Wacoal Holdings (TSE:3591): Assessing Valuation After Earnings Forecast Revision and U.S. Sales Challenges

Reviewed by Simply Wall St

Wacoal Holdings (TSE:3591) has updated its consolidated earnings forecast for the second quarter, pointing to a 9% drop in revenue as sluggish sales in major markets continue, including softness in women’s innerwear and persistent challenges in the U.S. retail landscape. The company’s full-year outlook is now under review, raising questions about the path forward for this established name in apparel.

See our latest analysis for Wacoal Holdings.

Wacoal’s shares have seen modest gains over the past year, with a 2% year-to-date share price return. The real story is its 15% total shareholder return in the past twelve months and a standout 194% total return over five years. While the recent dip follows downward revisions in sales forecasts and market concerns, the company’s longer-term momentum has rewarded investors who stayed patient through previous challenges.

If news-driven shifts like this have you rethinking your investment approach, it might be the right moment to broaden your horizons and discover fast growing stocks with high insider ownership

With shares still up strongly over the past five years and now trading below analyst targets, the question is whether Wacoal has become undervalued after recent weakness or if the market is rightly bracing for tougher times ahead.

Price-to-Earnings of 15.2x: Is it justified?

Wacoal Holdings currently trades at a price-to-earnings (P/E) ratio of 15.2x, which puts it above both the Japanese Luxury industry average and the company’s own long-term fair ratio benchmarks.

The price-to-earnings ratio shows what investors are willing to pay today for one yen of the company’s earnings. For an established apparel brand like Wacoal, this multiple can reflect future growth expectations, confidence in brand strength, or skepticism about near-term profit trends.

However, Wacoal’s P/E is not just above the industry average of 13.2x; it is also nearly triple its statistically estimated fair value multiple of 5.2x. This premium may signal the market still believes in a turnaround. Compared to similar companies, it suggests shares are expensive on earnings power alone. If market sentiment reverses, the P/E ratio could drift closer to the fair ratio as expectations normalize.

Explore the SWS fair ratio for Wacoal Holdings

Result: Price-to-Earnings of 15.2x (OVERVALUED)

However, risks remain if U.S. sales softness deepens further or if Wacoal’s profit margins do not recover as anticipated by the market.

Find out about the key risks to this Wacoal Holdings narrative.

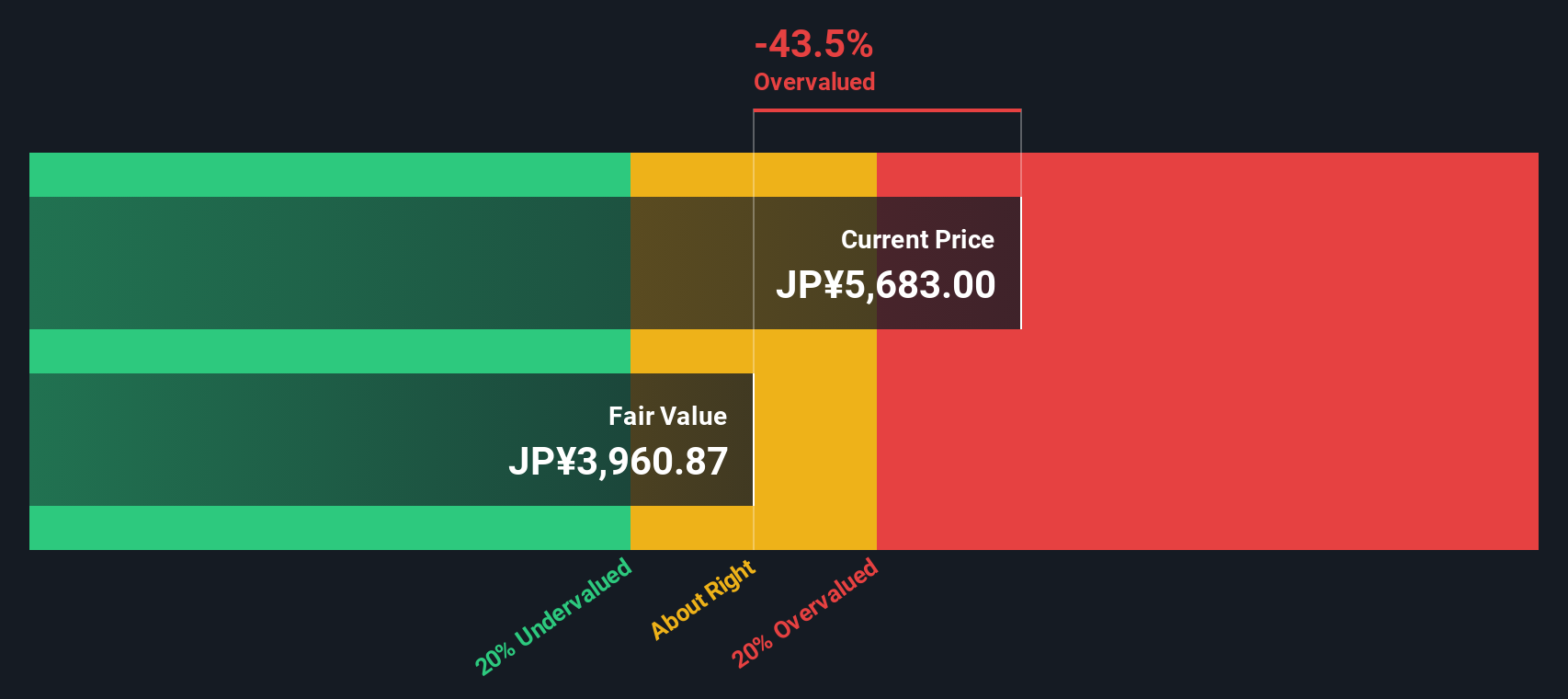

Another View: SWS DCF Model Challenges the Premium

While market multiples suggest Wacoal is expensive, our DCF model provides a starkly different take. According to our calculations, the company’s shares are trading well above their estimated fair value. This indicates the price might not be justified by future cash flows. What happens if the market starts to see it the same way?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Wacoal Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 848 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Wacoal Holdings Narrative

If you have a different perspective or want to dive into the numbers yourself, it takes only a few minutes to develop and share your own view. Do it your way

A great starting point for your Wacoal Holdings research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors know the best opportunities often hide in plain sight. See what you’ve been missing and get inspired to make your next move with these hand-picked screens:

- Unlock potential value by analyzing these 848 undervalued stocks based on cash flows with strong cash flow at attractive prices.

- Tap into future healthcare trends by following these 34 healthcare AI stocks that are shaping innovation in medical technology.

- Capture steady income and resilience by targeting these 21 dividend stocks with yields > 3% offering yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wacoal Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3591

Wacoal Holdings

Engages in the manufacturing, wholesale, and retail sale of intimate apparel, outerwear, sportswear, and other textile products and accessories in Japan, Asia, Oceania, the United States, and Europe.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives