- Japan

- /

- Consumer Durables

- /

- TSE:1766

Assessing Token (TSE:1766) Valuation After Its Newly Announced Large Share Buyback Program

Reviewed by Simply Wall St

Token (TSE:1766) just rolled out a sizeable share buyback, with board approval to retire a meaningful slice of its outstanding stock. This move immediately sharpens the conversation around valuation and capital allocation.

See our latest analysis for Token.

The buyback news lands after a steady climb, with the share price up strongly year to date and a robust three year total shareholder return suggesting momentum is still in Token’s favor.

If this kind of capital return story has your attention, it is also worth exploring fast growing stocks with high insider ownership as another way to spot compelling opportunities building behind the scenes.

With earnings growth still positive and the buyback priced below the current market level, investors now face a key question: Is Token trading at a discount, or has the market already priced in its future growth?

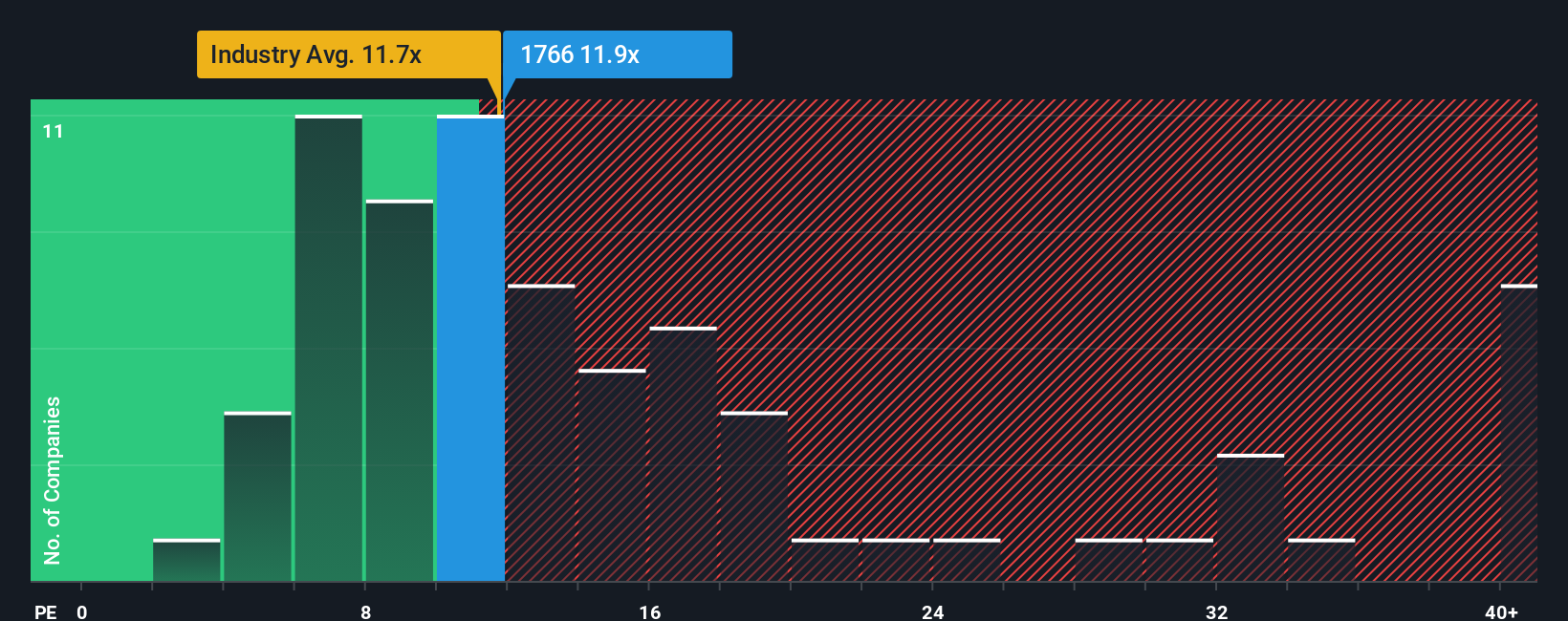

Price to Earnings of 11.9x: Is it justified?

Our DCF model estimates Token’s fair value at approximately ¥22,764, implying the current ¥14,850 share price is trading at a notable discount.

The SWS DCF model projects Token’s future cash flows, then discounts them back to today using a required rate of return, producing a single intrinsic value estimate. This approach is especially useful for a mature, cash generative construction and leasing business where growth is steady rather than explosive.

In Token’s case, the model factors in modest forecast profit growth alongside improving profitability, which helps support a fair value materially above the market price. For investors, that discount suggests the market may not be fully recognising the company’s earnings power and long term cash flow profile.

Look into how the SWS DCF model arrives at its fair value.

Beyond the DCF lens, Token’s current price to earnings ratio of 11.9x is another way to frame valuation. The price to earnings multiple compares what investors are willing to pay today for each unit of current earnings. This is a central yardstick for established, profitable companies in Japan’s consumer durables and construction linked sectors.

Relative to peers, Token screens attractively valued, with its 11.9x multiple sitting well below the peer average of 34.3x. This hints that the market could be underestimating its earnings resilience and growth prospects. When set against the estimated fair price to earnings ratio of 14x, today’s lower multiple also suggests there is room for the valuation to expand if sentiment and fundamentals stay aligned.

Explore the SWS fair ratio for Token

Result: Price to Earnings of 11.9x (UNDERVALUED)

However, the thesis could unravel if Japan’s construction cycle softens or leasing demand weakens, which could pressure Token’s margins and dampen buyback supported sentiment.

Find out about the key risks to this Token narrative.

Another Take on Valuation

While our DCF view paints Token as undervalued, its 11.9x earnings multiple sits almost exactly in line with the 11.6x Consumer Durables industry average. That narrows the apparent bargain and raises a fair question: is this really mispricing, or just a solid stock at a fair going rate?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Token for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 919 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Token Narrative

If you see the numbers differently, or simply want to dig into the data yourself, you can build a tailored view in minutes: Do it your way.

A great starting point for your Token research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Before you move on, consider your next set of ideas with targeted stock lists from Simply Wall St, so you are not leaving potential opportunities on the table.

- Explore higher-upside potential by reviewing these 3608 penny stocks with strong financials built around smaller companies with stronger financial foundations than the usual speculative names.

- Position yourself at the frontier of innovation by using these 24 AI penny stocks to focus on companies harnessing artificial intelligence for real, scalable growth.

- Strengthen your income strategy by scanning these 13 dividend stocks with yields > 3% that aim to balance yield and sustainability in one straightforward shortlist.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Token might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1766

Flawless balance sheet established dividend payer.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion