- Japan

- /

- Consumer Durables

- /

- TSE:6632

Can JVCKENWOOD's (TSE:6632) Fast Buyback Reveal a Shift in Capital Allocation Priorities?

Reviewed by Sasha Jovanovic

- JVCKENWOOD Corporation announced and swiftly completed a repurchase of 3,513,700 shares for ¥5,000 million, representing 2.39% of its issued share capital, following board authorization on November 13, 2025.

- This buyback was designed to improve return on equity and earnings per share, as well as to mitigate the anticipated impact from a recent issuance of zero coupon convertible bonds.

- We'll examine how this rapid share buyback, aimed at boosting key financial metrics, contributes to JVCKENWOOD's current investment narrative.

Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

What Is JVCKENWOOD's Investment Narrative?

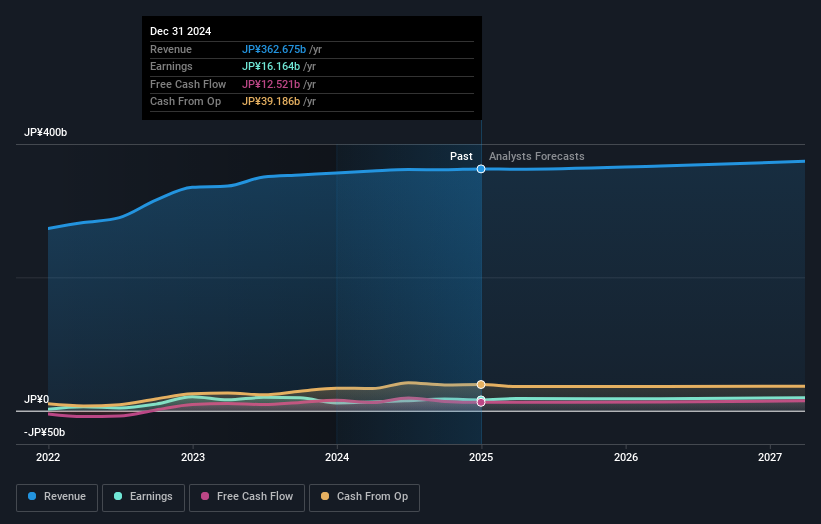

To see JVCKENWOOD as a compelling investment hinges on your outlook for steady, if modest, growth, a focus on capital returns, and faith in management’s ability to unlock shareholder value as the company pivots after a turbulent year. The rapid completion of the recent ¥5,000 million buyback, representing 2.39% of issued shares, is an effort to shore up earnings per share and return on equity, addressing concerns about dilution following the zero coupon convertible bond issuance. While this action aligns with the board’s capital efficiency plans and may temporarily boost key metrics, it doesn’t fundamentally alter the near-term catalysts or underlying risks highlighted previously. The most pressing challenges remain: muted revenue growth versus the broader market, continued share price weakness, and whether cost controls or margin improvements can drive outperformance as sector competition stays fierce.

But sharp swings in recent share price volatility are something every investor should keep an eye on. Despite retreating, JVCKENWOOD's shares might still be trading 49% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore another fair value estimate on JVCKENWOOD - why the stock might be worth as much as 52% more than the current price!

Build Your Own JVCKENWOOD Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your JVCKENWOOD research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free JVCKENWOOD research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate JVCKENWOOD's overall financial health at a glance.

No Opportunity In JVCKENWOOD?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6632

JVCKENWOOD

Manufactures and sells products in the mobility and telematics services, public service, and media service sectors in Japan and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives