- Japan

- /

- Construction

- /

- TSE:1762

Takamatsu Construction Group And 2 Other Undiscovered Gems in Japan

Reviewed by Simply Wall St

Japan's stock markets have shown modest gains recently, with the Nikkei 225 Index rising by 0.8% and the broader TOPIX Index up by 0.2%. Amid a backdrop of economic stability and cautious optimism, small-cap stocks in Japan present intriguing opportunities for investors looking to diversify their portfolios. In this article, we explore three lesser-known but promising stocks: Takamatsu Construction Group and two other hidden gems that could offer significant potential given the current market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| NCD | 11.89% | 8.95% | 25.43% | ★★★★★★ |

| Nihon Parkerizing | 0.31% | 0.86% | 4.40% | ★★★★★★ |

| QuickLtd | 0.73% | 9.61% | 14.56% | ★★★★★★ |

| NJS | NA | 4.97% | 5.30% | ★★★★★★ |

| Ad-Sol Nissin | NA | 4.02% | 7.90% | ★★★★★★ |

| Otec | 9.81% | 2.32% | -1.39% | ★★★★★★ |

| Techno Smart | NA | 6.07% | -0.57% | ★★★★★★ |

| Kondotec | 11.75% | 6.85% | 2.62% | ★★★★★☆ |

| AJIS | 0.69% | 0.07% | -12.44% | ★★★★★☆ |

| Nippon Ski Resort DevelopmentLtd | 39.31% | 2.95% | 19.16% | ★★★★★☆ |

Let's uncover some gems from our specialized screener.

Takamatsu Construction Group (TSE:1762)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Takamatsu Construction Group Co., Ltd. operates in the construction industry in Japan with a market capitalization of ¥101.70 billion.

Operations: Takamatsu Construction Group generates revenue primarily from three segments: Real Estate (¥68.47 billion), Civil Engineering (¥101 billion), and Construction Business (¥157.64 billion).

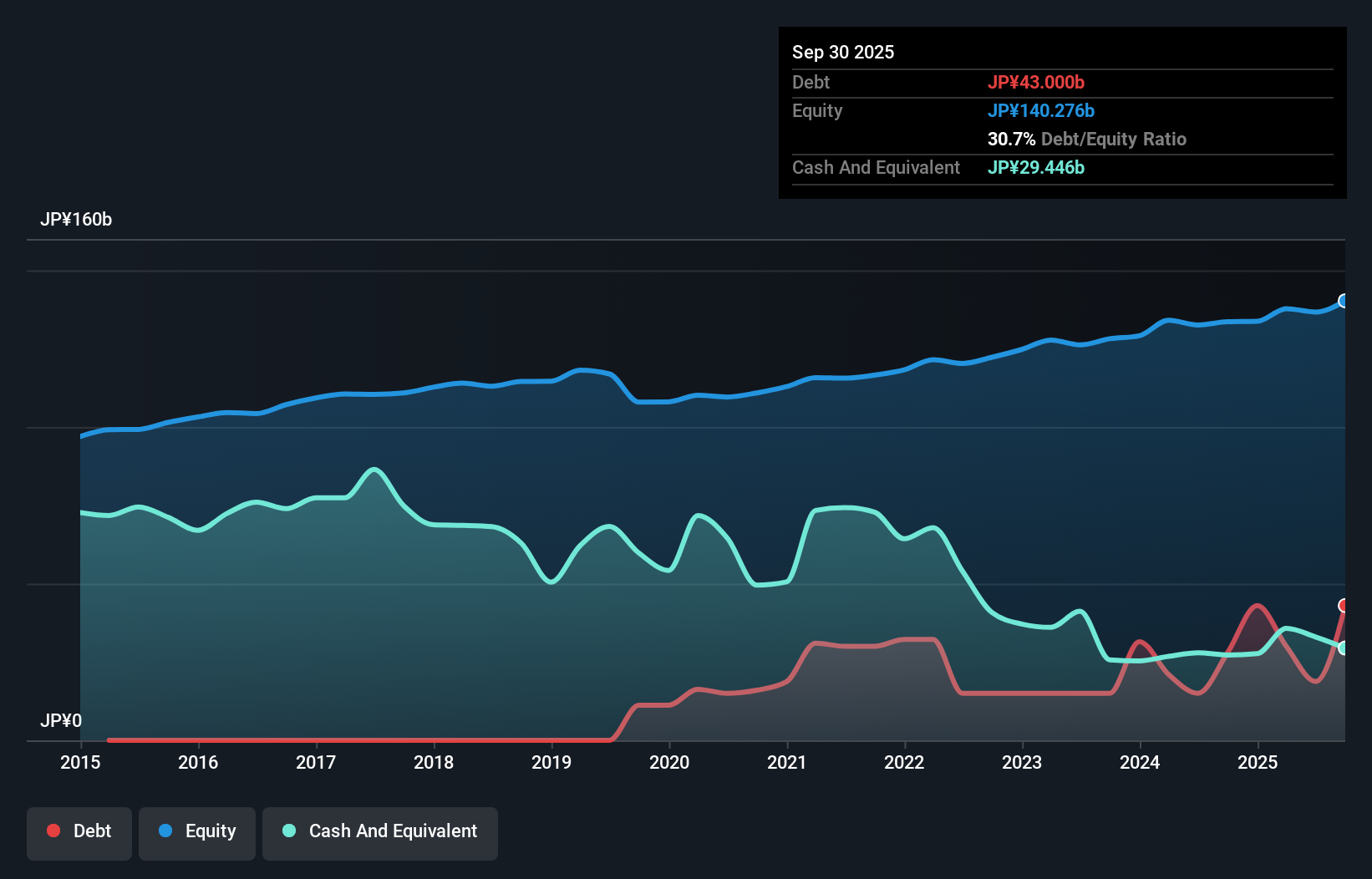

Takamatsu Construction Group, a small but promising player in Japan's construction industry, has seen its earnings grow by 29.7% over the past year, outpacing the industry's 21.2% growth. Trading at a P/E ratio of 11x, it offers good value compared to the JP market's 13.4x. The company’s debt-to-equity ratio increased from 0% to 11.3% over five years but remains manageable with interest payments well covered by EBIT (125.8x).

Kawada Technologies (TSE:3443)

Simply Wall St Value Rating: ★★★★★☆

Overview: Kawada Technologies, Inc. operates in the steel, civil engineering, architecture, and IT service sectors in Japan with a market cap of ¥45.72 billion.

Operations: Kawada Technologies generates revenue from its steel, civil engineering, architecture, and IT service sectors in Japan. The company has a market cap of ¥45.72 billion.

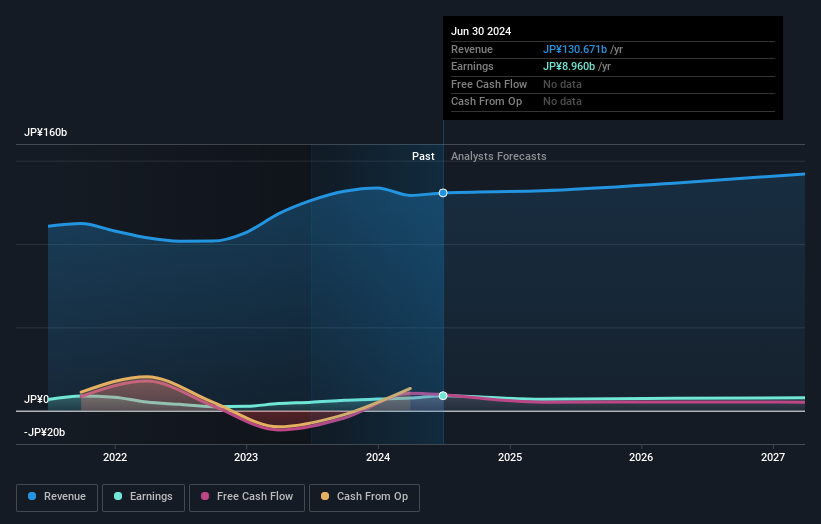

Kawada Technologies has shown impressive growth, with earnings increasing by 78.7% over the past year, outpacing the construction industry’s 21.2%. Trading at 15.9% below its estimated fair value, it presents a compelling opportunity despite recent volatility in its share price. The company’s net debt to equity ratio stands at a satisfactory 20.1%, and interest payments are well covered by EBIT (36.1x). However, future earnings are expected to decline by an average of 3.7% annually over the next three years.

- Unlock comprehensive insights into our analysis of Kawada Technologies stock in this health report.

Evaluate Kawada Technologies' historical performance by accessing our past performance report.

Oita Bank (TSE:8392)

Simply Wall St Value Rating: ★★★★☆☆

Overview: The Oita Bank, Ltd. offers a range of banking products and services to individual and corporate clients mainly in Japan, with a market cap of ¥47.62 billion.

Operations: Oita Bank generates revenue primarily through interest income from loans and advances, as well as fees from various banking services. The company's net profit margin is a key financial metric to consider.

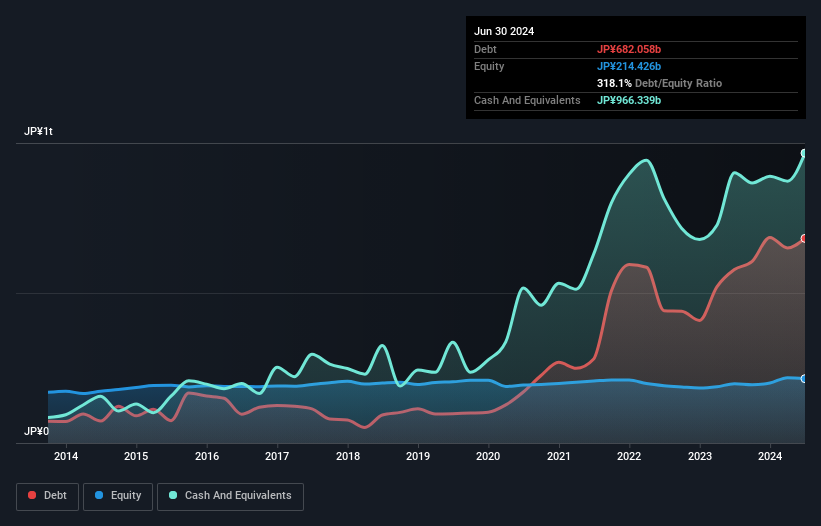

Oita Bank, a small-cap financial institution, boasts total assets of ¥4,656.1B and equity of ¥214.4B. With deposits amounting to ¥3,691.6B and loans at ¥2,142.1B, the bank's net interest margin stands at 1%. Despite a 45.8% earnings growth in the past year surpassing industry averages (19.1%), it has an insufficient allowance for bad loans at 2% of total loans. Recently announced share repurchase program aims to enhance shareholder value by buying back up to 250,000 shares for ¥600M by November 2024.

- Click to explore a detailed breakdown of our findings in Oita Bank's health report.

Gain insights into Oita Bank's historical performance by reviewing our past performance report.

Seize The Opportunity

- Delve into our full catalog of 754 Japanese Undiscovered Gems With Strong Fundamentals here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Takamatsu Construction Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1762

Takamatsu Construction Group

Engages in the construction business in Japan.

Proven track record with adequate balance sheet and pays a dividend.