- Japan

- /

- Professional Services

- /

- TSE:6200

Insource (TSE:6200) Margin Gains Reinforce Bullish Narratives Despite Slower Earnings Growth

Reviewed by Simply Wall St

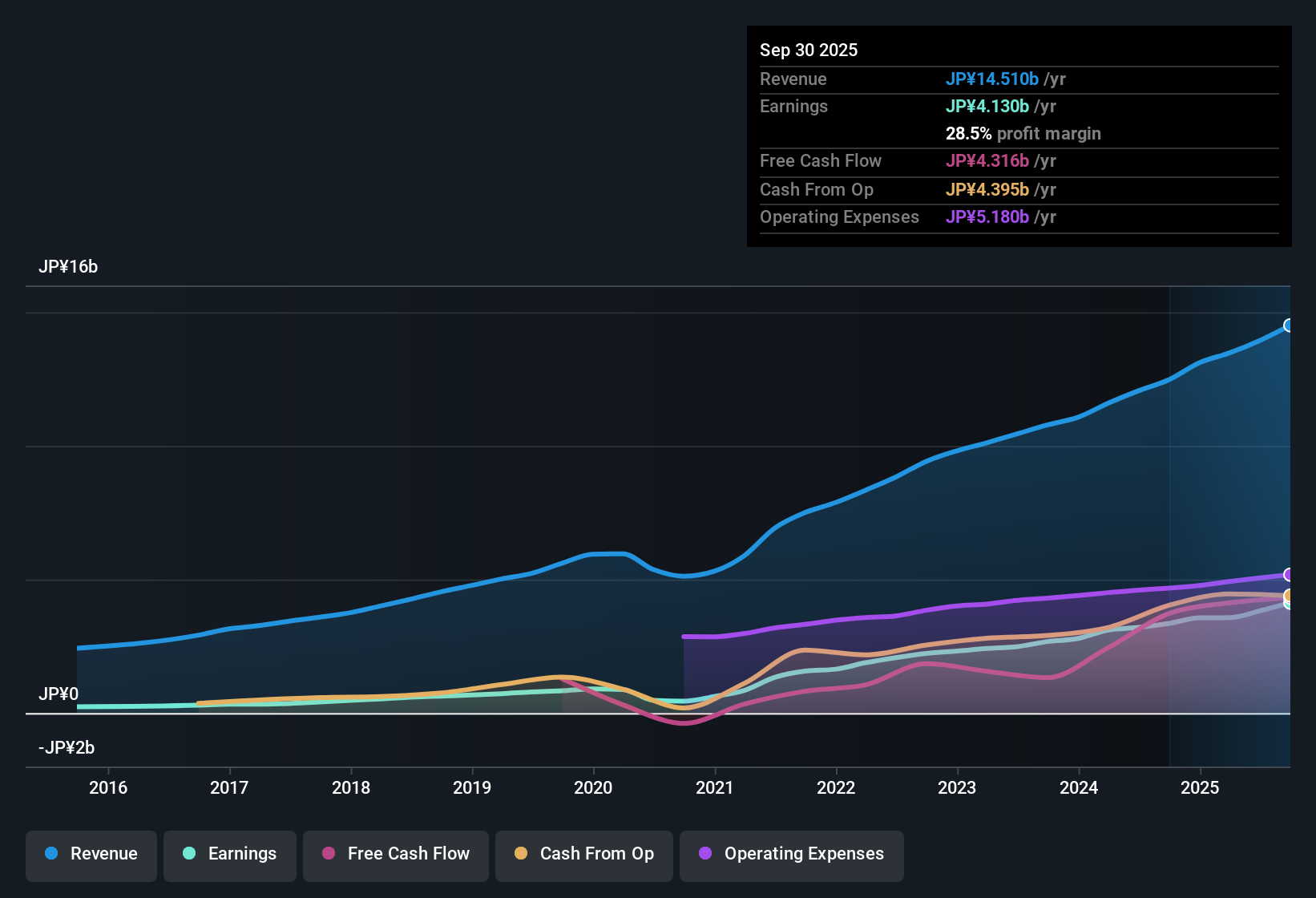

Insource (TSE:6200) posted a compound annual earnings growth rate of 29.1% over the last five years. The most recent year saw earnings growth of 19.4%, slightly trailing its long-term average. Net profit margins improved to 27.4%, up from 26.6% a year earlier, reinforcing the company's reputation for high-quality reported earnings. The current price-to-earnings ratio stands at 19.4x, which is above both the industry and peer averages. However, the share price of ¥883 remains below the estimated fair value of ¥1,678.18, suggesting the stock is trading at a discount despite a market premium multiple.

See our full analysis for Insource.Up next, we will see how these headline results measure up against the broader market narratives. We will explore which viewpoints are confirmed and which may need to be reconsidered.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Edge Higher

- Net profit margins reached 27.4% this year, moving up slightly from 26.6% and reinforcing the company’s above-average profitability compared to most industry players.

- Recent data shows that robust margins continue to support optimism around the company’s ability to deliver consistent profit growth:

- The company’s margins remain well above typical sector levels, supporting arguments that Insource commands strong pricing power and operational discipline.

- The sustained margin strength strongly supports investor hopes for continued earnings durability even if top-line growth moderates from historical highs.

Valuation Premium Despite Discounted Price

- The company's price-to-earnings ratio stands at 19.4x, outpacing both the industry average of 14.9x and the peer average of 14.4x. However, the current share price of ¥883 is still trading below the DCF fair value of ¥1,678.18.

- This creates an interesting tension as the prevailing narrative urges investors to weigh a premium multiple against the potential value opportunity:

- Despite paying more per yen of earnings than the average company in the sector, investors see a possible upside if the share price converges with DCF fair value in the future.

- The discount to estimated fair value may be viewed as a cushion, challenging the typical view that a premium P/E automatically means the stock is expensive in today’s market context.

Sustained Multi-Year Growth Trajectory

- Earnings have compounded annually at 29.1% over the past five years, with the latest year delivering a solid 19.4%, which is slower than the longer-term average but still a significant gain relative to peers.

- The prevailing view emphasizes that even as annual growth cools, the company’s performance track record continues to underpin long-term growth expectations:

- The latest figures provide evidence that the company is not just a one-year wonder; multi-year momentum could keep supporting investor confidence.

- The absence of flagged risks in current disclosures further focuses attention on sustained growth and operational execution going forward.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Insource's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While Insource delivers impressive growth and margins, its slowing momentum and premium valuation may leave investors seeking steadier, more predictable performers. However, if consistent expansion matters to you, check out stable growth stocks screener (2083 results) to focus on companies that achieve reliable earnings and revenue growth year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6200

Insource

Provides various lecturer dispatch type training, open lecture, and other services in Japan.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives