- Japan

- /

- Professional Services

- /

- TSE:9746

TKC Corporation (TSE:9746): Assessing Valuation After Dividend Hike, Strong Turnover, and Share Buyback Plans

Reviewed by Simply Wall St

TKC (TSE:9746) has caught investors’ attention after announcing an 11% rise in turnover for fiscal 2025, along with decisions to increase both its annual and special dividends.

See our latest analysis for TKC.

TKC’s latest moves, including raising dividends, retiring shares, and publishing strong fiscal guidance, have clearly caught the market’s eye, with the share price up over 10% year-to-date. Despite some recent short-term turbulence, the stock’s five-year total shareholder return of 39% shows steady long-term momentum and suggests confidence is building around its outlook.

If you’re interested in what else could be capturing this kind of momentum, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

But with shares already rallying this year and TKC now trading at a discount to analyst targets, the key question is whether the current price reflects the company’s growth potential or if there is further upside for investors.

Price-to-Earnings of 19x: Is it justified?

TKC trades at a price-to-earnings (P/E) ratio of 19x, putting it below the peer group average of 21x but above what some models see as fair value in this market.

The price-to-earnings ratio is a key metric for investors because it compares a company’s share price to its per-share earnings. It serves as a widely used shortcut for evaluating business value versus profits. In service-based industries like TKC’s, the P/E ratio often reflects expectations for future growth and earnings quality, while also considering consistency and sector stability.

At 19x, the market appears to value TKC at a discount relative to its peers, which raises the question of whether investors are underestimating its long-term potential. However, compared to the JP Professional Services industry average of 14.7x, TKC looks significantly more expensive. This suggests the market may be pricing in above-average prospects or a lower risk profile. The estimated fair P/E ratio for TKC is 17.1x, which the current multiple exceeds and could set a new level for the stock if market sentiment changes.

Explore the SWS fair ratio for TKC

Result: Price-to-Earnings of 19x (ABOUT RIGHT)

However, slower revenue growth or a downturn in total returns could challenge confidence in TKC’s current premium and growth outlook.

Find out about the key risks to this TKC narrative.

Another Perspective: The SWS DCF Model

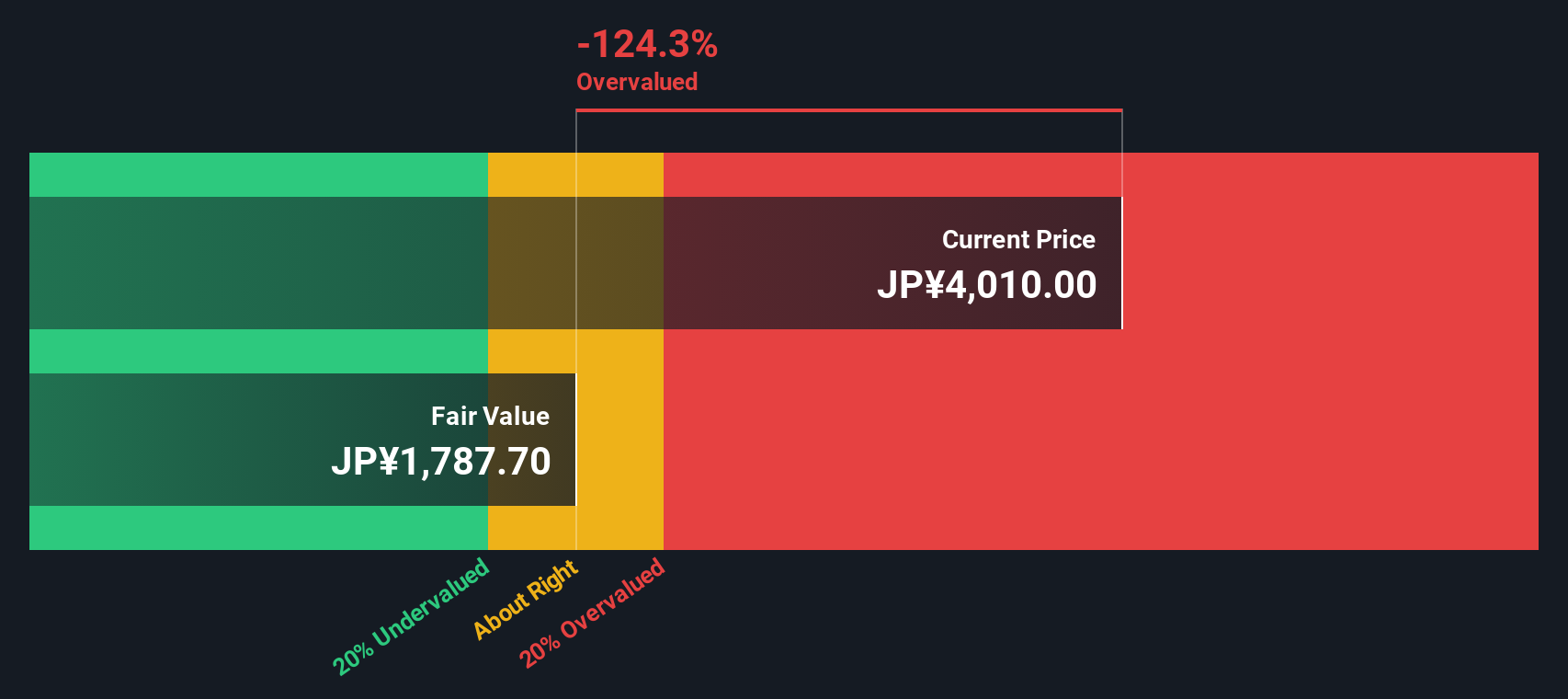

Looking at TKC through the lens of our DCF model tells a different story. The SWS DCF model estimates fair value for TKC shares at ¥1,791.32, which is much lower than the current price of ¥4,085. By this method, the stock appears overvalued and this challenges the confidence seen in recent trading.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out TKC for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 878 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own TKC Narrative

If you’d like to take the analysis into your own hands or want to investigate alternative viewpoints, you can quickly develop your own narrative in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding TKC.

Looking for More Investment Ideas?

Seize the chance to boost your portfolio with stocks outperforming the crowd. Don’t miss proven opportunities quietly gaining momentum within transformative industries and smart strategies. Act now to uncover:

- Unlock value by targeting strong returns from companies trading below intrinsic worth using these 878 undervalued stocks based on cash flows.

- Tap into the surging demand for medical innovation with these 31 healthcare AI stocks, which focuses on advancing healthcare technology and patient care.

- Accelerate your passive income strategy by scanning these 16 dividend stocks with yields > 3%, featuring stocks that consistently offer attractive yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TKC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9746

TKC

Operates as a specialized electronic data processing center for accounting firms and local governments in Japan.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives