- Japan

- /

- Consumer Durables

- /

- TSE:6758

Does Sony’s ¥249.99 Billion Buyback Strengthen the Long-Term Investment Case for Sony Group (TSE:6758)?

Reviewed by Sasha Jovanovic

- In late October 2025, Sony Group completed its previously announced share buyback program, having repurchased 63,156,800 shares, equal to 1.05% of its outstanding shares, for ¥249.99 billion.

- This signals management's focus on capital returns and can often be seen as a vote of confidence in the company's long-term value by market participants.

- We'll examine how the completion of Sony’s ¥249.99 billion share repurchase impacts the company's updated investment narrative and outlook.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Sony Group Investment Narrative Recap

The core appeal for Sony Group shareholders lies in the company’s ability to harness global leadership in gaming, entertainment, and sensor technology, building a stable base of recurring digital and content-driven earnings. Sony’s recent completion of its ¥249.99 billion buyback plan is largely symbolic in the short term, it boosts investor returns but does not impact the main catalyst of recurring digital growth, nor does it move the needle on current margin or supply chain risks.

Of the recent announcements, Sony’s raised profit guidance in August 2025 stands out. While this increased confidence supports the thesis of ongoing digital and IP monetization, it does not directly address the operational and regulatory risks now pressuring Sony’s hardware and financial segments.

In contrast, investors should also acknowledge that cost pressures from supply chain adjustments may still challenge Sony’s profits if international tensions escalate...

Read the full narrative on Sony Group (it's free!)

Sony Group's narrative projects ¥12,813.1 billion in revenue and ¥1,265.8 billion in earnings by 2028. This outlook assumes a yearly revenue decline of 0.5% and an earnings increase of ¥75.3 billion from current earnings of ¥1,190.5 billion.

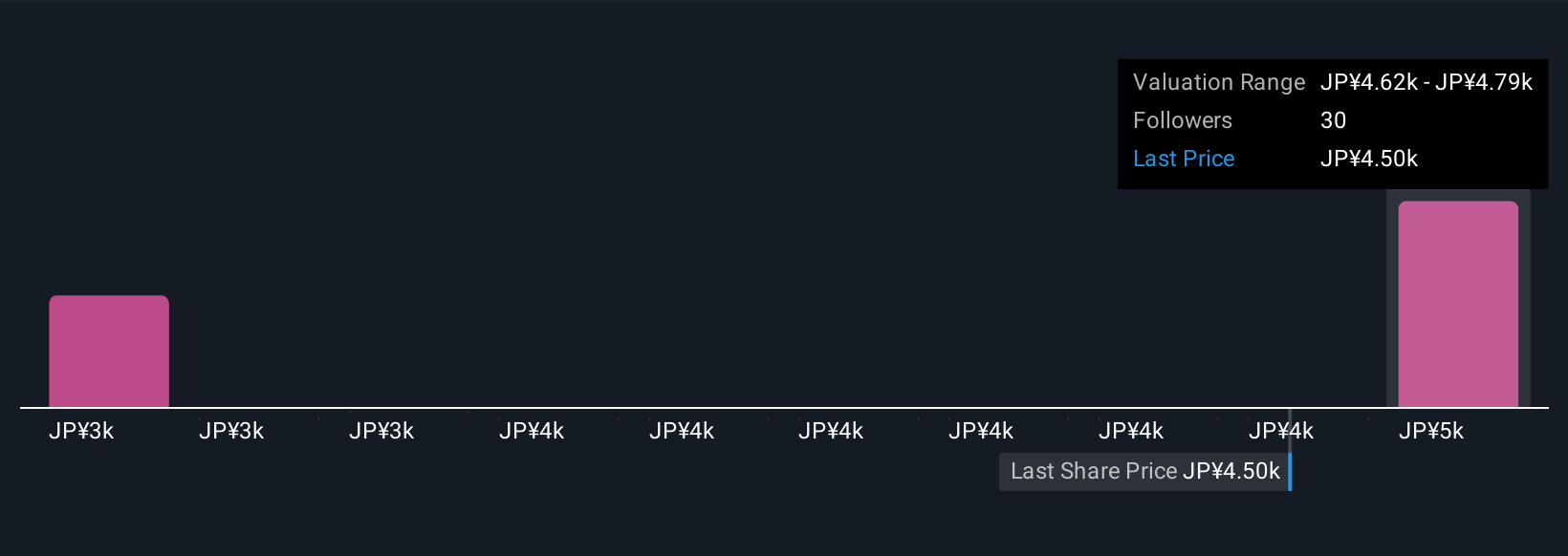

Uncover how Sony Group's forecasts yield a ¥4868 fair value, a 12% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have set fair value targets for Sony Group ranging from ¥2,521 to ¥4,867, based on five individual assessments. With key catalysts tied to recurring digital income streams, your interpretation of value could shift considerably in light of evolving digital and supply chain trends.

Explore 5 other fair value estimates on Sony Group - why the stock might be worth as much as 12% more than the current price!

Build Your Own Sony Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sony Group research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Sony Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sony Group's overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6758

Sony Group

Designs, develops, produces, and sells electronic equipment, instruments, and devices for the consumer, professional, and industrial markets in Japan, the United States, Europe, China, the Asia-Pacific, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives