- Japan

- /

- Commercial Services

- /

- TSE:7911

Does TOPPAN Holdings' Shift to Equity Method for Tekscend Signal a New Portfolio Approach for TSE:7911?

Reviewed by Sasha Jovanovic

- Earlier in October 2025, TOPPAN Holdings revised its earnings guidance for the fiscal year ending March 31, 2026, following the listing of Tekscend Photomask Corp. as it moves from a consolidated subsidiary to an equity-method affiliate, which will impact reported net sales and operating profit.

- Despite lower sales and profit forecasts due to this change, the company's net profit attributable to shareholders, basic earnings per share, and dividend forecast remain unchanged, reflecting the limited effect on shareholder returns.

- We'll assess how the exclusion of Tekscend Photomask Corp. from consolidation impacts TOPPAN's future business outlook and portfolio diversification.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

TOPPAN Holdings Investment Narrative Recap

To be a shareholder of TOPPAN Holdings, you have to believe in the company's ability to execute its portfolio transformation and capitalize on growth in secure digital solutions and sustainable packaging. The removal of Tekscend Photomask Corp. from consolidation, while lowering headline sales and operating profit, does not materially change the near-term catalysts around digital security growth or pose a major new short-term risk, as shareholder return metrics remain on track.

The company’s recent revision of its full-year guidance on October 15, 2025, matches the timing of Tekscend Photomask’s listing and confirms the direct financial impact relates mainly to accounting treatment. No changes were made to the dividend or EPS outlook, suggesting management sees minimal disruption to their broader capital allocation and ongoing shareholder initiatives.

However, investors should be aware that while the impact of this event is limited, pressure from ongoing declines in traditional print media revenue could still...

Read the full narrative on TOPPAN Holdings (it's free!)

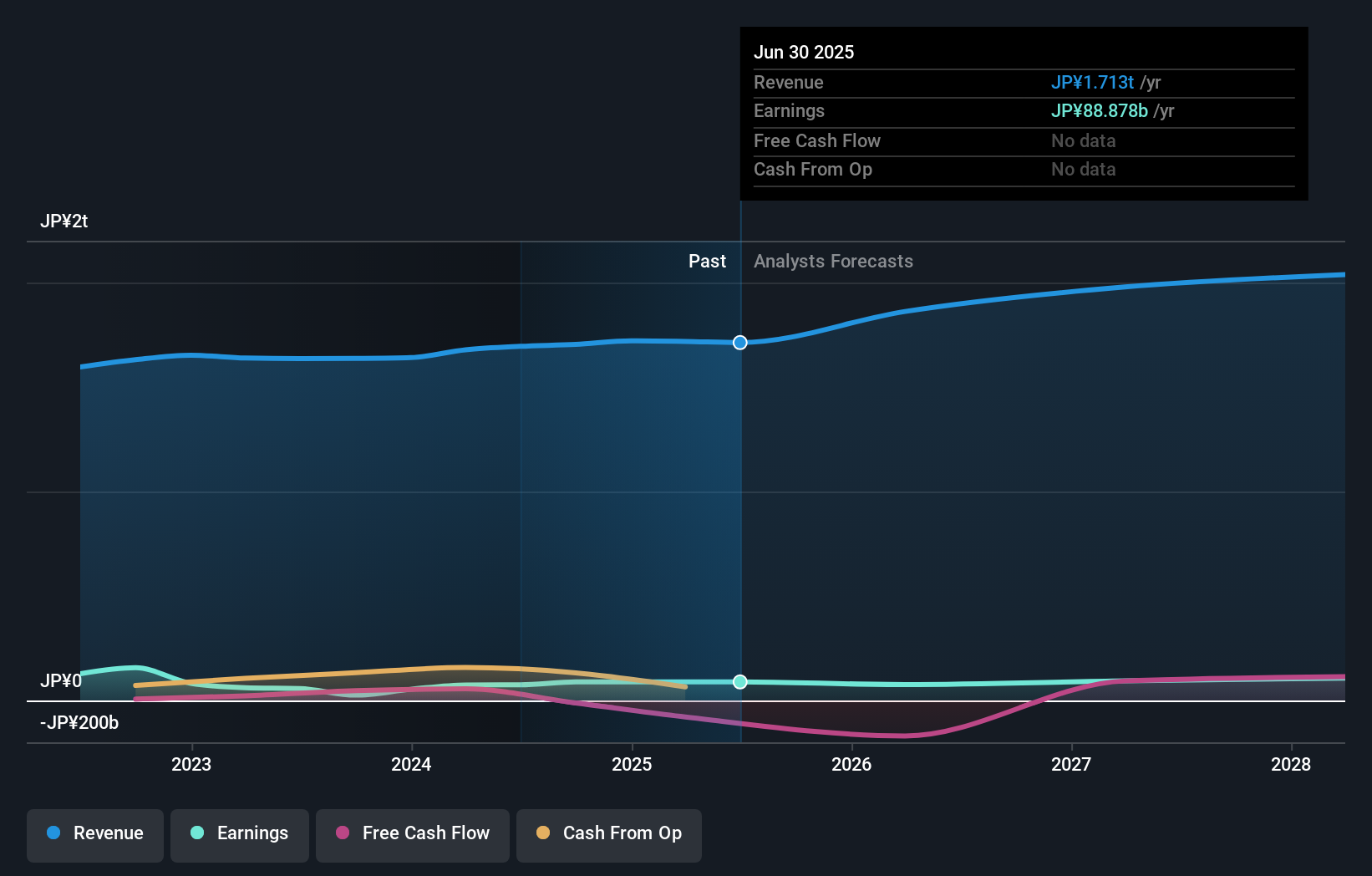

TOPPAN Holdings' narrative projects ¥2,059.6 billion revenue and ¥107.8 billion earnings by 2028. This requires 6.3% yearly revenue growth and a ¥18.9 billion earnings increase from ¥88.9 billion currently.

Uncover how TOPPAN Holdings' forecasts yield a ¥4883 fair value, a 29% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community submitted 1 fair value estimate for TOPPAN Holdings, with all perspectives indicating a value of ¥4,883.33 per share. As many in the market look to global expansion and digital security as critical growth drivers, consider how persistent weakness in traditional print media could limit upside potential and review other members’ viewpoints for more context.

Explore another fair value estimate on TOPPAN Holdings - why the stock might be worth as much as 29% more than the current price!

Build Your Own TOPPAN Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TOPPAN Holdings research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free TOPPAN Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TOPPAN Holdings' overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TOPPAN Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7911

TOPPAN Holdings

Develops solutions based on its printing technologies in Japan, Asia, and internationally.

Very undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives