- Japan

- /

- Professional Services

- /

- TSE:6098

3 Asian Stocks Estimated To Be Trading At Discounts Of Up To 37.6%

Reviewed by Simply Wall St

As global markets face challenges such as fluctuating consumer sentiment and concerns over elevated valuations, Asian markets present intriguing opportunities for investors seeking value. In the current climate, identifying undervalued stocks can be a prudent strategy, especially when market conditions prompt a closer examination of companies trading at significant discounts.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xi'an International Medical Investment (SZSE:000516) | CN¥4.77 | CN¥9.38 | 49.2% |

| Wuhan Guide Infrared (SZSE:002414) | CN¥12.95 | CN¥25.26 | 48.7% |

| Takara Bio (TSE:4974) | ¥913.00 | ¥1814.63 | 49.7% |

| Lotes (TWSE:3533) | NT$1345.00 | NT$2661.68 | 49.5% |

| LianChuang Electronic TechnologyLtd (SZSE:002036) | CN¥10.15 | CN¥20.06 | 49.4% |

| EROAD (NZSE:ERD) | NZ$1.60 | NZ$3.14 | 49% |

| East Buy Holding (SEHK:1797) | HK$20.28 | HK$39.94 | 49.2% |

| Daiichi Sankyo Company (TSE:4568) | ¥3368.00 | ¥6603.36 | 49% |

| CHEMTRONICS.Co.Ltd (KOSDAQ:A089010) | ₩36500.00 | ₩72851.82 | 49.9% |

| Andes Technology (TWSE:6533) | NT$260.50 | NT$509.05 | 48.8% |

Let's dive into some prime choices out of the screener.

Zijin Gold International (SEHK:2259)

Overview: Zijin Gold International Company Limited is involved in the exploration, mining, processing, smelting, refining, and sale of gold and other mineral resources in the PRC with a market cap of HK$372.01 billion.

Operations: The company's revenue segment includes exploration and mining of gold and non-ferrous metal, generating $3.58 billion.

Estimated Discount To Fair Value: 14.3%

Zijin Gold International's recent acquisition of the Raygorodok Gold Mine in Kazakhstan, with substantial resources and low all-in sustaining costs, positions it for enhanced cash flow generation. Despite trading 14.3% below its estimated fair value, its earnings are forecasted to grow significantly at 33.1% annually, outpacing the Hong Kong market average. The company's IPO raised HK$24.98 billion, bolstering its financial capacity to leverage growth opportunities and optimize existing operations across Central Asia.

- According our earnings growth report, there's an indication that Zijin Gold International might be ready to expand.

- Navigate through the intricacies of Zijin Gold International with our comprehensive financial health report here.

Wanguo Gold Group (SEHK:3939)

Overview: Wanguo Gold Group Limited is an investment holding company involved in mining, ore processing, and the sale of concentrate products in China and the Solomon Islands, with a market cap of HK$35.00 billion.

Operations: The company's revenue is derived from two main segments: the Yifeng Project, contributing CN¥597.84 million, and the Solomon Project, generating CN¥1.59 billion.

Estimated Discount To Fair Value: 37.6%

Wanguo Gold Group's recent financial performance and strategic actions suggest it is undervalued based on cash flows. The company reported significant earnings growth, with net income reaching CNY 600.76 million for the first half of 2025, up from CNY 254.27 million a year prior. Trading at HK$31.64, it is approximately 37.6% below its estimated fair value of HK$50.71, highlighting its potential as an investment opportunity in the Asian market for those focused on cash flow metrics.

- Insights from our recent growth report point to a promising forecast for Wanguo Gold Group's business outlook.

- Click to explore a detailed breakdown of our findings in Wanguo Gold Group's balance sheet health report.

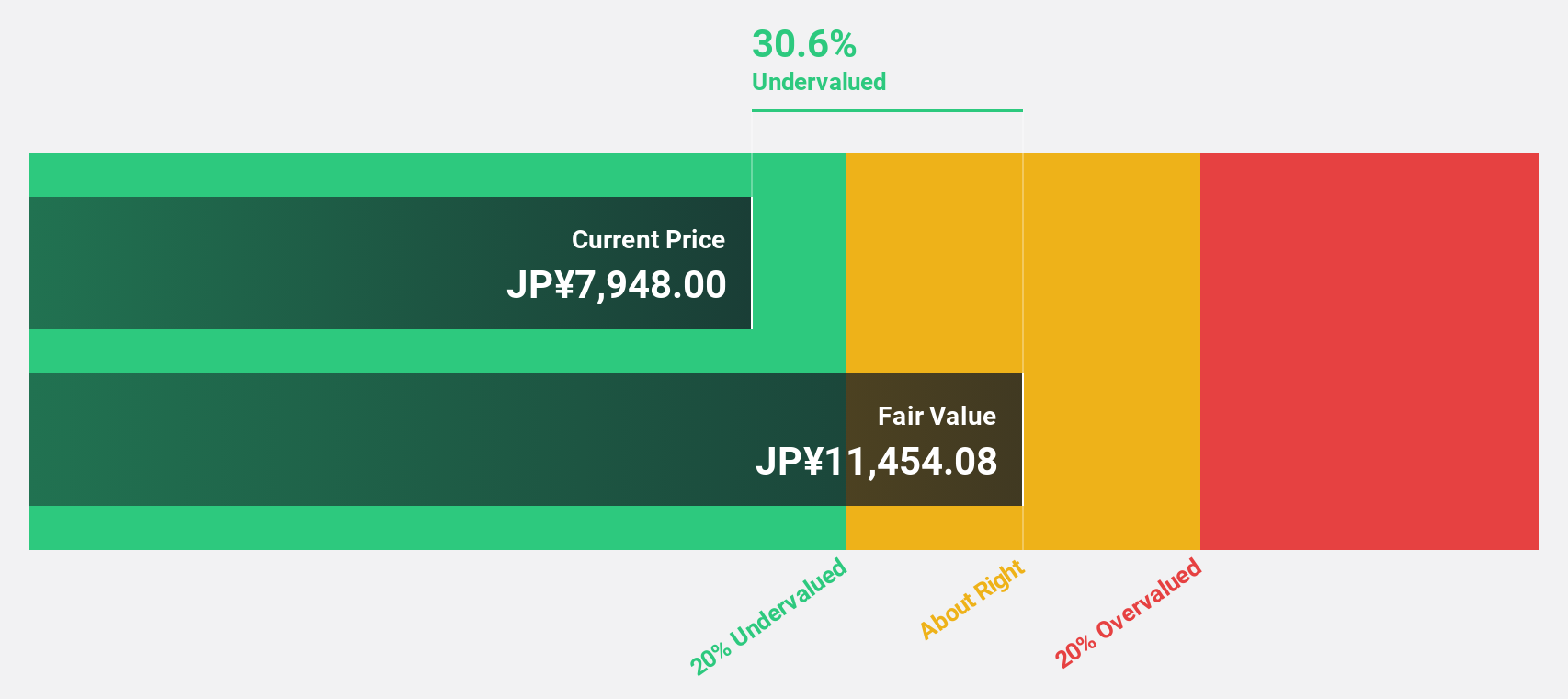

Recruit Holdings (TSE:6098)

Overview: Recruit Holdings Co., Ltd. operates in HR technology and business solutions, aiming to transform the world of work, with a market cap of approximately ¥12 trillion.

Operations: The company's revenue segments are comprised of Staffing at ¥1.66 billion, HR Technology at ¥1.12 billion, and Marketing Matching Technologies at ¥833.64 million.

Estimated Discount To Fair Value: 27.5%

Recruit Holdings is trading at ¥8,487, significantly below its estimated fair value of ¥11,704.47, indicating potential undervaluation based on cash flows. The company recently raised its earnings guidance for fiscal 2026 and announced a share buyback program to enhance capital efficiency. Despite high share price volatility and slower revenue growth compared to some benchmarks, Recruit's projected earnings growth of 9.49% annually outpaces the broader Japanese market forecast.

- Upon reviewing our latest growth report, Recruit Holdings' projected financial performance appears quite optimistic.

- Click here to discover the nuances of Recruit Holdings with our detailed financial health report.

Make It Happen

- Take a closer look at our Undervalued Asian Stocks Based On Cash Flows list of 290 companies by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6098

Recruit Holdings

Provides HR technology and business solutions that transforms the world of work.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives