- Japan

- /

- Professional Services

- /

- TSE:4641

Top 3 Dividend Stocks On The Japanese Exchange In August 2024

Reviewed by Simply Wall St

Japan's stock markets have seen modest gains recently, with the Nikkei 225 Index rising 0.8% and the broader TOPIX Index up 0.2%. Amid this backdrop of cautious optimism and ongoing monetary policy normalization by the Bank of Japan, investors are increasingly looking at dividend stocks as a stable source of income. In such an environment, a good dividend stock typically offers consistent payouts and has strong fundamentals that can withstand market volatility.

Top 10 Dividend Stocks In Japan

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.16% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.08% | ★★★★★★ |

| Globeride (TSE:7990) | 4.12% | ★★★★★★ |

| Mitsubishi Research Institute (TSE:3636) | 3.79% | ★★★★★★ |

| Innotech (TSE:9880) | 4.64% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.48% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.07% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.42% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 4.74% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.35% | ★★★★★★ |

Click here to see the full list of 444 stocks from our Top Japanese Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

FTGroup (TSE:2763)

Simply Wall St Dividend Rating: ★★★★★★

Overview: FTGroup Co., Ltd. provides network infrastructure services in Japan and has a market cap of ¥35.04 billion.

Operations: FTGroup Co., Ltd. generates revenue through its network infrastructure services in Japan.

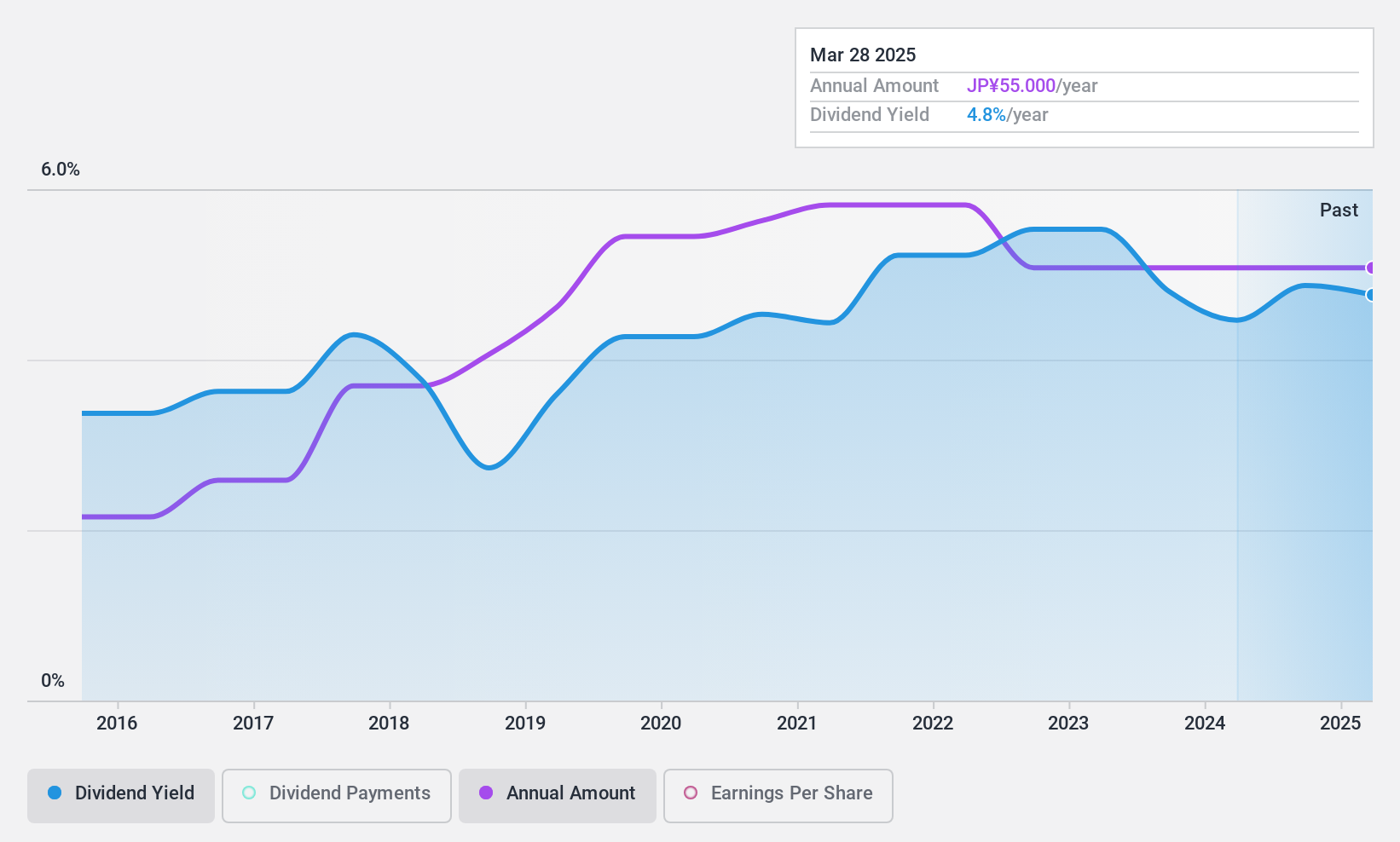

Dividend Yield: 4.7%

FTGroup's dividend payments are well-covered by earnings (31.5% payout ratio) and cash flows (25.5% cash payout ratio), ensuring sustainability. The company offers a high and reliable dividend yield of 4.67%, which is in the top 25% of Japanese dividend payers, with stable and growing dividends over the past decade. A recent share repurchase program worth ¥500 million aims to enhance shareholder returns, reflecting a flexible capital policy amid changing business conditions.

- Take a closer look at FTGroup's potential here in our dividend report.

- Our valuation report unveils the possibility FTGroup's shares may be trading at a premium.

Riken Technos (TSE:4220)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Riken Technos Corporation operates in the compound, film, and food wrapping film sectors both domestically and internationally, with a market cap of ¥54.09 billion.

Operations: Riken Technos Corporation's revenue segments include Electronics (¥24.59 billion), Transportation (¥40.88 billion), Daily Life & Healthcare (¥34.24 billion), and Building & Construction (¥26.24 billion).

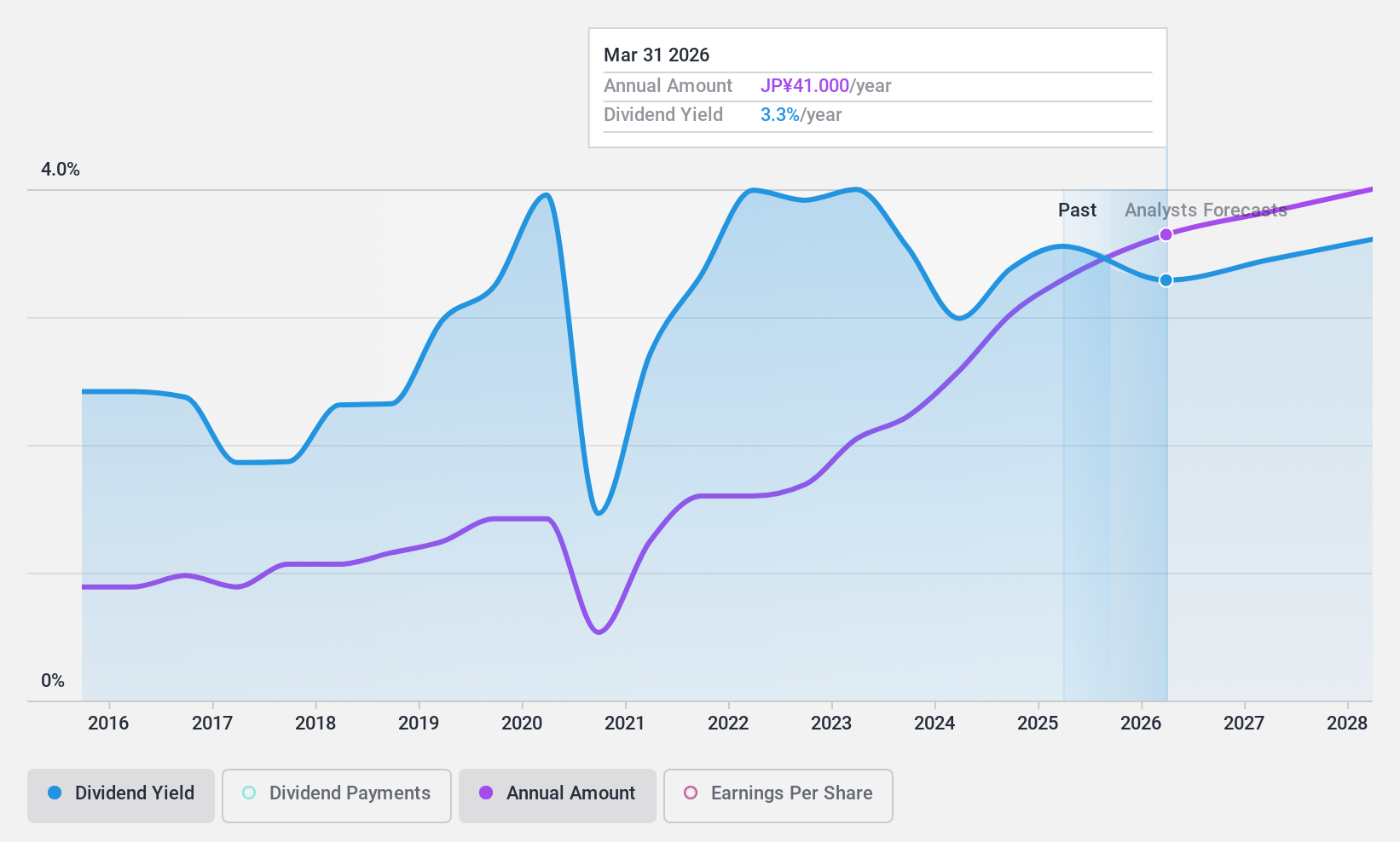

Dividend Yield: 3.4%

Riken Technos' dividends are well-covered by earnings (25.2% payout ratio) and cash flows (27.9% cash payout ratio), though the dividend yield of 3.36% is below the top 25% in Japan. Despite a volatile dividend history, payments have increased over the past decade. The company trades at a significant discount to its estimated fair value and has announced a ¥3 billion share buyback program to enhance shareholder returns and capital efficiency, running until October 31, 2024.

- Dive into the specifics of Riken Technos here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that Riken Technos is priced lower than what may be justified by its financials.

Altech (TSE:4641)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Altech Corporation offers technical and engineering assignment services both in Japan and internationally, with a market cap of ¥50.59 billion.

Operations: Altech Corporation generates revenue from its Global Business segment, which contributed ¥3.23 billion, and its Outsourcing Service Business (including Staffing Service), which brought in ¥44.26 billion.

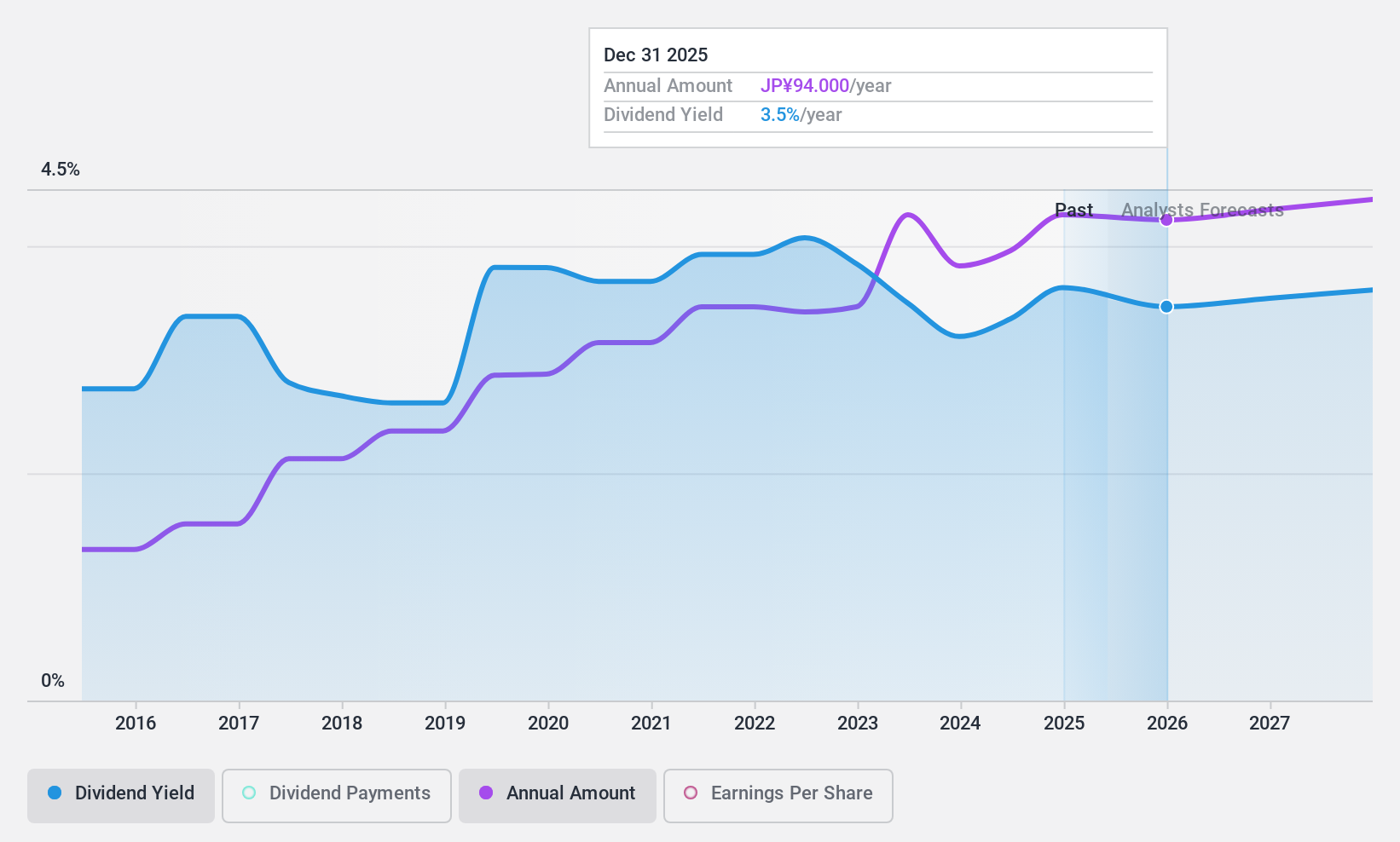

Dividend Yield: 3.4%

Altech's dividends are well-covered by earnings (29.1% payout ratio) and cash flows (40.9% cash payout ratio), though the yield of 3.35% is below the top 25% in Japan. Despite a volatile dividend history, payments have increased over the past decade. Recently, Altech announced a year-end dividend decrease to ¥44 per share from ¥51 last year but increased its Q2 dividend to ¥44 from ¥42, with payments starting September 13, 2024.

- Navigate through the intricacies of Altech with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Altech shares in the market.

Taking Advantage

- Dive into all 444 of the Top Japanese Dividend Stocks we have identified here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4641

Altech

Provides technical and engineer assignment services in Japan and internationally.

Flawless balance sheet average dividend payer.