Sega Sammy Holdings (TSE:6460) Dividend Hike Signals Confidence—A Fresh Look at Its Valuation

Reviewed by Simply Wall St

Sega Sammy Holdings (TSE:6460) just announced a higher dividend for the second quarter, raising its payout to JPY 27.00 per share from JPY 25.00 last year. The change is scheduled to take effect on December 3, 2025, which underscores management’s confidence in the company’s outlook.

See our latest analysis for Sega Sammy Holdings.

Sega Sammy’s latest dividend boost arrives as momentum in the share price has cooled, with a 1-year total shareholder return of -1.5%. This contrasts with robust gains of over 50% for investors holding over three years. The stock’s recent dip may be prompting renewed questions around its long-term value, especially amid upbeat signals from management.

If you’re evaluating where investor confidence is building, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

With shares lagging despite rising profits and analyst targets far above the current price, the big question is whether Sega Sammy is being overlooked by the market or if expectations already capture the company’s growth potential.

Price-to-Earnings of 30.5x: Is it justified?

Sega Sammy trades at a price-to-earnings (P/E) ratio of 30.5x, which is well above the average for its leisure industry peers and the broader market. With the stock’s last close at ¥2524.5, this multiple signals a significant premium compared to typical competitors.

The price-to-earnings ratio tells investors how much they are paying for each yen of company earnings. It is a widely used metric in profit-driven sectors like leisure. A higher P/E can reflect optimistic growth expectations or a company’s strong market positioning. However, it may also indicate overvaluation if it is not supported by robust fundamentals.

Sega Sammy’s P/E of 30.5x is more than double the Japanese leisure industry average of 13.3x and also exceeds the estimated fair price-to-earnings ratio of 24.5x. This substantial premium to both the sector and the company’s own fair value benchmark suggests that the market is highly optimistic about future earnings growth, or that investors might be overpaying relative to the company’s current fundamentals. The fair ratio represents a more sustainable level that the market could potentially move toward if sentiment changes.

Explore the SWS fair ratio for Sega Sammy Holdings

Result: Price-to-Earnings of 30.5x (OVERVALUED)

However, slower revenue growth or a reversal in net income trends could quickly shift market sentiment and challenge the current optimistic valuation.

Find out about the key risks to this Sega Sammy Holdings narrative.

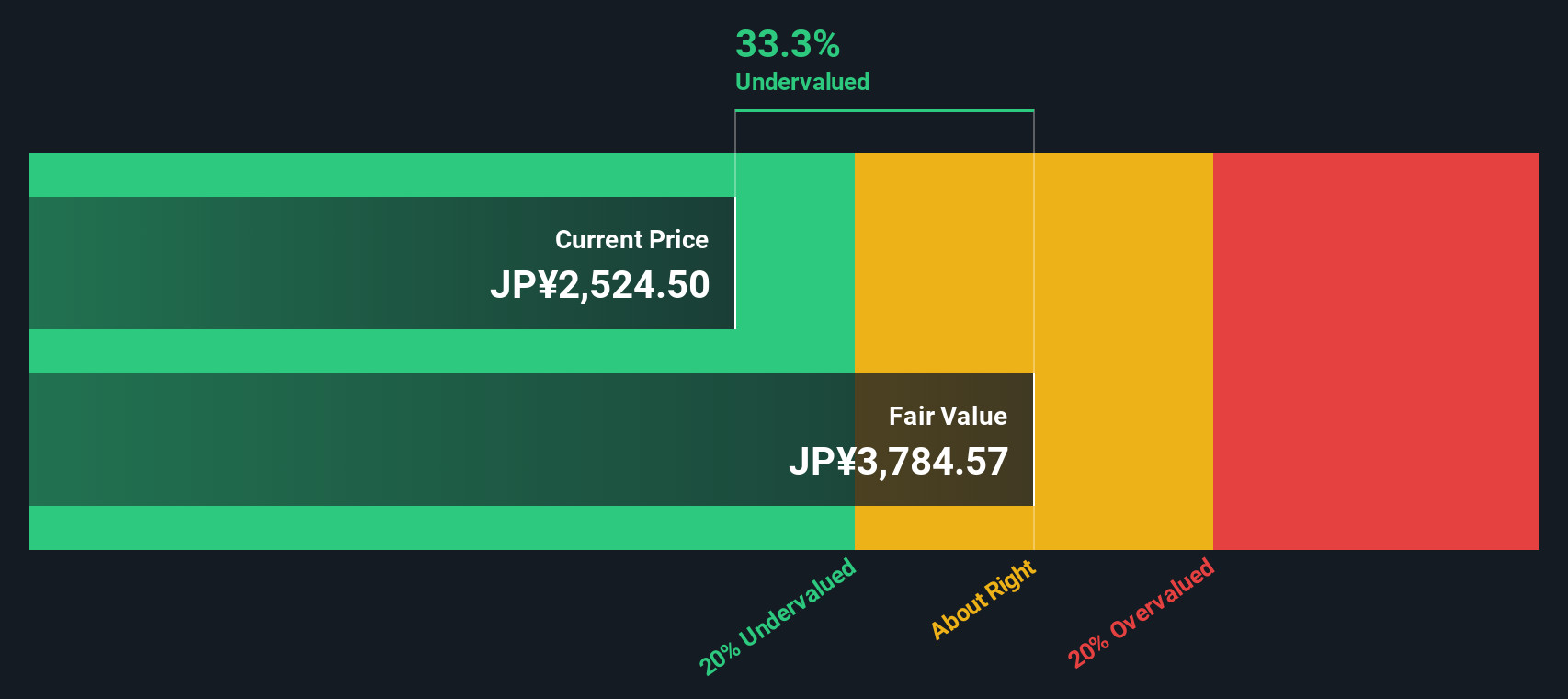

Another View: Discounted Cash Flow Paints a Different Picture

Looking beyond headline multiples, our SWS DCF model takes a deep dive into Sega Sammy's projected future cash flows. This model suggests the shares might actually be undervalued by over 33%, with a fair value estimate closer to ¥3,781 per share. Does this indicate a genuine bargain, or are future expectations too lofty?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sega Sammy Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 879 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sega Sammy Holdings Narrative

If you want to check the figures for yourself or think there’s more to the story, you can quickly craft your own view in just a few minutes using the following tool: Do it your way

A great starting point for your Sega Sammy Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Find the smartest opportunities on Simply Wall Street before everyone else. It is the fastest way to access strategies that could reshape your investment game.

- Unlock the power of next-gen innovation by scanning these 25 AI penny stocks, which are shaping the future with breakthrough applications in artificial intelligence.

- Boost your income potential by checking out these 16 dividend stocks with yields > 3%, offering reliable yields and strong fundamentals for a smoother investment journey.

- Get ahead of the curve with these 82 cryptocurrency and blockchain stocks, advancing digital assets, blockchain solutions, and the technologies transforming global finance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6460

Sega Sammy Holdings

Through its subsidiaries, engages in the entertainment contents business.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives