- Japan

- /

- Professional Services

- /

- TSE:6532

How Investors May Respond To Baycurrent (TSE:6532) Doubling Its Dividend and Raising Guidance

Reviewed by Sasha Jovanovic

- Baycurrent, Inc. recently announced that its interim cash dividend for the second quarter ended August 31, 2025, will be JPY 50.00 per share, double the JPY 25.00 per share distributed a year earlier, and set year-end dividend guidance at JPY 50.00 per share, up from JPY 37.00 per share last year, with payment scheduled for November 28, 2025.

- This significant increase in both interim and year-end dividends highlights management's confidence in the company's financial position and its commitment to delivering shareholder returns.

- Given the sharp boost in dividends, we'll explore how Baycurrent's focus on rewarding shareholders shapes its current investment narrative.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Baycurrent's Investment Narrative?

To be a Baycurrent shareholder right now, you’ll have to buy into a story centered on high expectations for both growth and strong shareholder returns. The recent dividend hike, doubling the interim payout and lifting year-end guidance, signals management’s increased confidence and a firm stance on capital returns. While earnings growth forecasts and return on equity remain robust, the dividend news could increase short-term investor attention and raise the profile of the company among income seekers. This may fuel near-term share price support, although much of the fundamental story, like sector-leading forecasted growth, premium valuation multiples, and consistent buyback activity, remains unchanged from previous analysis. At the same time, board turnover and valuation metrics still present possible speed bumps for the medium term. The dividend news amplifies Baycurrent’s shareholder focus but may also heighten scrutiny if profit growth or cash flows falter ahead.

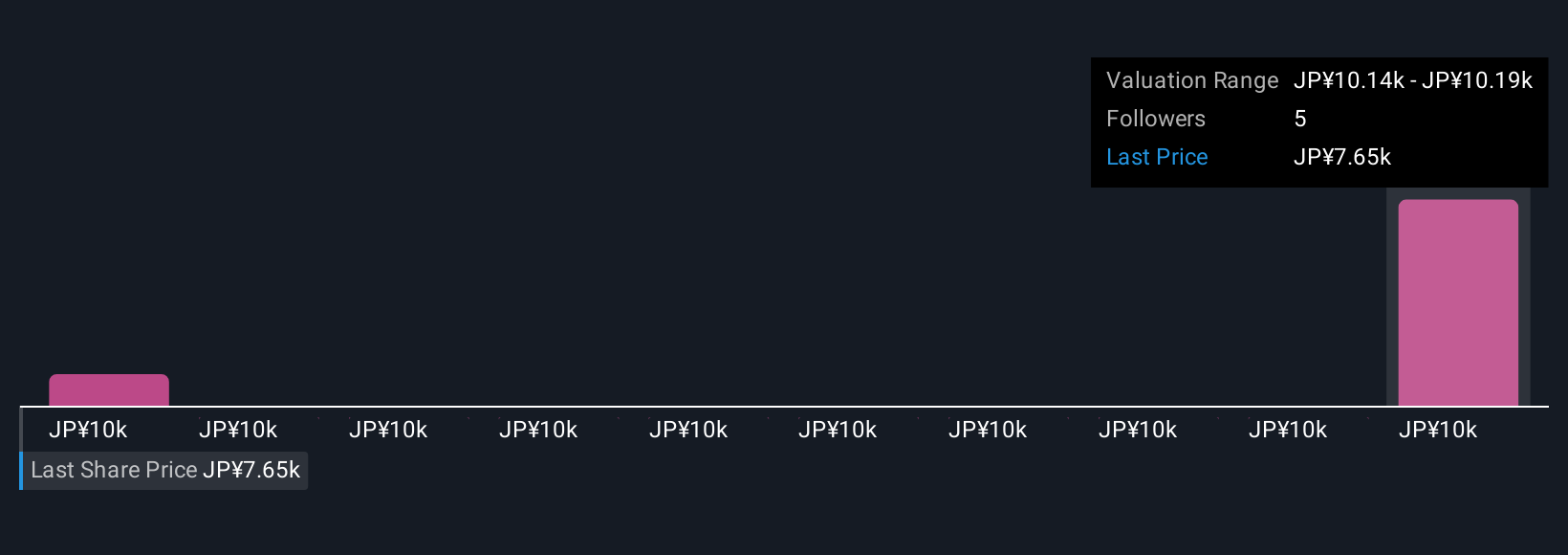

On the other hand, ongoing board turnover remains a risk that investors should note. Despite retreating, Baycurrent's shares might still be trading 29% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 2 other fair value estimates on Baycurrent - why the stock might be worth just ¥9688!

Build Your Own Baycurrent Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Baycurrent research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Baycurrent research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Baycurrent's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Baycurrent might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6532

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives