The Bull Case For Sega Sammy Holdings (TSE:6460) Could Change Following Second Quarter Dividend Increase

Reviewed by Sasha Jovanovic

- Sega Sammy Holdings announced a second quarter dividend increase to ¥27.00 per share for the fiscal year ending March 31, 2026, up from ¥25.00 per share a year earlier, with payments scheduled to commence on December 3, 2025.

- This higher dividend marks a shift in payout policy and may indicate greater confidence from management in the company’s stability and outlook.

- To see how the newly announced dividend increase feeds into Sega Sammy Holdings’ investment narrative, we’ll focus on its implied management confidence.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

What Is Sega Sammy Holdings' Investment Narrative?

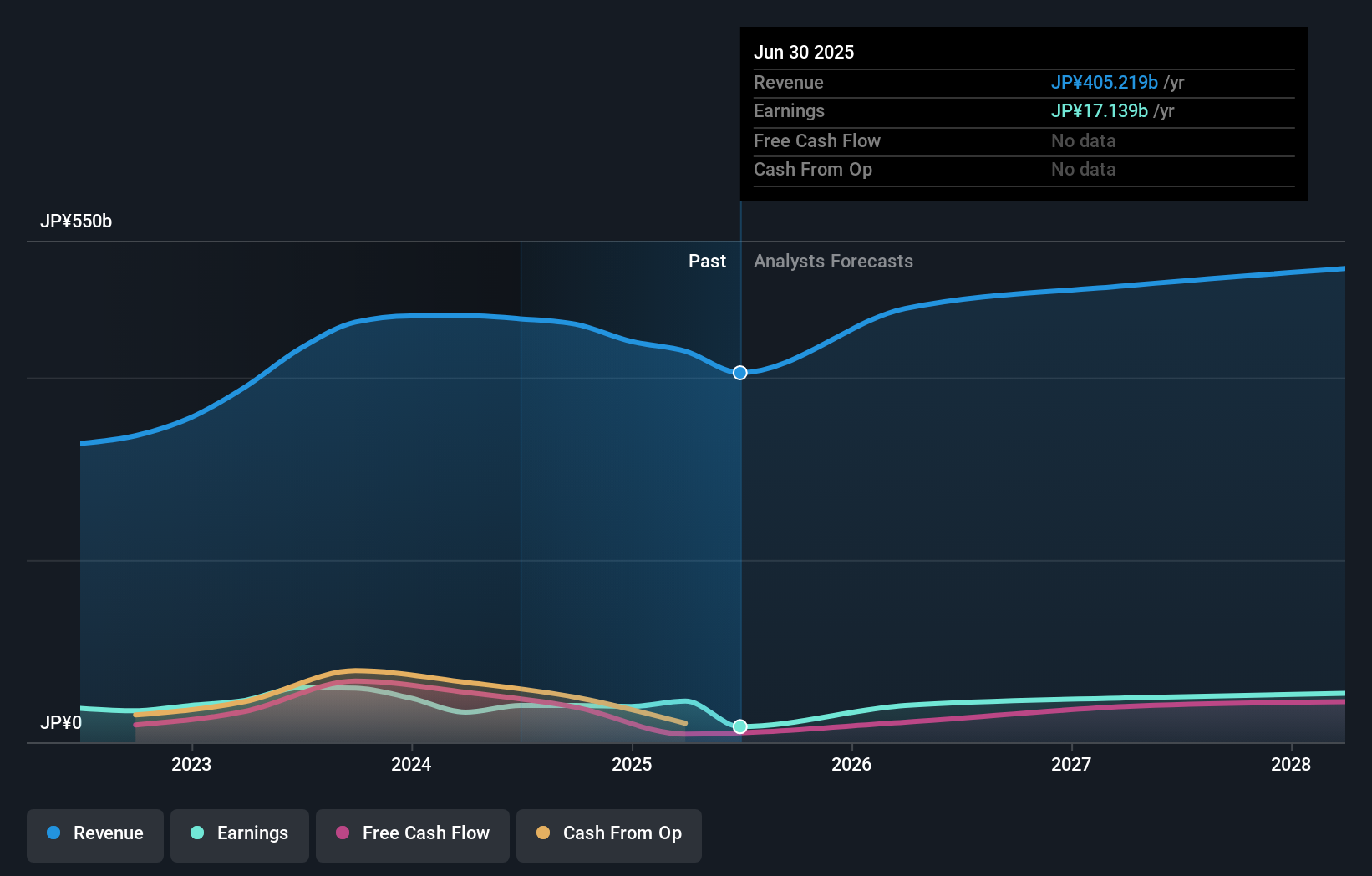

For anyone considering Sega Sammy Holdings stock, the core belief is in management’s ability to turn stable, long-term growth potential into value, especially in Japan’s leisure and gaming sectors. The recent Q2 dividend hike to ¥27 per share signals management’s confidence, but in the near term, it’s unlikely to shift the main catalysts driving the share price, namely, the company’s upcoming earnings announcements, guidance for profit acceleration, and the ongoing impact of recent share buybacks. Risks remain centered on slow revenue expansion and weaker profit margins compared to last year, which have driven share underperformance despite steady dividends and a large discount to consensus fair value. The increased dividend so soon after earlier guidance tweaks might dampen some risk perception, but it doesn’t fundamentally change the drag of sluggish sales growth or expensive valuation metrics. Recent price declines suggest investors are still cautious.

But against this dividend confidence, the risk of slowing revenue and margin compression can’t be ignored. Despite retreating, Sega Sammy Holdings' shares might still be trading 33% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 3 other fair value estimates on Sega Sammy Holdings - why the stock might be worth as much as 49% more than the current price!

Build Your Own Sega Sammy Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sega Sammy Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Sega Sammy Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sega Sammy Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6460

Sega Sammy Holdings

Through its subsidiaries, engages in the entertainment contents business.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives