- Japan

- /

- Capital Markets

- /

- TSE:6196

3 Japanese Exchange Stocks Estimated To Be Up To 49.5% Below Intrinsic Value

Reviewed by Simply Wall St

Japan’s stock markets have made modest gains recently, with the Nikkei 225 Index rising 0.8% and the broader TOPIX Index up 0.2%. Amid ongoing market volatility and a commitment from the Bank of Japan to normalize monetary policy, investors are increasingly looking for undervalued opportunities. In this environment, identifying stocks trading below their intrinsic value can offer significant potential for growth as market conditions stabilize.

Top 10 Undervalued Stocks Based On Cash Flows In Japan

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Funai Soken Holdings (TSE:9757) | ¥2342.00 | ¥4634.31 | 49.5% |

| IMAGICA GROUP (TSE:6879) | ¥505.00 | ¥1005.28 | 49.8% |

| Kotobuki Spirits (TSE:2222) | ¥1760.00 | ¥3434.73 | 48.8% |

| Hottolink (TSE:3680) | ¥332.00 | ¥660.62 | 49.7% |

| BayCurrent Consulting (TSE:6532) | ¥4422.00 | ¥8584.55 | 48.5% |

| EnomotoLtd (TSE:6928) | ¥1495.00 | ¥2933.87 | 49% |

| Adventure (TSE:6030) | ¥3775.00 | ¥7393.94 | 48.9% |

| Visional (TSE:4194) | ¥8890.00 | ¥17120.62 | 48.1% |

| SBI ARUHI (TSE:7198) | ¥867.00 | ¥1703.42 | 49.1% |

| freee K.K (TSE:4478) | ¥3080.00 | ¥5917.03 | 47.9% |

Let's take a closer look at a couple of our picks from the screened companies.

Kotobuki Spirits (TSE:2222)

Overview: Kotobuki Spirits Co., Ltd. produces and sells sweets in Japan and has a market cap of approximately ¥266.62 billion.

Operations: The company generates revenue from several segments, including Shukrei (¥27.03 billion), Casey Shii (¥18.88 billion), Kotobuki Confectionery/Tajima Kotobuki (¥13.19 billion), Sales Subsidiaries (¥7.06 billion), and Kujukushima (¥6.56 billion).

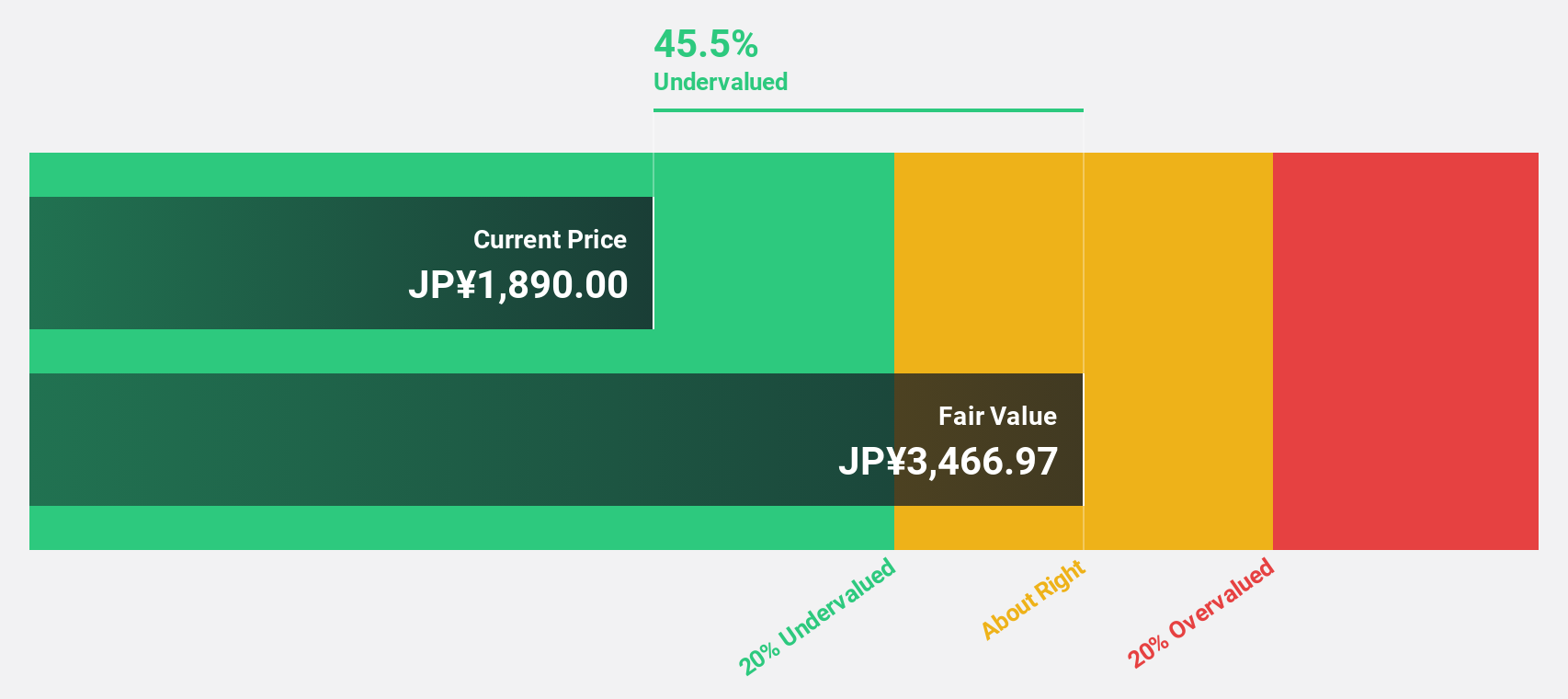

Estimated Discount To Fair Value: 48.8%

Kotobuki Spirits is trading 48.8% below its estimated fair value of ¥3434.73, with a current price of ¥1760. Despite slower revenue growth forecasts (10.9% per year) compared to the market, its earnings are expected to grow faster than the JP market at 12.8% annually. Recent earnings showed a significant increase of 33.7%, and analysts agree on a potential stock price rise by 39.4%.

- Our comprehensive growth report raises the possibility that Kotobuki Spirits is poised for substantial financial growth.

- Get an in-depth perspective on Kotobuki Spirits' balance sheet by reading our health report here.

Strike CompanyLimited (TSE:6196)

Overview: Strike Company, Limited (TSE:6196) offers mergers and acquisitions brokerage services for small and medium-sized companies in Japan, with a market cap of ¥79.69 billion.

Operations: Strike Company, Limited generates revenue primarily from its M&A Intermediary Business, amounting to ¥17.97 billion.

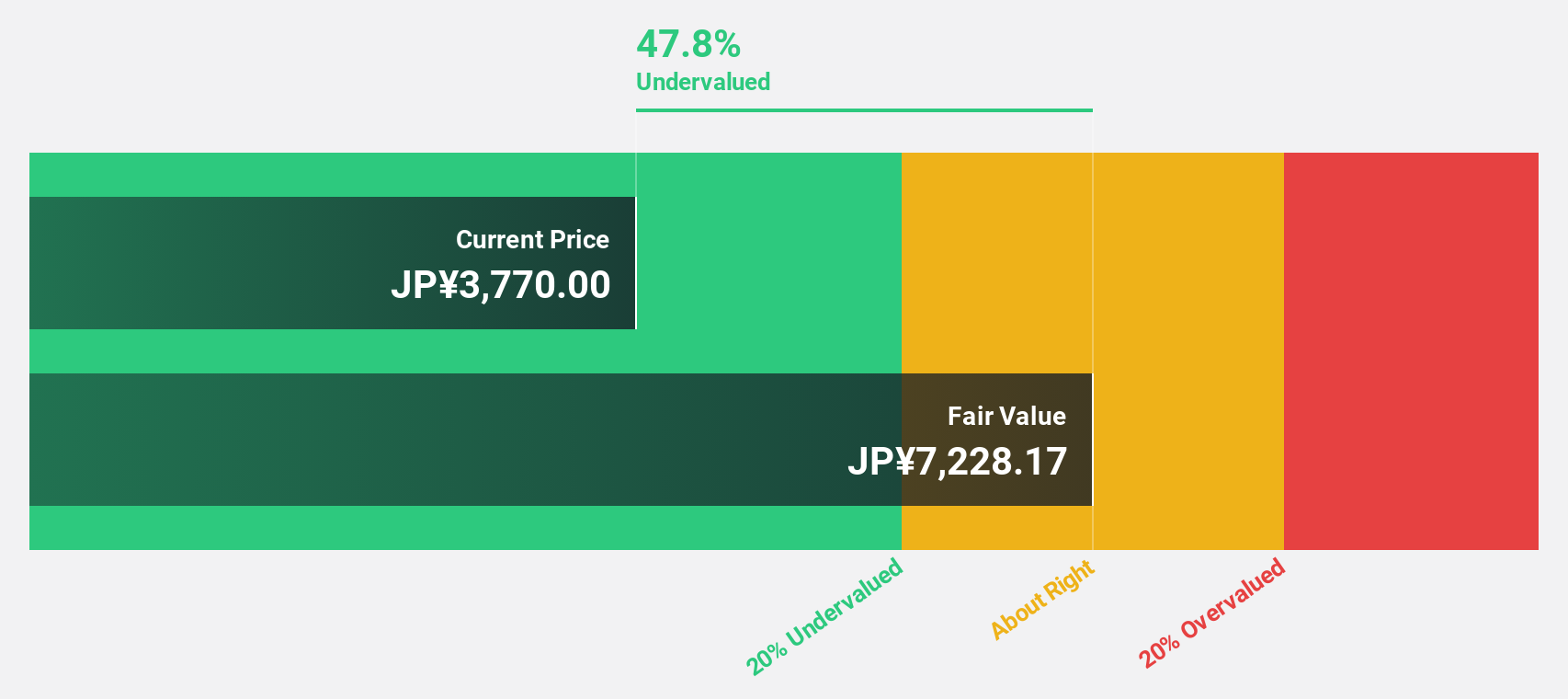

Estimated Discount To Fair Value: 32.6%

Strike Company Limited is trading at ¥4430, significantly below its estimated fair value of ¥6575.47. Forecasts indicate revenue growth of 18.6% per year and earnings growth of 17.7% annually, both outpacing the JP market averages. Despite a volatile share price recently, the company has shown strong past earnings growth (62.3%). Recent guidance projects net sales of ¥18.22 billion and a revised dividend increase to ¥85 per share for FY2024/9, reflecting robust financial health and potential undervaluation based on cash flows.

- The analysis detailed in our Strike CompanyLimited growth report hints at robust future financial performance.

- Dive into the specifics of Strike CompanyLimited here with our thorough financial health report.

Funai Soken Holdings (TSE:9757)

Overview: Funai Soken Holdings Incorporated offers consulting services to manufacturing and retail businesses in Japan and has a market cap of ¥108.69 billion.

Operations: Funai Soken Holdings generates revenue from providing consulting services to manufacturing and retail businesses in Japan.

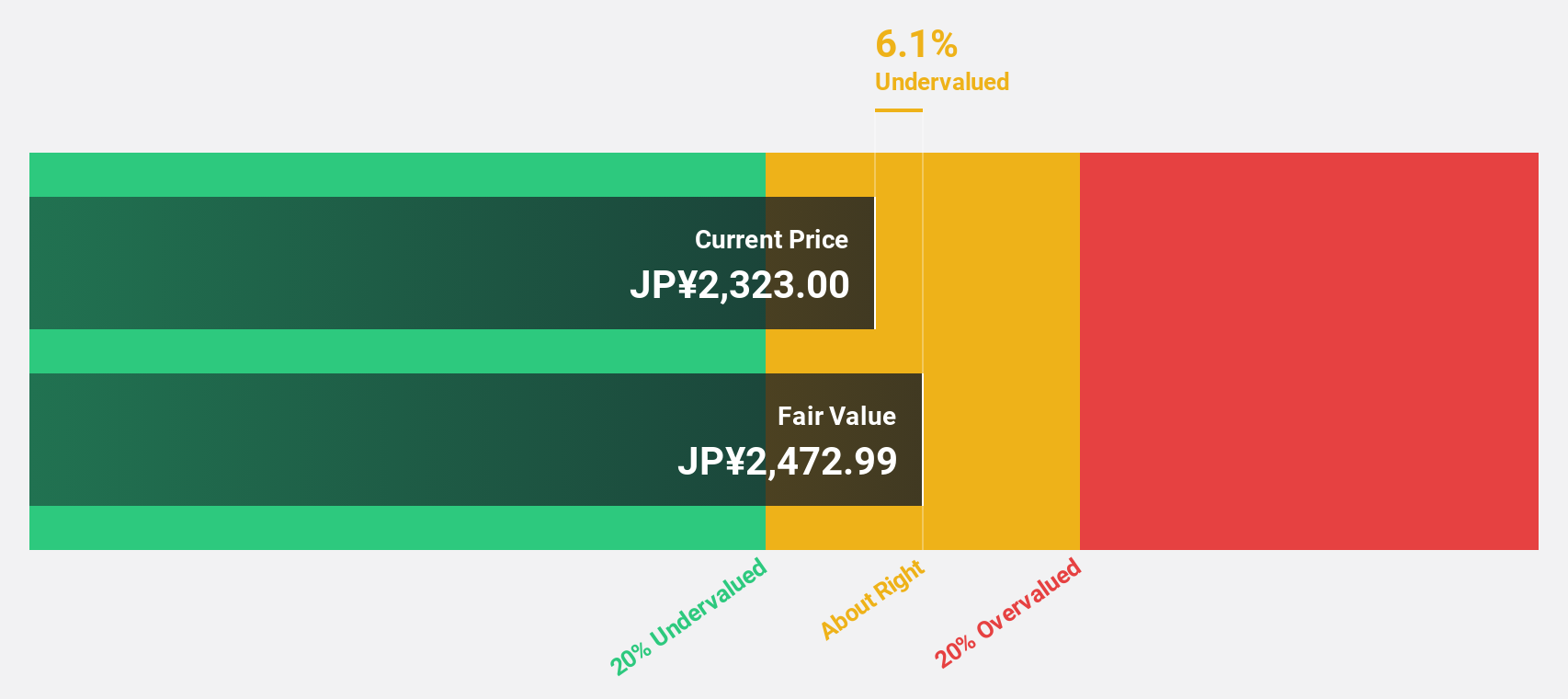

Estimated Discount To Fair Value: 49.5%

Funai Soken Holdings is trading at ¥2342, significantly below its estimated fair value of ¥4634.31. Despite a slower revenue growth forecast (8.7% per year), it outpaces the JP market average of 4.3%. Earnings are expected to grow at 8.64% annually, slightly above the market rate, with a high return on equity forecasted at 23.5%. Recent activities include a dividend increase to ¥37 per share and completion of a significant share buyback program totaling ¥1.90 billion.

- Our earnings growth report unveils the potential for significant increases in Funai Soken Holdings' future results.

- Navigate through the intricacies of Funai Soken Holdings with our comprehensive financial health report here.

Summing It All Up

- Explore the 84 names from our Undervalued Japanese Stocks Based On Cash Flows screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6196

Strike CompanyLimited

Provides mergers and acquisitions brokerage services for small and medium-sized companies in Japan.

Outstanding track record with flawless balance sheet.