- Japan

- /

- Professional Services

- /

- TSE:6532

3 Japanese Growth Stocks With Insider Ownership Up To 21%

Reviewed by Simply Wall St

As Japan's stock markets continue to make modest gains amid the Bank of Japan's commitment to normalizing monetary policy, investors are increasingly focusing on growth opportunities within the region. In this context, identifying companies with high insider ownership can provide valuable insights into potential long-term performance and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In Japan

| Name | Insider Ownership | Earnings Growth |

| Micronics Japan (TSE:6871) | 15.3% | 32.7% |

| Hottolink (TSE:3680) | 27% | 61.9% |

| Kasumigaseki CapitalLtd (TSE:3498) | 34.7% | 43.3% |

| Medley (TSE:4480) | 34% | 30.5% |

| Kanamic NetworkLTD (TSE:3939) | 25% | 28.3% |

| SHIFT (TSE:3697) | 35.4% | 32.1% |

| ExaWizards (TSE:4259) | 22% | 63% |

| Money Forward (TSE:3994) | 21.4% | 66.9% |

| Astroscale Holdings (TSE:186A) | 21.3% | 90% |

| AeroEdge (TSE:7409) | 10.7% | 22.1% |

Let's uncover some gems from our specialized screener.

Money Forward (TSE:3994)

Simply Wall St Growth Rating: ★★★★★★

Overview: Money Forward, Inc. offers financial solutions for individuals, financial institutions, and corporations primarily in Japan with a market cap of ¥309.21 billion.

Operations: The company's revenue segments include financial solutions for individuals, financial institutions, and corporations primarily in Japan.

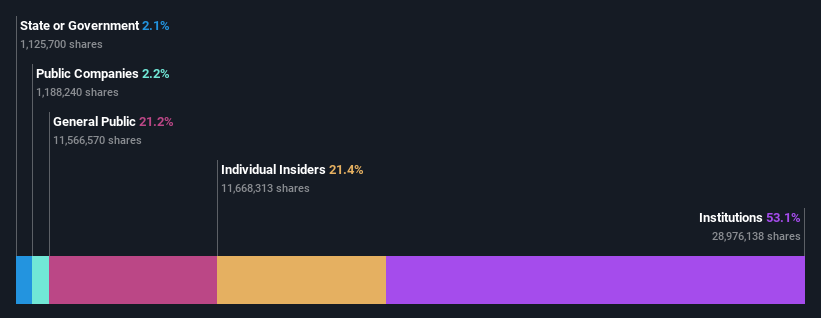

Insider Ownership: 21.4%

Money Forward, Inc. is a growth company with substantial insider ownership in Japan. The company's revenue is forecasted to grow 20.7% annually, significantly outpacing the market's 4.3%. Earnings are expected to increase by 66.91% per year, with profitability anticipated within three years. Recent board meetings have focused on strategic restructuring and joint ventures, such as transferring fintech-related business rights and establishing a PFM services joint venture with Sumitomo Mitsui Card Company.

- Navigate through the intricacies of Money Forward with our comprehensive analyst estimates report here.

- Our expertly prepared valuation report Money Forward implies its share price may be too high.

Rakuten Group (TSE:4755)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Rakuten Group, Inc. operates in e-commerce, fintech, digital content, and communications across Japan and internationally with a market cap of ¥2.15 trillion.

Operations: Revenue segments include Mobile at ¥382.95 million, Fin Tech at ¥772.29 million, and Internet Services at ¥1.24 billion.

Insider Ownership: 17.3%

Rakuten Group's revenue is projected to grow 7.6% annually, outpacing the broader Japanese market's 4.3%. Earnings are forecasted to increase by 83.28% per year, with profitability expected within three years. Despite high volatility in its share price over the past three months and a low return on equity forecast of 9.7%, Rakuten remains a key player in Japan’s growth sector with significant insider ownership and no substantial insider trading activity recently reported.

- Get an in-depth perspective on Rakuten Group's performance by reading our analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Rakuten Group is priced higher than what may be justified by its financials.

BayCurrent Consulting (TSE:6532)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BayCurrent Consulting, Inc. provides consulting services in Japan and has a market cap of ¥692.15 billion.

Operations: BayCurrent Consulting, Inc. generates revenue primarily through its consulting services in Japan.

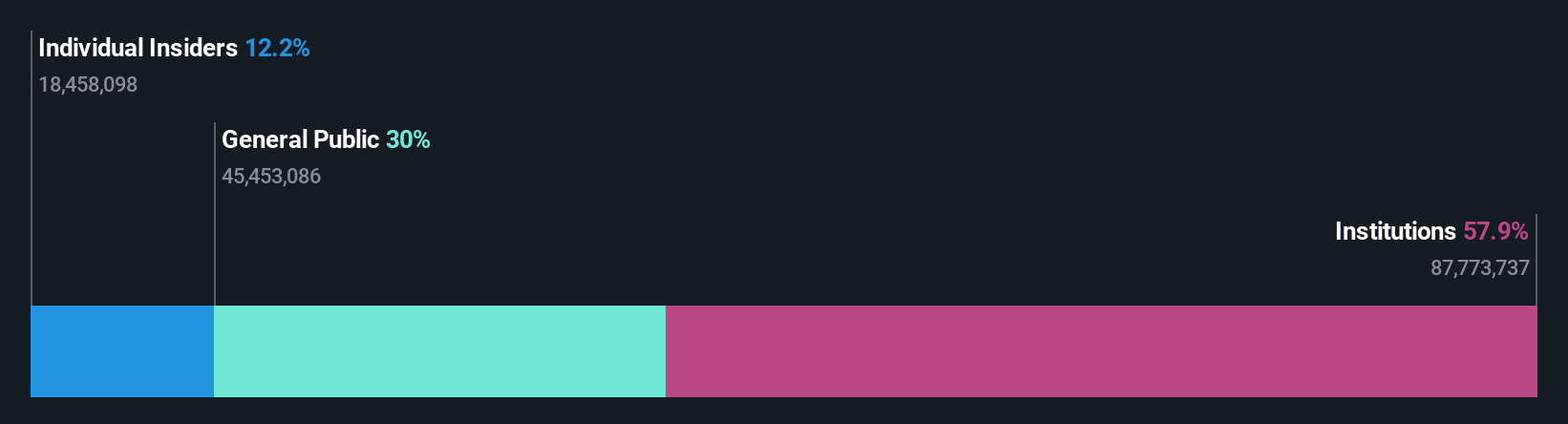

Insider Ownership: 13.9%

BayCurrent Consulting's earnings are forecast to grow 18.61% annually, surpassing the Japanese market's 8.5%. The company trades at a significant discount of 47.3% below its estimated fair value and has shown strong earnings growth of 16.8% over the past year. With a high projected return on equity of 34.7% in three years and no substantial insider trading activity recently, BayCurrent demonstrates robust growth potential backed by solid insider ownership.

- Unlock comprehensive insights into our analysis of BayCurrent Consulting stock in this growth report.

- The valuation report we've compiled suggests that BayCurrent Consulting's current price could be quite moderate.

Taking Advantage

- Discover the full array of 101 Fast Growing Japanese Companies With High Insider Ownership right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if BayCurrent Consulting might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6532

Flawless balance sheet with reasonable growth potential.