- China

- /

- Electronic Equipment and Components

- /

- SZSE:301413

3 Global Growth Companies With High Insider Ownership Growing Earnings At 63%

Reviewed by Simply Wall St

As global markets navigate a mixed landscape with the U.S. ending its longest government shutdown and concerns about elevated valuations, investors are keenly focused on growth opportunities amid cautious economic signals. In this environment, companies with high insider ownership often attract attention for their potential alignment of interests and commitment to long-term growth, especially those demonstrating robust earnings expansion.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Pharma Mar (BME:PHM) | 12% | 41.5% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 31.1% |

| CD Projekt (WSE:CDR) | 29.7% | 50.7% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 30.3% |

Here's a peek at a few of the choices from the screener.

Orbbec (SHSE:688322)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Orbbec Inc. designs, manufactures, and sells 3D vision sensors with a market cap of CN¥31.92 billion.

Operations: Orbbec's revenue is primarily derived from the design, manufacturing, and sale of 3D vision sensors.

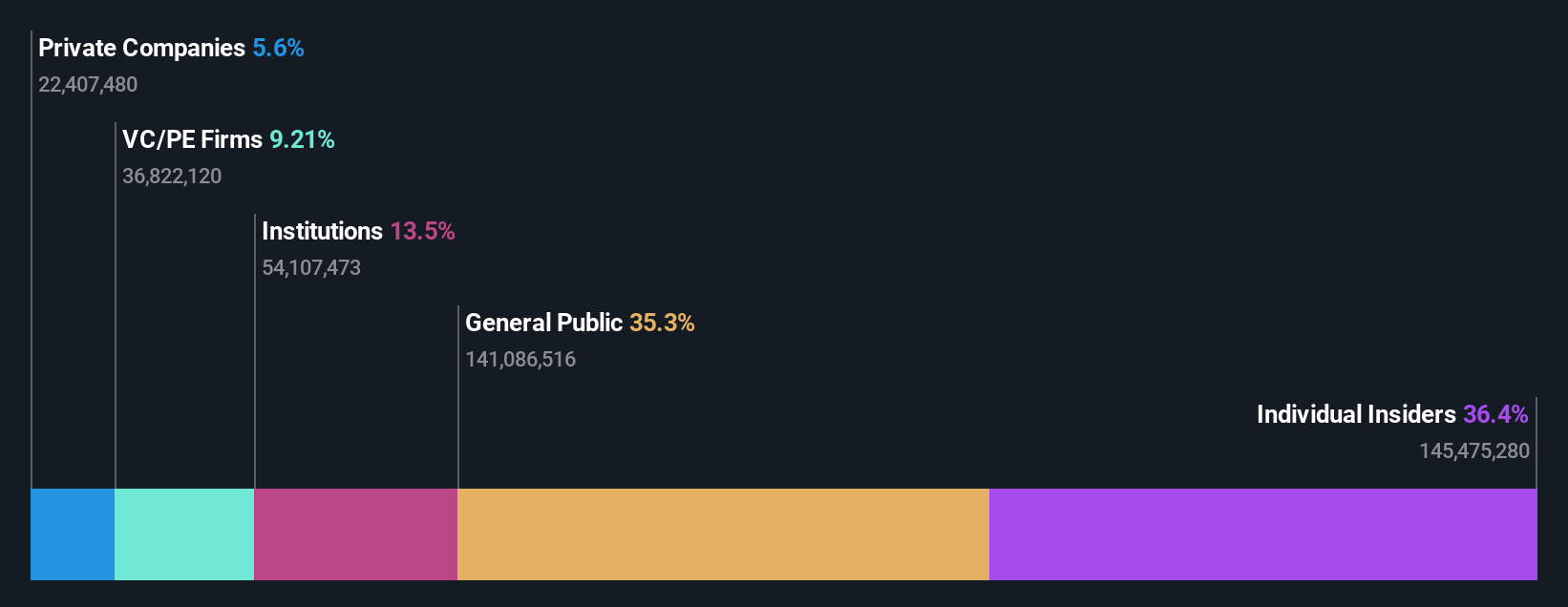

Insider Ownership: 36.4%

Earnings Growth Forecast: 63.2% p.a.

Orbbec Inc. has shown substantial growth, with sales reaching CNY 714 million for the nine months ending September 2025, up from CNY 350.86 million a year ago. The company turned profitable this year with net income of CNY 108.02 million compared to a loss last year. Orbbec's revenue is forecast to grow at an impressive rate of 36.4% annually, outpacing the broader market, while earnings are expected to increase significantly by over 63% per annum.

- Unlock comprehensive insights into our analysis of Orbbec stock in this growth report.

- According our valuation report, there's an indication that Orbbec's share price might be on the expensive side.

Shenzhen Ampron Technology (SZSE:301413)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Ampron Technology Co., Ltd. focuses on the research, development, manufacture, sale, and service of sensors in China with a market cap of CN¥12.22 billion.

Operations: The company generates revenue of CN¥1.14 billion from its Sensitive Components and Sensor Manufacturing segment.

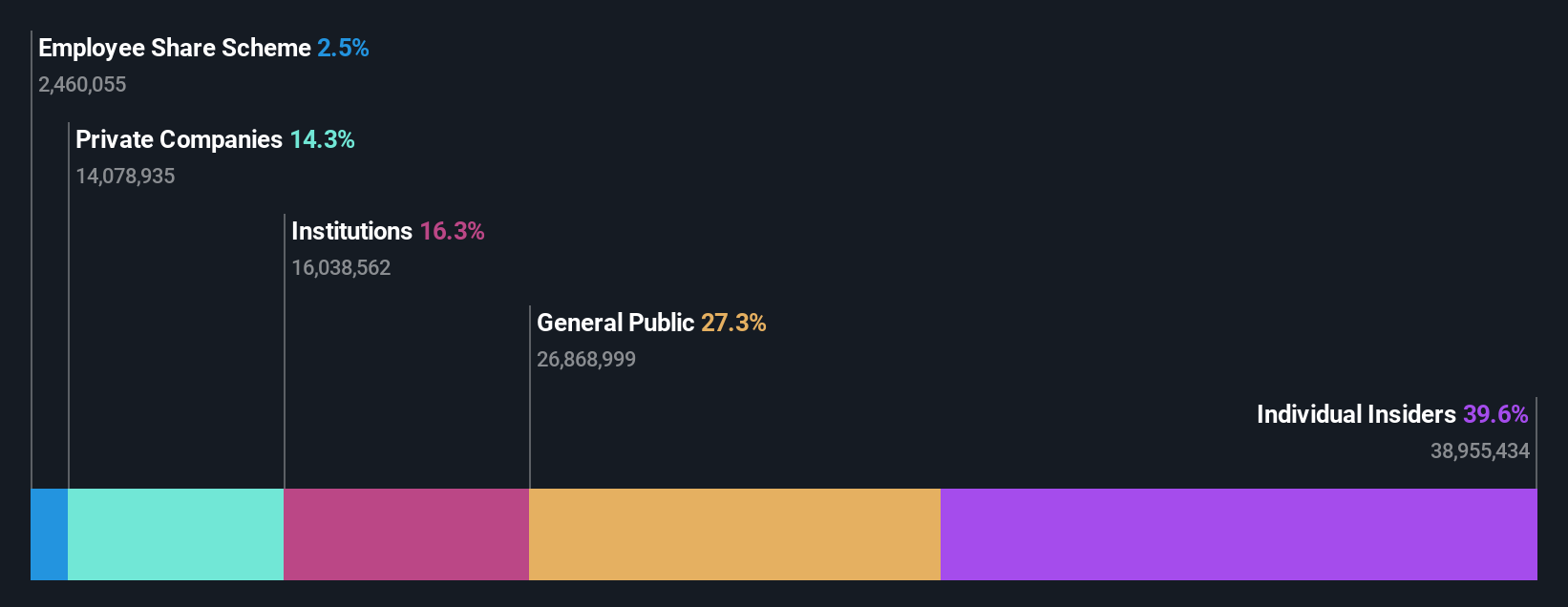

Insider Ownership: 39.6%

Earnings Growth Forecast: 26.5% p.a.

Shenzhen Ampron Technology has demonstrated solid revenue growth, reporting CNY 862.1 million for the first nine months of 2025, up from CNY 661.79 million a year earlier. Despite high volatility in its share price and large one-off items affecting results, earnings grew by 14.8% last year and are forecast to rise significantly at an annual rate of 26.54%. This growth is expected to surpass the market's average revenue increase but lag slightly behind in earnings growth expectations.

- Navigate through the intricacies of Shenzhen Ampron Technology with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Shenzhen Ampron Technology is priced higher than what may be justified by its financials.

Sega Sammy Holdings (TSE:6460)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sega Sammy Holdings Inc., with a market cap of ¥547.08 billion, operates in the entertainment contents business through its subsidiaries.

Operations: The company's revenue is primarily derived from its Entertainment Contents segment at ¥329.25 billion, followed by Pachislot & Pachinko Machines at ¥74.41 billion, and the Gaming Business contributing ¥12.22 billion.

Insider Ownership: 10.8%

Earnings Growth Forecast: 23.7% p.a.

Sega Sammy Holdings is trading at a significant discount to its estimated fair value, with analysts predicting a 40.4% price increase. Despite current profit margins declining from last year, earnings are forecasted to grow significantly at 23.7% annually, outpacing the broader Japanese market's growth rate of 7.9%. However, revenue growth projections remain modest at 6.5% annually. The recent dividend increase to ¥27 per share underscores the company's commitment to returning value to shareholders despite sustainability concerns due to insufficient free cash flow coverage.

- Dive into the specifics of Sega Sammy Holdings here with our thorough growth forecast report.

- Our expertly prepared valuation report Sega Sammy Holdings implies its share price may be lower than expected.

Make It Happen

- Take a closer look at our Fast Growing Global Companies With High Insider Ownership list of 843 companies by clicking here.

- Ready For A Different Approach? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301413

Shenzhen Ampron Technology

Engages in the research and development, manufacture, sale, and service of sensors in China.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives