- Japan

- /

- Professional Services

- /

- TSE:7352

Discovering Three Undiscovered Gems with Strong Potential

Reviewed by Simply Wall St

As global markets continue to navigate the evolving landscape of trade policies and economic indicators, major indices like the S&P 500 have reached new highs, buoyed by optimism around AI investments and a potential easing of tariffs. While large-cap stocks have generally outperformed their smaller-cap counterparts, the current market environment presents unique opportunities for discerning investors to uncover lesser-known stocks with promising growth potential. In this dynamic setting, identifying a good stock often involves looking beyond popular names to find companies that are well-positioned within their sectors and can capitalize on emerging trends or favorable economic shifts.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| E-Commodities Holdings | 21.33% | 9.04% | 28.46% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Changjiu Holdings | NA | 11.84% | 2.46% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | -3.84% | 16.33% | ★★★★★★ |

| Segar Kumala Indonesia | NA | 21.81% | 18.21% | ★★★★★★ |

| S.A.S. Dragon Holdings | 60.96% | 4.62% | 10.02% | ★★★★★☆ |

| Yibin City Commercial Bank | 94.70% | 10.75% | 23.87% | ★★★★★☆ |

| Time Interconnect Technology | 212.50% | 18.13% | 93.08% | ★★★★☆☆ |

| Krom Bank Indonesia | NA | 40.04% | 35.44% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

MUGEN ESTATELtd (TSE:3299)

Simply Wall St Value Rating: ★★★★☆☆

Overview: MUGEN ESTATE Co., Ltd. is engaged in purchasing and reselling used real estate properties in Japan, with a market capitalization of ¥40.35 billion.

Operations: The primary revenue stream for MUGEN ESTATE Co., Ltd. is its Real Estate Sales Business, generating ¥57.62 billion, while its Leasing and Other Business contributes ¥2.41 billion.

MUGEN ESTATE Ltd., a small player in the real estate sector, is making waves with its impressive earnings growth of 45% over the past year, outpacing the industry's 26%. Its price-to-earnings ratio stands at 8.8x, notably lower than Japan's market average of 13.7x, suggesting potential undervaluation. Despite a high net debt to equity ratio of 91%, which has improved from 187% five years ago, interest payments are well-covered by EBIT at an impressive coverage of 11.4x. Recent strategic expansions and organizational changes aim to bolster its core business operations and capture new market opportunities in western Japan and Okinawa.

CELSYS (TSE:3663)

Simply Wall St Value Rating: ★★★★★★

Overview: CELSYS, Inc. offers web services and applications to support creators in production and publishing, with a market cap of ¥39.78 billion.

Operations: CELSYS, Inc. generates revenue primarily from its Content Production Solution Business, which accounts for ¥6.89 billion, and the Content Distribution Solution Business contributing ¥1.04 billion.

