- Japan

- /

- Commercial Services

- /

- TSE:7846

Will Pilot's (TSE:7846) Dividend Cut Reveal a Shift in Long-Term Capital Strategy?

Reviewed by Sasha Jovanovic

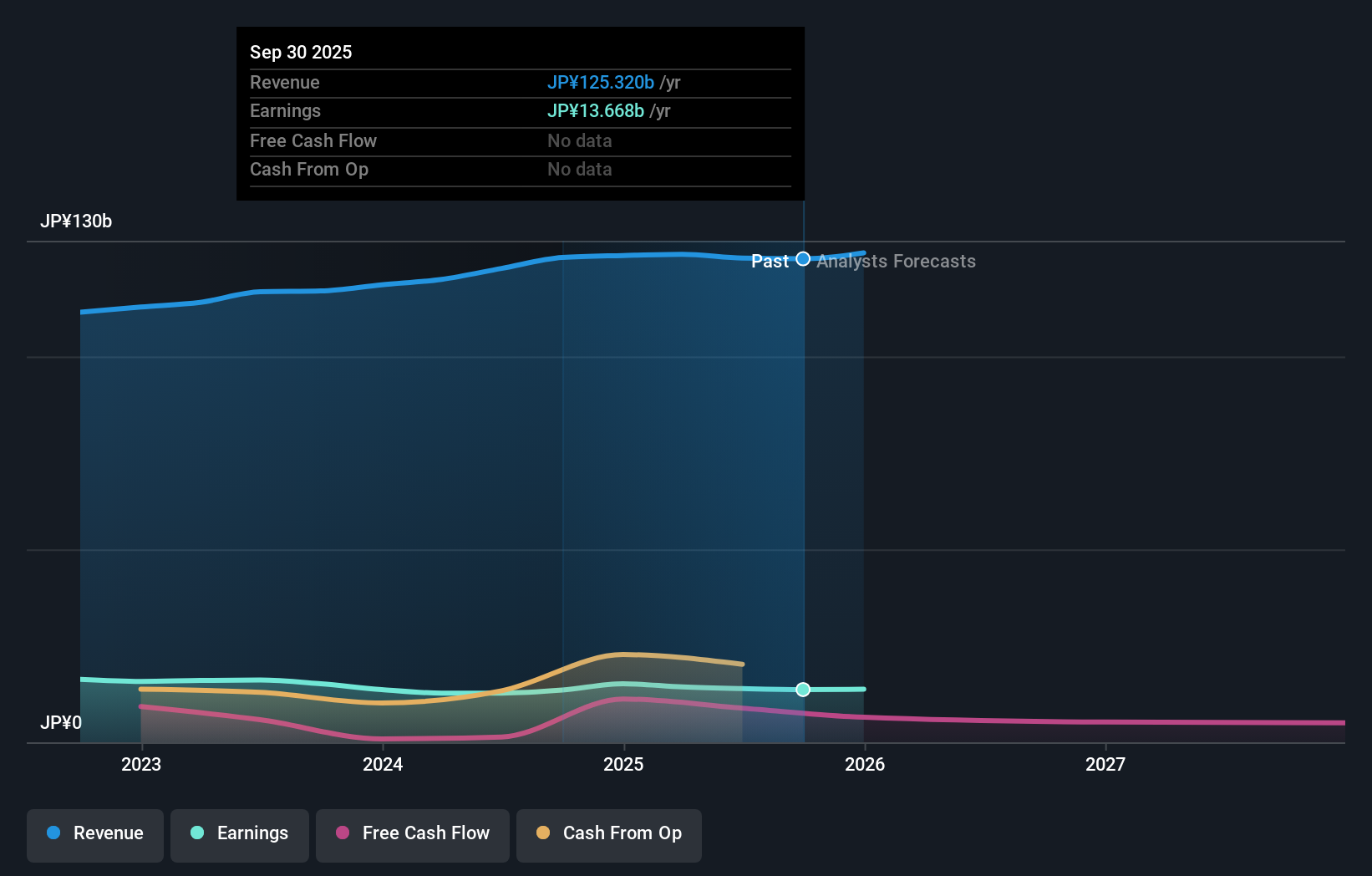

- Pilot Corporation recently issued guidance for the fiscal year ending December 31, 2025, forecasting net sales of ¥133 billion, operating profit of ¥18 billion, and a reduced annual dividend of ¥60 per share versus ¥64 paid the prior year.

- This shift signals management’s expectations for more moderate business performance and shareholder returns in the upcoming fiscal year.

- We’ll explore how the planned dividend reduction shapes Pilot’s investment narrative and future return considerations.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Pilot's Investment Narrative?

For investors considering Pilot, the fundamental case often comes down to the company’s reputation for reliable profitability, a stable dividend, and its commitment to steady international expansion, evidenced by footprint growth in Indonesia and Dubai. The latest update, guiding to flat revenues and earnings paired with a cut to the annual dividend, reinforces the view that management expects only modest progress in the near term. This shift, while not unexpected, could alter how the market weighs short-term catalysts, such as improved operational efficiency or geographic gains, versus build-up of risk from softening returns and constrained profit growth. While the fair value estimate shows the share trading at a discount to consensus price targets, recent underperformance against both the sector and the wider market may limit enthusiasm for near-term upside. If the dividend cut signals deeper caution by management, risk perceptions could rise. Yet, any sign of further erosion in shareholder returns is something investors should watch closely.

Pilot's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore another fair value estimate on Pilot - why the stock might be worth just ¥6100!

Build Your Own Pilot Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pilot research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Pilot research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Pilot's overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7846

Pilot

Engages in the manufacturing, purchase, and sale of writing instruments and other stationery goods in Japan, the United States, Europe, and Asia.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives