- Japan

- /

- Commercial Services

- /

- TSE:7811

Nakamoto PacksLtd (TSE:7811) Profit Growth Beats Five-Year Trend, Reinforcing Bullish Community Sentiment

Reviewed by Simply Wall St

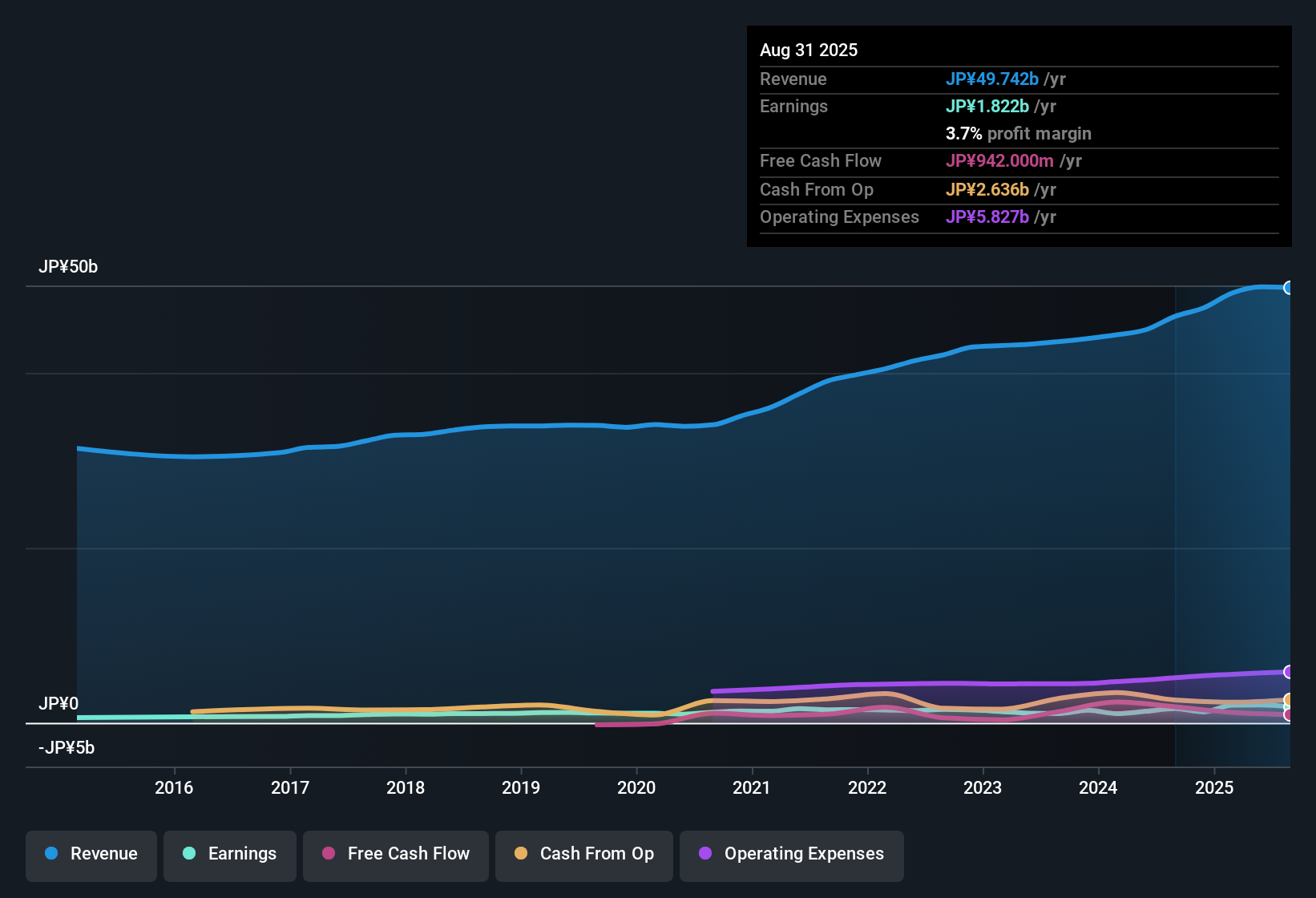

Nakamoto PacksLtd (TSE:7811) delivered notable profit growth this year, with earnings up 12.5%, outpacing its five-year average growth rate of 4.4% per year. Profit margins rose to 3.7% from last year’s 3.5%, and forecasts point to annual earnings growth of 14.51% and revenue growth of 4.9%, both exceeding Japanese market averages. This improving momentum, plus a share price of ¥1748 that sits below an estimated fair value, will be closely watched by investors who are eyeing continued operational strength in the next quarters.

See our full analysis for Nakamoto PacksLtd.The real test is how these figures stack up against the market and investor narratives. Some stories may get stronger, while others might be up for debate as we dig deeper.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Climb Beyond Last Year’s Level

- Profit margins expanded to 3.7%, a notable improvement compared to the previous year’s 3.5%, signaling strengthened operational efficiency relative to the company’s own recent history.

- The improving margin profile supports the narrative that investors see Nakamoto PacksLtd as a steady performer, with confidence coming from a consistent track record.

- Operational updates and ongoing growth in both profit and revenue back up the case for stability, setting expectations for reliable execution rather than dramatic swings.

- With margins ticking up and growth forecasts running ahead of the market, the outlook aligns with the belief that the company can continue to deliver predictable progress, even if excitement stays measured.

Valuation Sits Well Below DCF Fair Value

- Nakamoto PacksLtd’s share price of ¥1748 is considerably lower than its DCF fair value estimate of ¥2633.93, suggesting meaningful upside remains if the growth trajectory holds or improves.

- The gap between current share price and fair value lends weight to the belief that the stock is not pricing in the company’s operational momentum.

- Trading at a Price-To-Earnings ratio of 8.6x, which is discounted compared to the industry average of 13.1x but a touch above immediate peers at 7.9x, invites debate about whether market caution is justified or simply reflects overlooked quality.

- As profit margins trend higher and both earnings and revenue growth outpace the sector, the discounted valuation becomes more difficult to overlook for investors searching for efficient growth in the packaging space.

Growth Forecasts Outpace Industry Benchmarks

- Earnings growth is forecast at 14.51% per year with revenue expected to rise 4.9% annually, both ahead of the Japanese market’s averages of 8.1% and 4.4% respectively.

- Expected outperformance on these measures drives investors' attention toward Nakamoto PacksLtd’s operational momentum.

- What stands out is that not only are growth rates strong on their own, but they meaningfully surpass most competitors, supporting the notion that management’s consistent execution is translating into sector-leading results.

- This backdrop explains why many in the investment community see the company as an appealing pick for those seeking both steady growth and reasonable value relative to the broader market’s pace.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Nakamoto PacksLtd's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While Nakamoto PacksLtd’s valuation appears attractive, its relatively modest profit margins and only slight increases in operational efficiency may limit near-term upside potential.

If you want to prioritize companies consistently delivering stable growth and reliable expansion, use our stable growth stocks screener to find stocks with performance that stands out across cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nakamoto PacksLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7811

Nakamoto PacksLtd

Provides gravure printing services in Japan and internationally.

Flawless balance sheet 6 star dividend payer.

Market Insights

Community Narratives