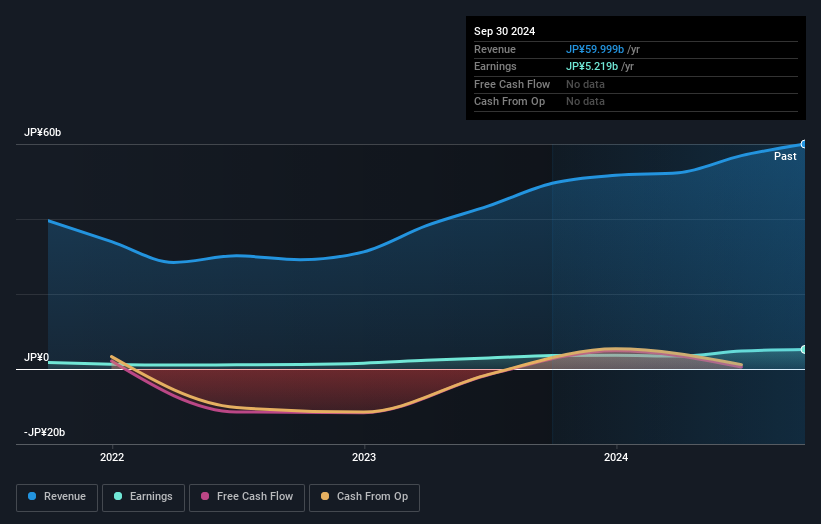

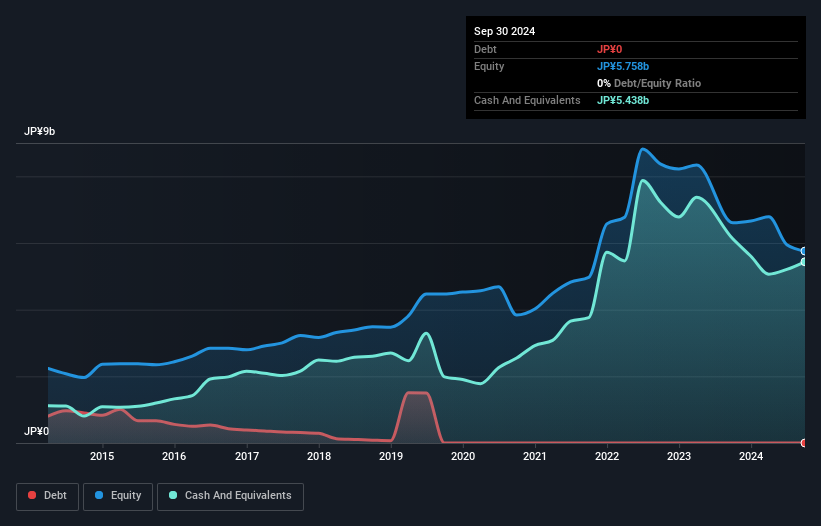

Celsys, a nimble player in the software sector, has been making waves with its impressive earnings growth of 642.6% over the past year, outpacing the industry average of 12.1%. This debt-free company boasts high-quality past earnings and recently initiated a share repurchase program to enhance capital efficiency, buying back 363,900 shares for ¥499.88 million from November to December 2024. Despite having no debt five years ago and maintaining this status today, Celsys's volatile share price over recent months may present both opportunities and challenges for investors seeking potential value in this dynamic market landscape.

- Get an in-depth perspective on CELSYS' performance by reading our health report here.

Explore historical data to track CELSYS' performance over time in our Past section.

TWOSTONE&Sons (TSE:7352)

Simply Wall St Value Rating: ★★★★★☆

Overview: TWOSTONE&Sons Inc. operates in the IT service sector in Japan with a market capitalization of ¥46.14 billion.

Operations: TWOSTONE&Sons generates revenue primarily from its IT service operations in Japan. The company has a market capitalization of ¥46.14 billion, indicating its substantial presence in the sector.

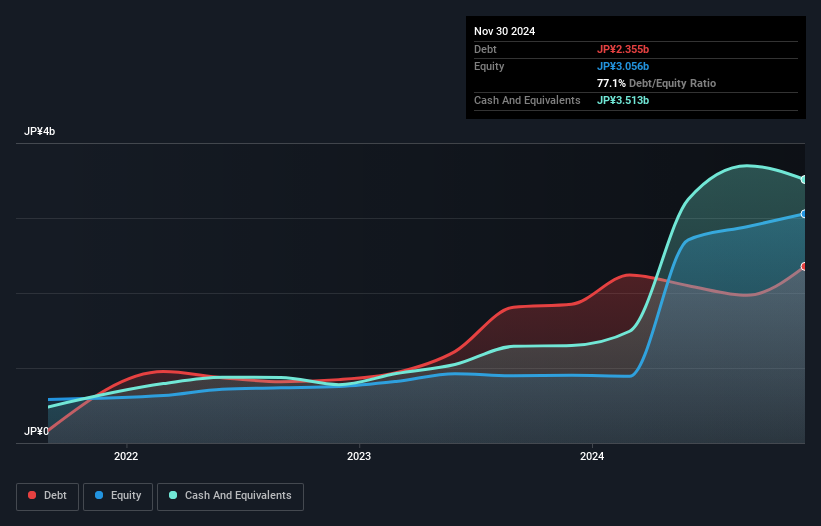

TWOSTONE&Sons, a small cap player, is making waves with its impressive earnings growth of 107.7% last year, outpacing the industry average of 10.4%. Despite a highly volatile share price over the past three months, the company boasts high-quality earnings and remains profitable with a strong cash position exceeding total debt. Its interest payments are comfortably covered by EBIT at 44 times over. Looking ahead, projected annual earnings growth stands at an optimistic 28.08%, suggesting potential for continued expansion in its sector despite recent market fluctuations.

- Click here to discover the nuances of TWOSTONE&Sons with our detailed analytical health report.

Gain insights into TWOSTONE&Sons' historical performance by reviewing our past performance report.

Make It Happen

- Dive into all 4666 of the Undiscovered Gems With Strong Fundamentals we have identified here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if TWOSTONE&Sons might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7352

High growth potential with solid track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion