- Japan

- /

- Consumer Durables

- /

- TSE:5947

A Look at Rinnai (TSE:5947) Valuation Following Dividend Hike and Major Share Buyback

Reviewed by Simply Wall St

Rinnai (TSE:5947) just wrapped up a notable period for shareholders, announcing a jump in its interim dividend to JPY 50.00 per share and completing a significant share buyback covering nearly 2% of total shares.

See our latest analysis for Rinnai.

Rinnai's announcement of a larger interim dividend and nearly 2% share buyback came shortly after a 9.0% one-month share price return, reflecting rising investor optimism about management's confidence and commitment to returning value. Over the past year, the stock has delivered a robust 22.3% total shareholder return, outpacing its longer-term trends and signaling that bullish momentum may be building.

If this mix of rising payouts and share repurchases piques your interest, it could be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With shares climbing on upbeat news and investor sentiment strong, the real question is whether Rinnai’s upside still has room to run or if the market has fully factored in all the good news. Is there still a buying opportunity here?

Price-to-Earnings of 15.7x: Is it justified?

Rinnai is trading at a price-to-earnings ratio of 15.7x, which positions the stock as undervalued compared to its peers, especially when the company's last closing price is weighed against sector averages.

The price-to-earnings (P/E) ratio measures what investors are willing to pay today for a yen of current earnings. This makes it a key tool for comparing profitability and value among similar companies in the consumer durables space.

In Rinnai’s case, the 15.7x P/E not only comes in far below the peer group average of 24.5x, but it also sits below the stock’s own fair value multiple of 17.1x. This could suggest room for further upside if fundamentals hold. Investors may be underestimating Rinnai’s earnings momentum and recent improvements in profit margins, while the market has yet to close the valuation gap.

Meanwhile, it is worth noting that, relative to the broader JP Consumer Durables industry average of 11.5x, Rinnai still looks somewhat expensive. However, when compared to its estimated fair price-to-earnings ratio of 17.1x, its valuation seems more balanced, highlighting both opportunity and potential reversion as investor sentiment evolves.

Explore the SWS fair ratio for Rinnai

Result: Price-to-Earnings of 15.7x (UNDERVALUED)

However, if revenue growth slows or pressure on margins increases again, the case for further upside could be challenged quickly. Ongoing performance will be key.

Find out about the key risks to this Rinnai narrative.

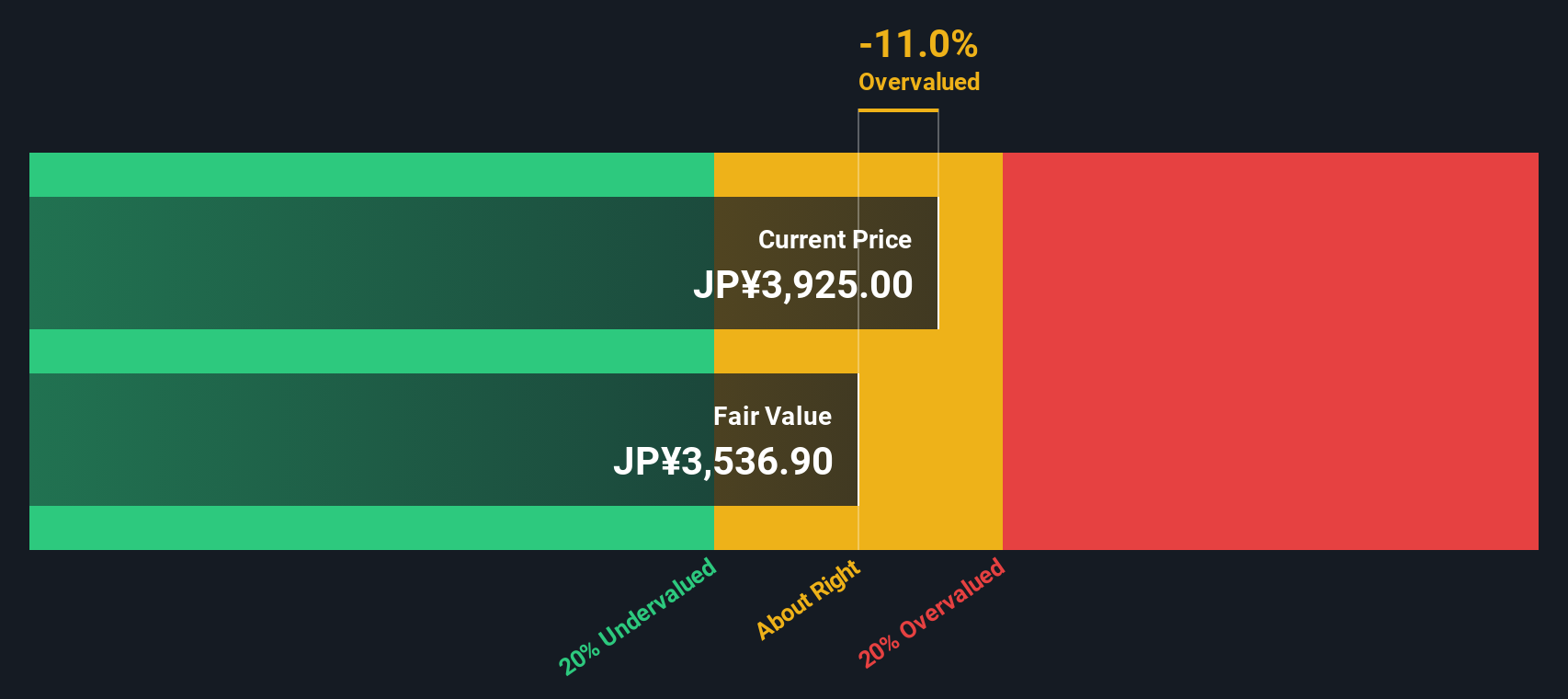

Another View: SWS DCF Model Takes a Cautious Stance

While Rinnai’s price-to-earnings ratio signals it could be undervalued, our SWS DCF model presents a less optimistic picture. According to this approach, the shares are trading above their estimated fair value. This may suggest the market’s optimism is already reflected in the price. Could this mean limited upside from here, or does it understate potential growth?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Rinnai for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 896 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Rinnai Narrative

If you see the story differently or prefer hands-on analysis, you can dive in and craft your own perspective in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Rinnai.

Looking for More Smart Investing Ideas?

Stay ahead of the market and keep your portfolio fresh by pursuing new investment frontiers picked for your potential. Don’t let these timely themes pass you by.

- Catalyze your growth strategy and target potential outliers by checking out these 896 undervalued stocks based on cash flows with untapped upside based on solid cash flows.

- Capitalize on cutting-edge progress in healthcare by browsing these 30 healthcare AI stocks, which is transforming diagnostics, patient care, and medical tech with AI.

- Seize the chance to potentially earn stronger income and hedge volatility by investigating these 15 dividend stocks with yields > 3%, offering reliable yields above 3% for income-focused investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5947

Rinnai

Manufactures and sells thermal equipment in Japan, the United States, Australia, China, South Korea, and Indonesia.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives