- Japan

- /

- Commercial Services

- /

- TSE:9768

IDEA Consultants (TSE:9768) Profit Margin Decline Challenges Perceived Earnings Quality

Reviewed by Simply Wall St

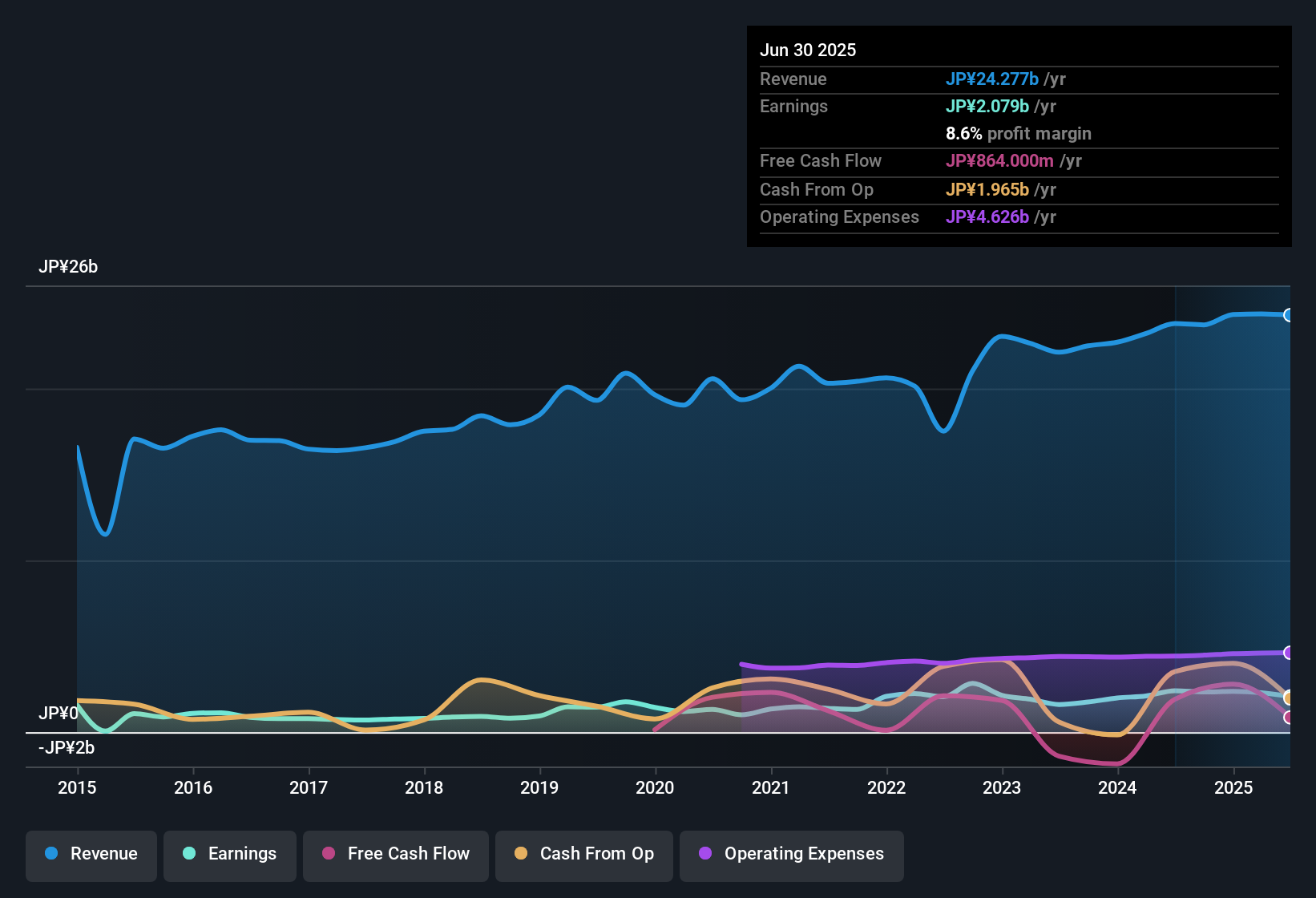

IDEA Consultants (TSE:9768) posted a net profit margin of 8.6%, down from 10.1% last year, as the latest results revealed a year-over-year decline in earnings. While the company’s earnings have averaged an impressive 10.4% annual growth over the past five years, this recent softness draws attention to changes in profitability. Investors will weigh the strong long-term track record against this dip, especially as valuation metrics and peer comparisons frame the numbers.

See our full analysis for IDEA ConsultantsInc.Next up, we will see how these results measure up against the market's prevailing stories and Simply Wall St's community narratives.

Curious how numbers become stories that shape markets? Explore Community Narratives

P/E Ratio Sits Well Below Peers

- The company’s Price-To-Earnings (P/E) ratio is 11.3x, noticeably lower than both the peer average of 17.6x and the wider Japanese Commercial Services industry at 12.9x. This gives IDEA Consultants shares an attractive edge on a relative valuation basis.

- It is noteworthy that, while the P/E discount usually signals caution, the prevailing market view recognizes that IDEA Consultants has consistently grown earnings by 10.4% per year over the last five years, supporting the notion that this valuation gap could reflect overlooked quality.

- At the same time, the recent decline in profit margins to 8.6% from 10.1% a year ago serves as a reminder that near-term softness is factoring into the muted valuation.

- Still, the company’s long-term track record, along with a below-industry P/E, supports the view that shares offer relative value despite the current dip in growth.

Market Price Far Above DCF Fair Value

- IDEA Consultants trades at ¥3,300 per share, which is significantly above the estimated DCF fair value of ¥1,223.37. This shows the market is paying a substantial premium to modeled future cash flows.

- The prevailing market view highlights a tension: on one hand, the shares are more attractively valued than peers by P/E. On the other hand, investors are willing to pay well above DCF fair value, suggesting confidence in the company’s long-term prospects not fully reflected by the cash flow model.

- This premium also fits with the narrative that the historical quality of earnings could drive sustained demand for the shares even after a weak recent period.

- However, the sharp disconnect between market price and DCF value underlines the importance of tracking how future earnings actually materialize compared to optimistic expectations.

Dividend Sustainability Flagged as Minor Risk

- The only explicit risk noted in disclosures is dividend sustainability, though it is categorized as minor rather than severe. This draws attention for investors relying on income from the stock.

- The prevailing market perspective maintains that reward from strong five-year earnings outpaces the minor risks:

- The robust earnings growth history creates a foundation for ongoing dividends, but the recent slip in profitability serves as a cautionary signal to monitor payout ratios in upcoming periods.

- Analysts also watch whether a persistent gap between dividend payments and earnings might eventually increase the significance of this minor risk over time.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on IDEA ConsultantsInc's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

IDEA Consultants' market price sits far above its modeled fair value. This raises concerns that investors may be paying too much for recent growth softness and dividend risks.

If you want to focus on stocks trading below their fair value and avoid potential overpayment, discover opportunities with these 840 undervalued stocks based on cash flows that could offer better value for your portfolio right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9768

IDEA ConsultantsInc

Provides integrated consultancy services on social infrastructure development and environmental conservation projects in Japan and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives