Does Sankyo's Dividend Increase Reflect Confidence in Its Capital Allocation Strategy for TSE:6417?

Reviewed by Sasha Jovanovic

- Sankyo Co., Ltd. announced a cash dividend increase to JPY 45.00 per share for the end of the second quarter of fiscal year ending March 31, 2026, up from JPY 40.00 paid a year earlier and payable on December 1, 2025.

- This higher dividend highlights Sankyo’s emphasis on shareholder returns and signals confidence in the company’s ongoing financial performance.

- We’ll examine how Sankyo’s commitment to increasing dividends shapes its investment narrative and outlook for shareholder value creation.

Rare earth metals are the new gold rush. Find out which 38 stocks are leading the charge.

What Is Sankyo's Investment Narrative?

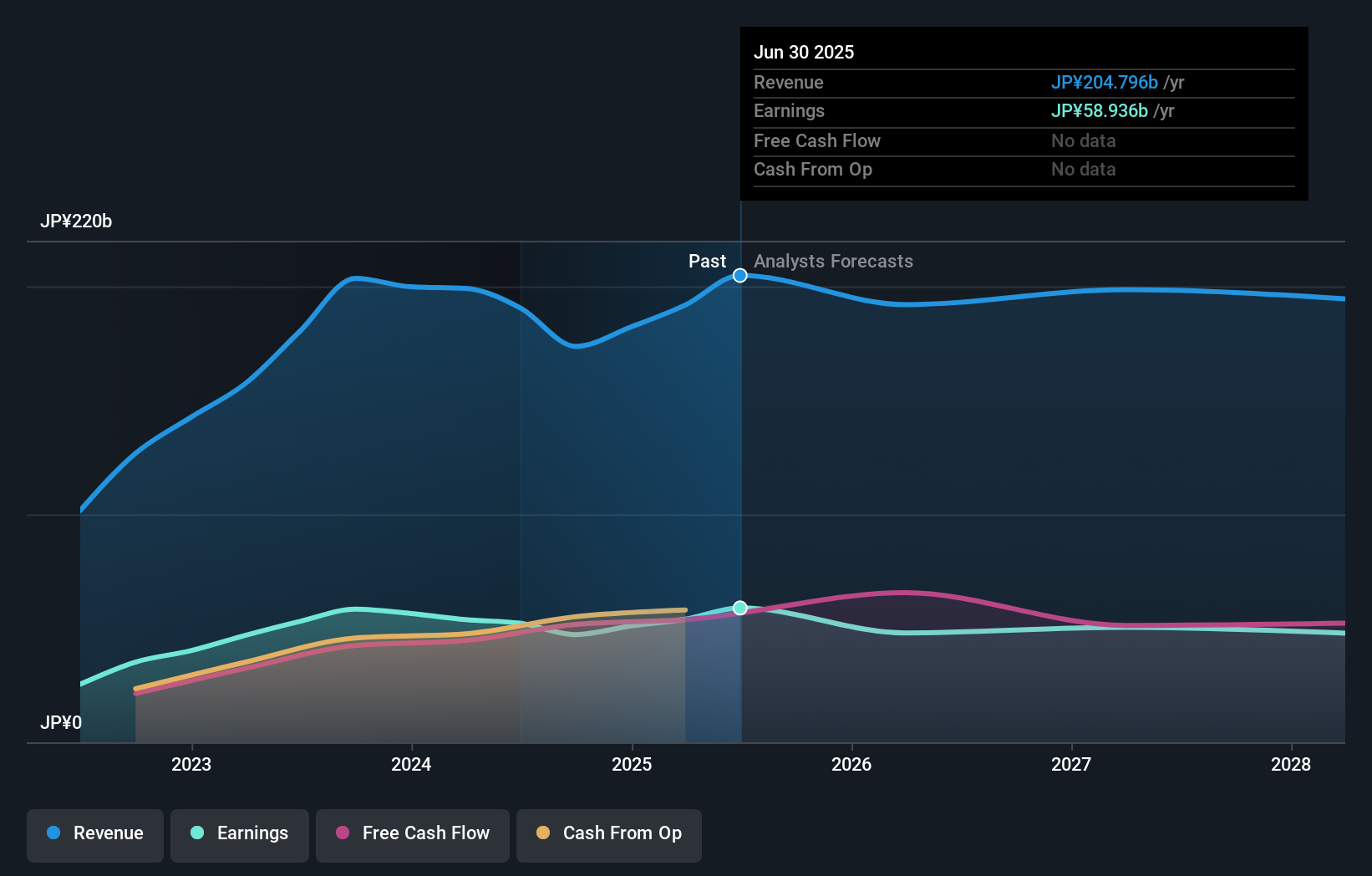

For anyone considering Sankyo as a long-term holding, the core investment thesis hinges on the company’s commitment to delivering shareholder value through steady dividends, share buybacks, and strategic moves in its traditional and digital gaming segments. The recent dividend increase signals confidence from management and may reinforce Sankyo’s appeal to income-focused investors, even as current guidance points to modest declines in both revenue and earnings over the coming years. While this boost to payouts could alleviate some concerns around short-term weakness and market volatility, the underlying catalysts for share price movement, like results from the new KUGITAMA project or partnerships aimed at refreshening the pachinko business, remain unchanged, with immediate impact still uncertain. Risks of declining industry demand and a relatively inexperienced board continue to loom, potentially muting the upside from shareholder returns amid challenging earnings outlooks. Yet, the latest news enhances Sankyo’s narrative as a company balancing resilience and reward.

However, investors should weigh the risks around a less experienced board when evaluating the case for Sankyo.

Sankyo's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 2 other fair value estimates on Sankyo - why the stock might be worth just ¥2760!

Build Your Own Sankyo Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sankyo research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Sankyo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sankyo's overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6417

Sankyo

Manufactures and sells game machines and ball bearing supply systems in Japan.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives