a step back from fair value estimates, Sony’s price-to-earnings ratio sits at 22.2x. This is nearly double the Japanese Consumer Durables industry average of 11.5x and is below the peer average of 27.9x. While this is still under the fair ratio of 26.1x, it suggests the market already bakes in high expectations alongside some upside.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sony Group Narrative

If you'd rather dig into the numbers or want to map out your own scenario, you can build your perspective in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Sony Group.

Looking for more investment ideas?

You could miss out on the next big winner if you only focus on one stock. Give yourself more options and set the stage for smarter investing with these tailored ideas from Simply Wall Street:

- Unlock steady income opportunities by reviewing these 17 dividend stocks with yields > 3% that consistently offer yields above 3% and reward shareholders with reliable cash flow.

- Boost your portfolio’s potential in tomorrow’s biggest markets by targeting these 25 AI penny stocks offering high growth in artificial intelligence and automation.

- Act early on undervalued gems by spotting these 917 undervalued stocks based on cash flows where the market has not fully priced in fundamental strengths.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6758

Sony Group

Designs, develops, produces, and sells electronic equipment, instruments, and devices for the consumer, professional, and industrial markets in Japan, the United States, Europe, China, the Asia-Pacific, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives