- Japan

- /

- Professional Services

- /

- TSE:9610

Wilson Learning Worldwide Inc. (TSE:9610) Stock's 26% Dive Might Signal An Opportunity But It Requires Some Scrutiny

Wilson Learning Worldwide Inc. (TSE:9610) shareholders that were waiting for something to happen have been dealt a blow with a 26% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 34% share price drop.

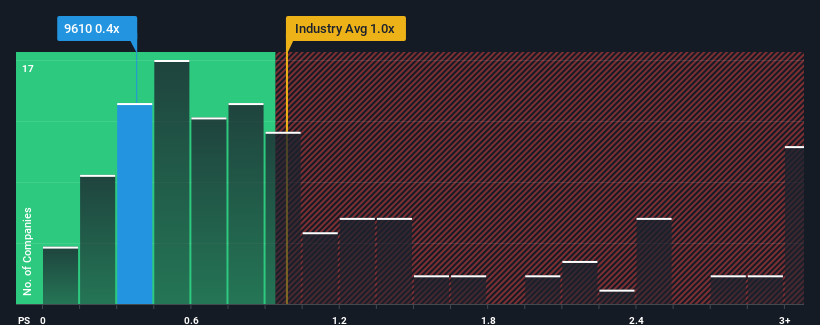

Since its price has dipped substantially, when close to half the companies operating in Japan's Professional Services industry have price-to-sales ratios (or "P/S") above 1x, you may consider Wilson Learning Worldwide as an enticing stock to check out with its 0.4x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Wilson Learning Worldwide

What Does Wilson Learning Worldwide's P/S Mean For Shareholders?

For example, consider that Wilson Learning Worldwide's financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Wilson Learning Worldwide will help you shine a light on its historical performance.How Is Wilson Learning Worldwide's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Wilson Learning Worldwide's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 30%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 18% in total. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

It's interesting to note that the rest of the industry is similarly expected to grow by 5.7% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

With this in consideration, we find it intriguing that Wilson Learning Worldwide's P/S falls short of its industry peers. It may be that most investors are not convinced the company can maintain recent growth rates.

The Key Takeaway

The southerly movements of Wilson Learning Worldwide's shares means its P/S is now sitting at a pretty low level. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

The fact that Wilson Learning Worldwide currently trades at a low P/S relative to the industry is unexpected considering its recent three-year growth is in line with the wider industry forecast. There could be some unobserved threats to revenue preventing the P/S ratio from matching the company's performance. medium-term

There are also other vital risk factors to consider and we've discovered 4 warning signs for Wilson Learning Worldwide (2 are a bit unpleasant!) that you should be aware of before investing here.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Wilson Learning Worldwide might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9610

Wilson Learning Worldwide

Develops and provides human resource and organizational development consulting and solutions in Japan, China, Europe, North America, Latin America, Asia Pacific, and internationally.

Flawless balance sheet with low risk.

Market Insights

Community Narratives