- Japan

- /

- Hospitality

- /

- TSE:2752

Top Growth Companies With High Insider Ownership On Japanese Exchange

Reviewed by Simply Wall St

Japan's stock markets have recently experienced significant declines, with the Nikkei 225 Index falling 4.7% and the broader TOPIX Index down 6.0%, amid a hawkish turn from the Bank of Japan and disappointing U.S. macroeconomic data. Despite these market challenges, growth companies with high insider ownership often present compelling investment opportunities due to their potential for strong performance driven by aligned management interests. In this article, we will explore three standout growth companies listed on Japanese exchanges that boast high insider ownership, highlighting what makes them attractive in today's volatile market environment.

Top 10 Growth Companies With High Insider Ownership In Japan

| Name | Insider Ownership | Earnings Growth |

| Hottolink (TSE:3680) | 27% | 59.7% |

| Kasumigaseki CapitalLtd (TSE:3498) | 34.8% | 43.3% |

| Medley (TSE:4480) | 34% | 28.7% |

| Micronics Japan (TSE:6871) | 15.3% | 39.8% |

| Kanamic NetworkLTD (TSE:3939) | 25% | 28.9% |

| SHIFT (TSE:3697) | 35.4% | 32.8% |

| ExaWizards (TSE:4259) | 21.8% | 91.1% |

| Money Forward (TSE:3994) | 21.4% | 66.8% |

| Astroscale Holdings (TSE:186A) | 20.9% | 90% |

| Soiken Holdings (TSE:2385) | 19.8% | 118.4% |

Let's explore several standout options from the results in the screener.

Fujio Food Group (TSE:2752)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Fujio Food Group Inc., with a market cap of ¥61.46 billion, operates restaurants both in Japan and internationally.

Operations: Revenue Segments (in millions of ¥): - Restaurant Operations: ¥45,000 - Food Manufacturing: ¥12,500 - Food Sales: ¥8,750 Fujio Food Group generates revenue primarily from restaurant operations at ¥45 billion, food manufacturing at ¥12.50 billion, and food sales at ¥8.75 billion.

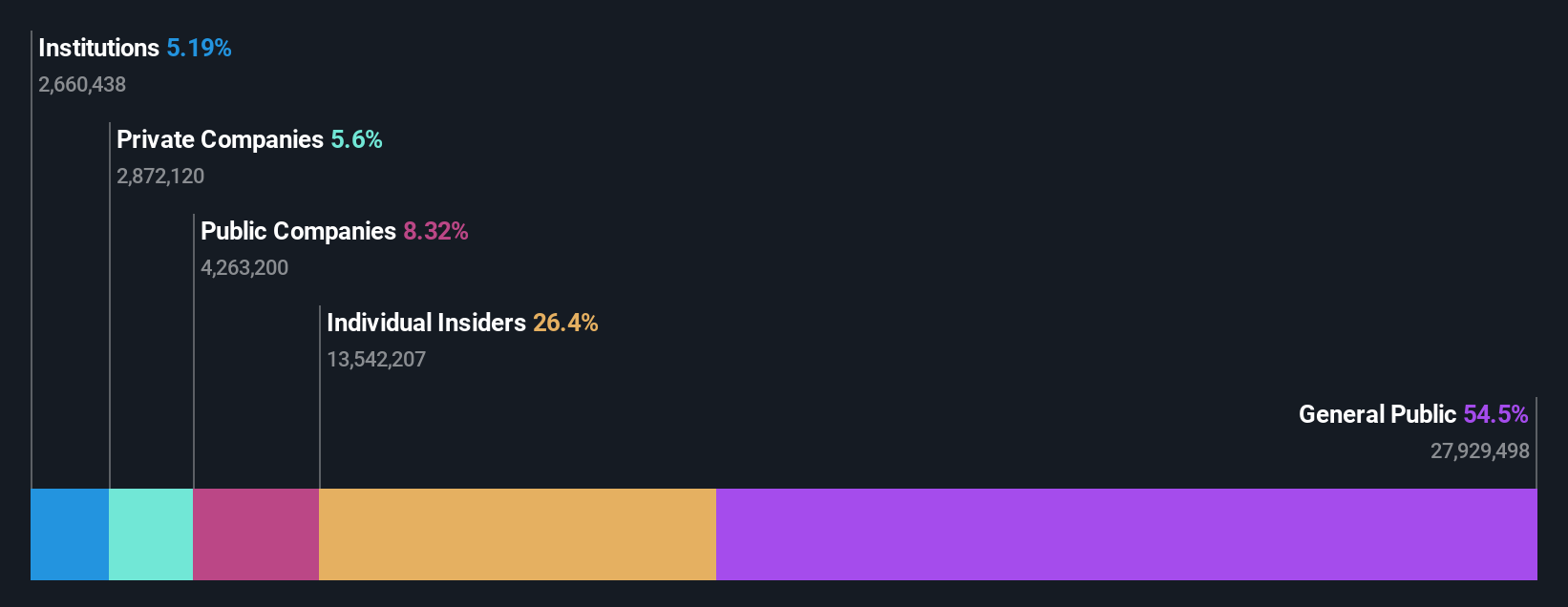

Insider Ownership: 29.5%

Fujio Food Group, with substantial insider ownership, is expected to become profitable within the next three years and shows an impressive forecasted earnings growth of 72.84% per year. Trading at 27.9% below its estimated fair value, the company’s revenue is projected to grow at 6.2% annually, outpacing the broader Japanese market's growth rate of 4.1%. Recent analysis indicates no significant insider trading activity over the past three months.

- Take a closer look at Fujio Food Group's potential here in our earnings growth report.

- Our valuation report here indicates Fujio Food Group may be overvalued.

Sato Holdings (TSE:6287)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sato Holdings Corporation manufactures and sells labeling products both in Japan and internationally, with a market cap of ¥62.88 billion.

Operations: The company generates revenue from Auto-ID Solutions in Japan (¥82.09 billion) and overseas (¥78.47 billion).

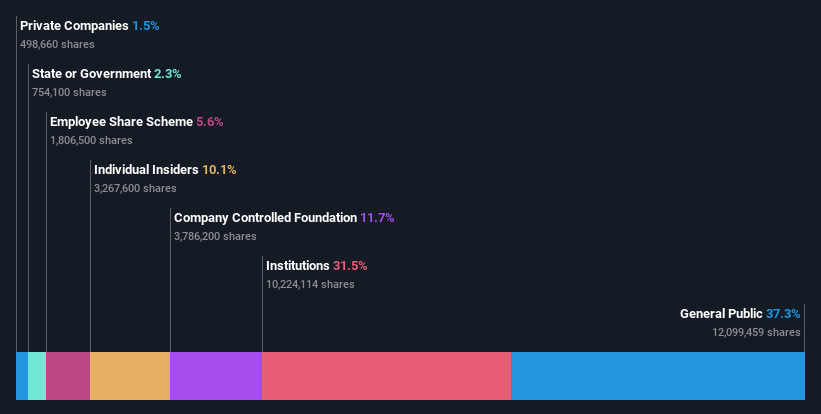

Insider Ownership: 10.1%

Sato Holdings, with high insider ownership, is leveraging its advanced RFID technology to drive growth across retail, healthcare, and industrial sectors. Recent collaborations, such as with EM Microelectronic for RAINFC labels, enhance its market position. Despite a modest revenue growth forecast of 4.1% annually—slightly above the JP market—its earnings are expected to grow significantly at 20.3% per year. The company also maintains a progressive dividend policy and trades at a substantial discount to fair value estimates.

- Unlock comprehensive insights into our analysis of Sato Holdings stock in this growth report.

- Insights from our recent valuation report point to the potential undervaluation of Sato Holdings shares in the market.

Marvelous (TSE:7844)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Marvelous Inc. (TSE:7844) specializes in the planning, development, production, marketing, and sale of game software for home-use game machines and has a market cap of ¥37.62 billion.

Operations: Marvelous Inc. generates revenue primarily through the planning, development, production, marketing, and sale of game software for home-use game machines.

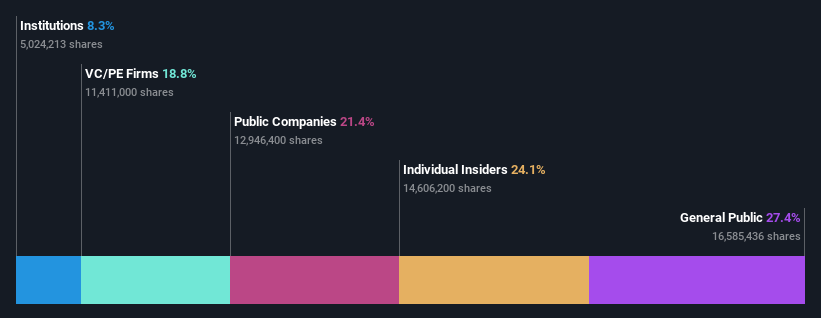

Insider Ownership: 24.1%

Marvelous Inc. showcases strong insider ownership and is forecasted to grow earnings by 64.51% annually, outpacing the JP market's average growth rate. The company is expected to become profitable within three years, aligning with above-average market growth expectations. Despite a dividend yield of 5.31%, it is not well covered by earnings or free cash flows, which could pose sustainability concerns. Recent Q1 2025 earnings call highlighted ongoing strategic initiatives aimed at bolstering future profitability.

- Delve into the full analysis future growth report here for a deeper understanding of Marvelous.

- Our valuation report unveils the possibility Marvelous' shares may be trading at a premium.

Where To Now?

- Unlock our comprehensive list of 99 Fast Growing Japanese Companies With High Insider Ownership by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2752

Reasonable growth potential with mediocre balance sheet.