- Japan

- /

- Professional Services

- /

- TSE:9715

3 Global Dividend Stocks To Consider With Up To 5.7% Yield

Reviewed by Simply Wall St

In recent weeks, global markets have been navigating a complex landscape marked by new U.S. tariffs and mixed economic signals, with major indices like the Nasdaq Composite showing resilience amid these challenges. As investors seek stability in uncertain times, dividend stocks can offer a reliable income stream; this is particularly appealing when market volatility and geopolitical tensions are at play.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.04% | ★★★★★★ |

| PAX Global Technology (SEHK:327) | 8.31% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.76% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.76% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.31% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.31% | ★★★★★★ |

| Global One Real Estate Investment (TSE:8958) | 4.50% | ★★★☆☆☆ |

| ERG (BIT:ERG) | 5.40% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.65% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.50% | ★★★★★★ |

Click here to see the full list of 822 stocks from our Top Global Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Unipres (TSE:5949)

Simply Wall St Dividend Rating: ★★★☆☆☆

Overview: Unipres Corporation manufactures and sells automotive parts in Japan, with a market cap of approximately ¥46.19 billion.

Operations: Unipres Corporation generates revenue from its primary business segment of manufacturing and selling automotive parts in Japan.

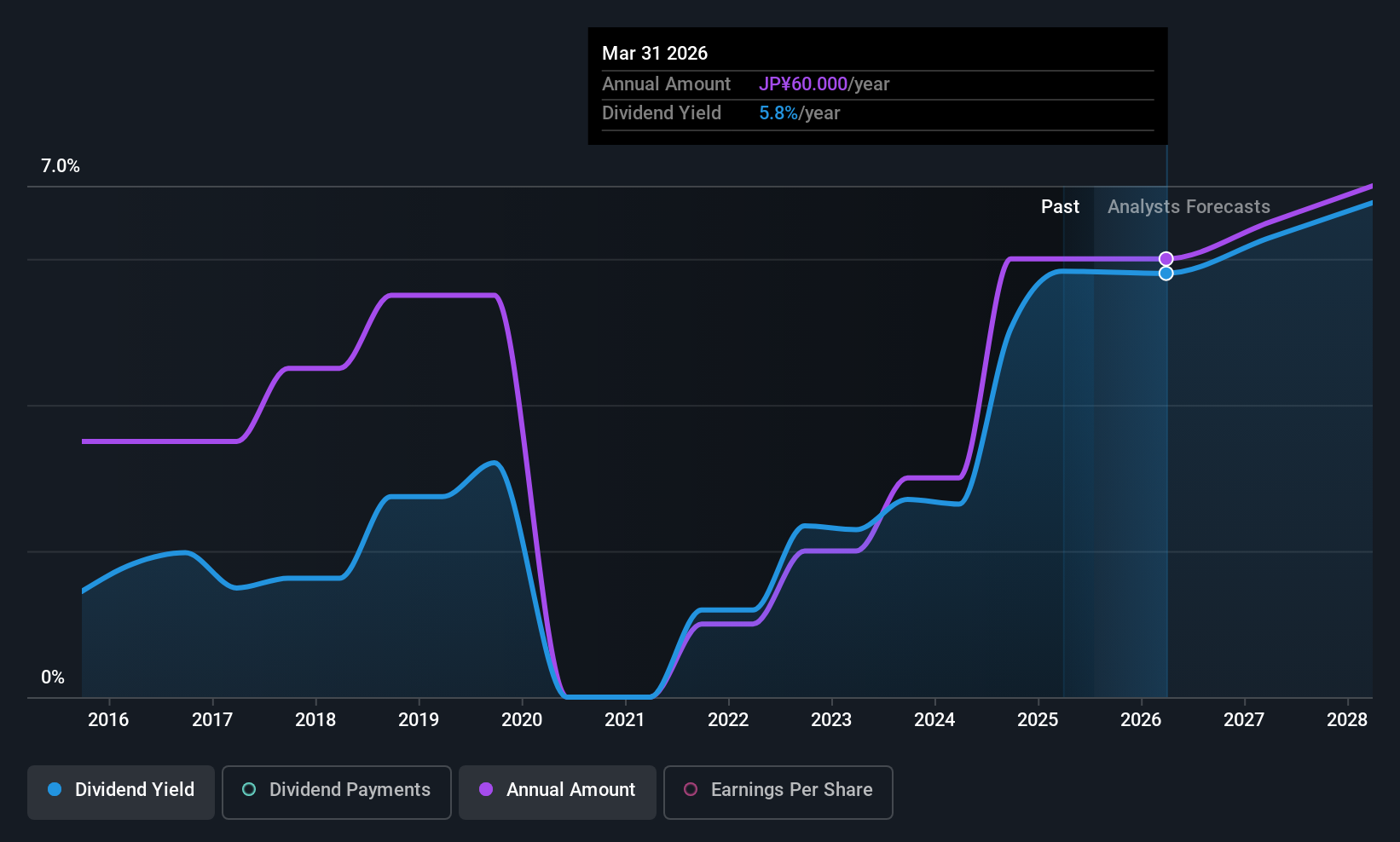

Dividend Yield: 5.8%

Unipres Corporation recently proposed a dividend increase to JPY 30.00 per share for the fiscal year ended March 31, 2025, up from JPY 20.00 previously, with a total payout of JPY 1.33 billion sourced from retained earnings. Despite this attractive yield in the top quartile of JP market payers, concerns arise as dividends are not well-covered by free cash flows and share liquidity is low; however, they remain covered by earnings at a payout ratio of 77.5%.

- Click to explore a detailed breakdown of our findings in Unipres' dividend report.

- Our valuation report here indicates Unipres may be overvalued.

Sakai Moving ServiceLtd (TSE:9039)

Simply Wall St Dividend Rating: ★★☆☆☆☆

Overview: Sakai Moving Service Co., Ltd. offers moving transportation services in Japan and has a market cap of ¥107.26 billion.

Operations: Sakai Moving Service Co., Ltd. generates its revenue primarily through providing moving transportation services within Japan.

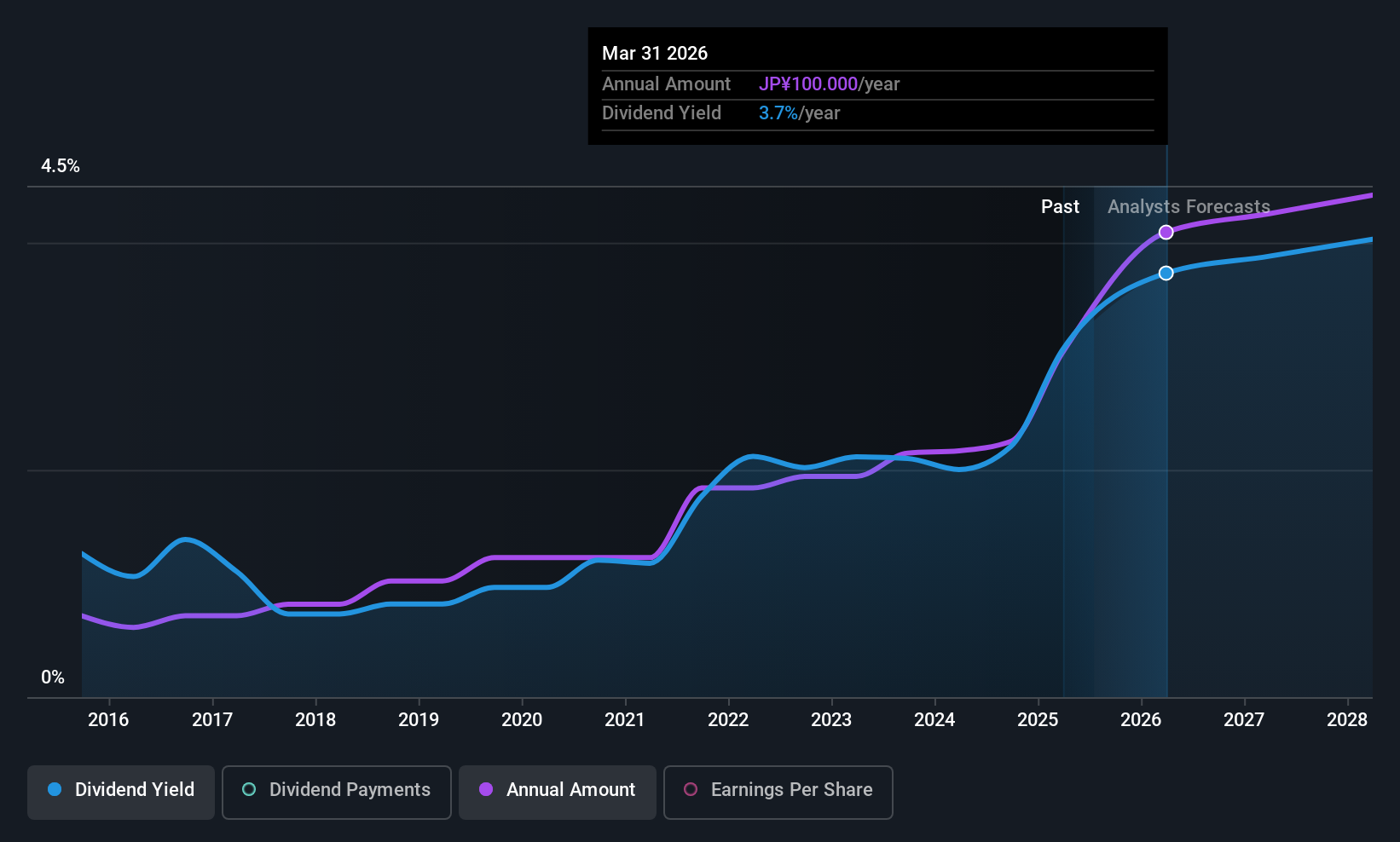

Dividend Yield: 3.7%

Sakai Moving Service Ltd. announced a significant dividend increase to JPY 82.00 per share for the year ended March 31, 2025, including a commemorative component, with a total payout of JPY 3.33 billion from retained earnings. Despite this rise and a low payout ratio of 27.5% indicating coverage by earnings, concerns persist over sustainability as dividends are not covered by free cash flows and shares remain highly illiquid in the market.

- Click here and access our complete dividend analysis report to understand the dynamics of Sakai Moving ServiceLtd.

- Upon reviewing our latest valuation report, Sakai Moving ServiceLtd's share price might be too optimistic.

transcosmos (TSE:9715)

Simply Wall St Dividend Rating: ★★☆☆☆☆

Overview: Transcosmos Inc. offers business outsourcing services both in Japan and internationally, with a market cap of ¥132.65 billion.

Operations: Transcosmos Inc.'s revenue is derived from Domestic Affiliated services at ¥43.29 billion, Overseas Affiliates contributing ¥102.28 billion, and Single Unit Service generating ¥244.02 billion.

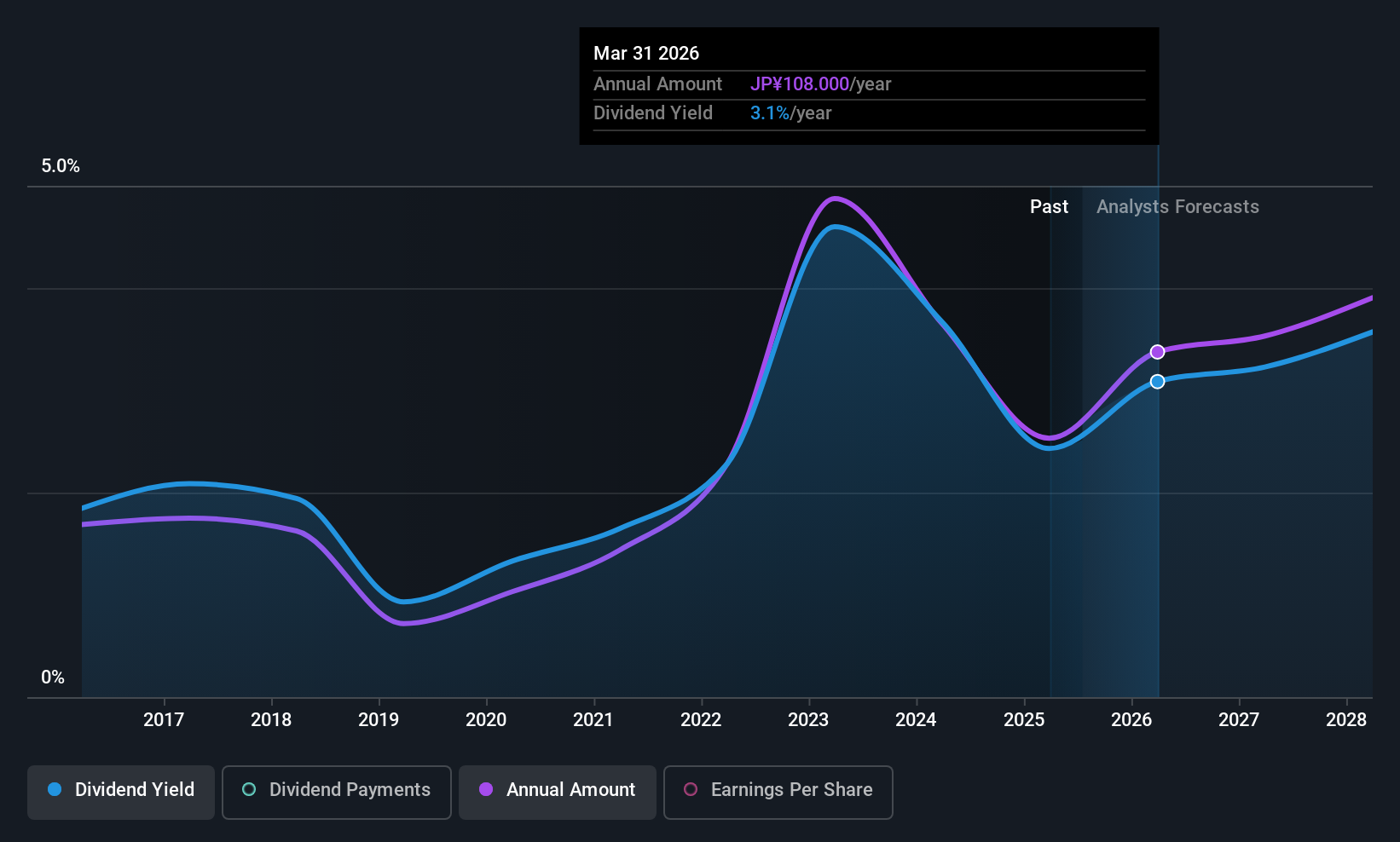

Dividend Yield: 3%

transcosmos has announced a dividend increase to JPY 106 per share for the fiscal year ended March 31, 2025, with plans for JPY 108 per share in the upcoming year. Despite a modest yield of 3.01%, dividends are well-covered by earnings due to a low payout ratio of 35.1%. However, coverage by free cash flows is lacking and shares exhibit high illiquidity, raising sustainability concerns despite recent earnings growth forecasts of 7.25% annually.

- Get an in-depth perspective on transcosmos' performance by reading our dividend report here.

- According our valuation report, there's an indication that transcosmos' share price might be on the expensive side.

Make It Happen

- Take a closer look at our Top Global Dividend Stocks list of 822 companies by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9715

transcosmos

Provides business outsourcing services in Japan and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives