- Japan

- /

- Commercial Services

- /

- TSE:7911

Will Expanded Hybrid Film Production Capacity Reshape TOPPAN Holdings' (TSE:7911) Sustainable Packaging Narrative?

Reviewed by Sasha Jovanovic

- Earlier this month, TOPPAN Holdings Inc. and its subsidiary TOPPAN Speciality Films completed the installation of a hybrid manufacturing line capable of producing both BOPP and BOPE films, boosting film production capacity by about 40% to address growing global demand for sustainable packaging.

- This new line, focused on mono-material recyclable packaging, reflects TOPPAN’s commitment to expanding its eco-friendly product offering, supporting environmental regulations, and enhancing its global supply network for sustainable solutions.

- We will assess how the expanded manufacturing capacity for sustainable packaging shapes TOPPAN's long-term investment narrative and sector positioning.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

TOPPAN Holdings Investment Narrative Recap

Investors considering TOPPAN Holdings must see value in its shift from legacy print operations to high-growth, sustainable packaging and digital security segments. The recent 40% boost in sustainable film capacity is significant for product momentum, but it does not directly offset the business's main short-term risk: continued contraction in traditional print and associated margin pressures.

Among recent announcements, the sizable share buyback reflects management's focus on capital efficiency and shareholder returns, which may help cushion any earnings volatility from legacy segment challenges. This approach could reinforce confidence as new packaging capacity starts ramping up and the integrated business model is tested further.

However, it is important to watch for signs that increased production may not fully overcome risks from declining print media, especially if...

Read the full narrative on TOPPAN Holdings (it's free!)

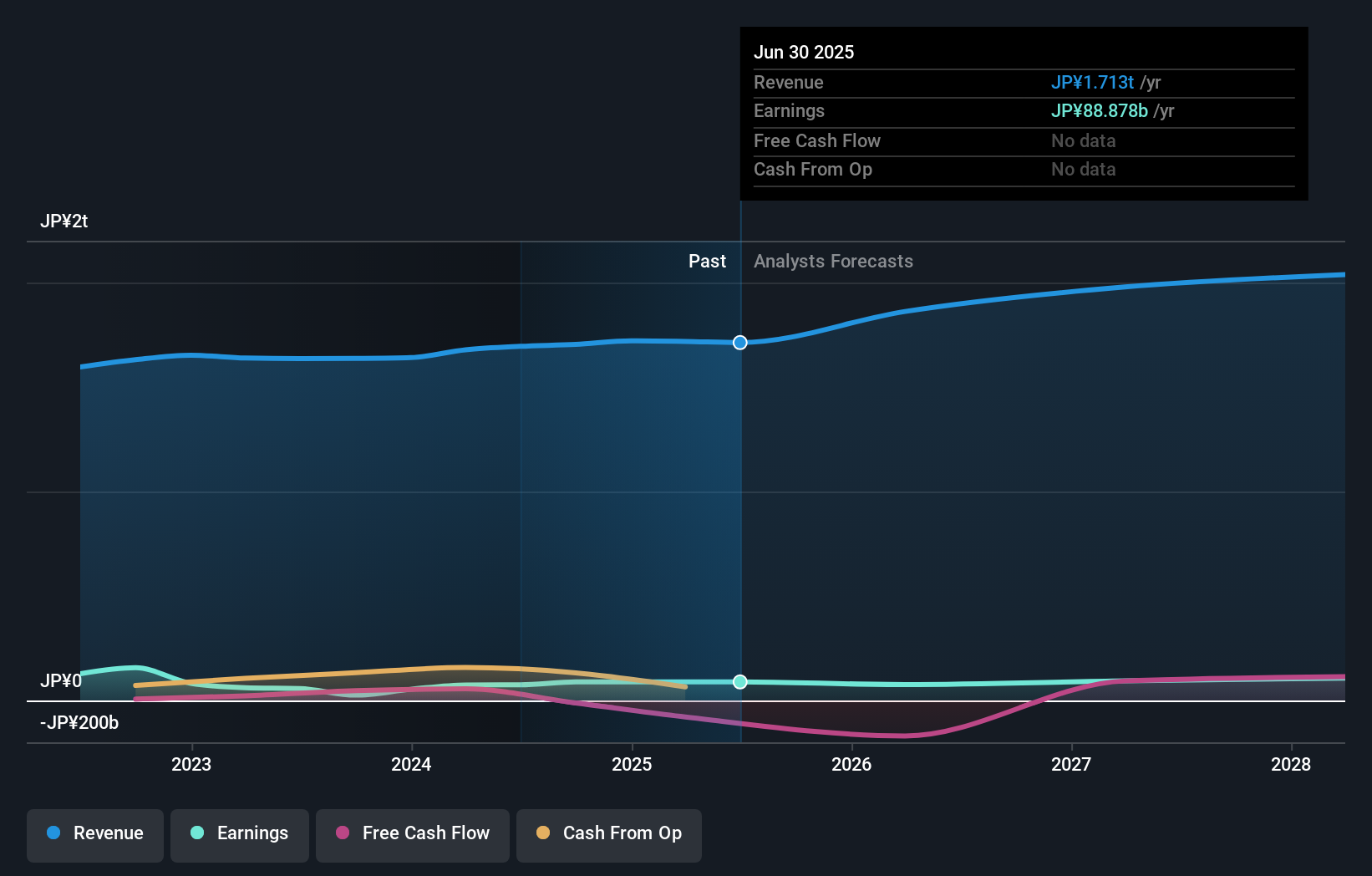

TOPPAN Holdings' narrative projects ¥2,059.6 billion revenue and ¥107.8 billion earnings by 2028. This requires 6.3% yearly revenue growth and a ¥18.9 billion earnings increase from ¥88.9 billion today.

Uncover how TOPPAN Holdings' forecasts yield a ¥4883 fair value, a 31% upside to its current price.

Exploring Other Perspectives

All 1 fair value estimate from the Simply Wall St Community put TOPPAN Holdings at ¥4,883, highlighting a single but confident outlook. As new capacity rolls out, your views on traditional print risk could set your expectations apart from the crowd.

Explore another fair value estimate on TOPPAN Holdings - why the stock might be worth as much as 31% more than the current price!

Build Your Own TOPPAN Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TOPPAN Holdings research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free TOPPAN Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TOPPAN Holdings' overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TOPPAN Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7911

TOPPAN Holdings

Develops solutions based on its printing technologies in Japan, Asia, and internationally.

Very undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives