- Japan

- /

- Professional Services

- /

- TSE:4792

3 Dividend Stocks To Consider With Yields Up To 5.6%

Reviewed by Simply Wall St

In a week marked by fluctuating indices and mixed economic signals, global markets have shown resilience amid uncertainty, with major indexes like the Nasdaq Composite and S&P MidCap 400 experiencing highs before retreating. As investors navigate this volatile landscape, dividend stocks can offer a stable income stream, making them an attractive option for those seeking to balance growth potential with consistent returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.29% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.96% | ★★★★★★ |

| Innotech (TSE:9880) | 4.82% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.18% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.10% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 6.36% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.94% | ★★★★★★ |

| James Latham (AIM:LTHM) | 5.83% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.63% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.03% | ★★★★★★ |

Click here to see the full list of 2022 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

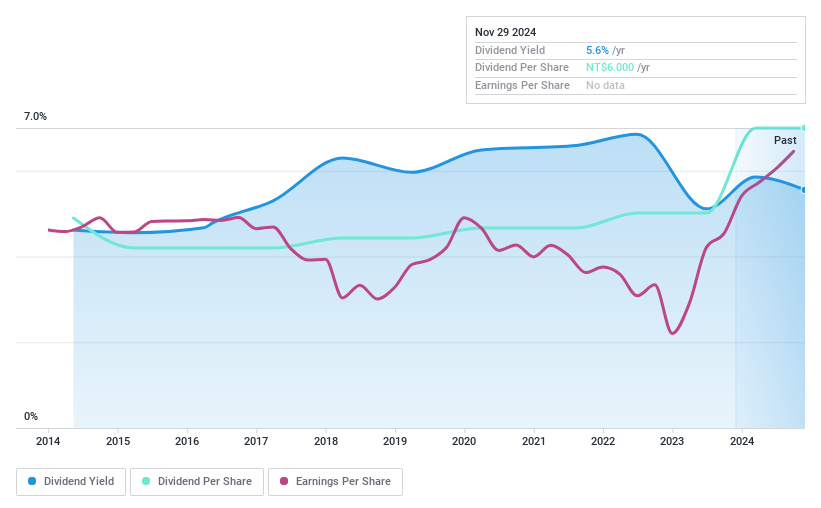

Formosa Optical TechnologyLtd (TPEX:5312)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Formosa Optical Technology Co., Ltd. operates in Taiwan, offering eyecare products, with a market capitalization of NT$6.43 billion.

Operations: Formosa Optical Technology Ltd. generates revenue from its Bio Division, which accounts for NT$929.73 million, and Bio Technology segment, contributing NT$2.89 billion.

Dividend Yield: 5.6%

Formosa Optical Technology Ltd. offers a reliable dividend yield of 5.8%, placing it in the top 25% of dividend payers in Taiwan. Over the past decade, dividends have been stable and growing, supported by earnings with a payout ratio of 77.1% and cash flows with a cash payout ratio of 67.3%. Recent financials show robust growth, with net income rising to TWD 107.48 million for Q2 2024 from TWD 82.49 million the previous year, underscoring its capacity to sustain dividends.

- Click here to discover the nuances of Formosa Optical TechnologyLtd with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Formosa Optical TechnologyLtd is priced lower than what may be justified by its financials.

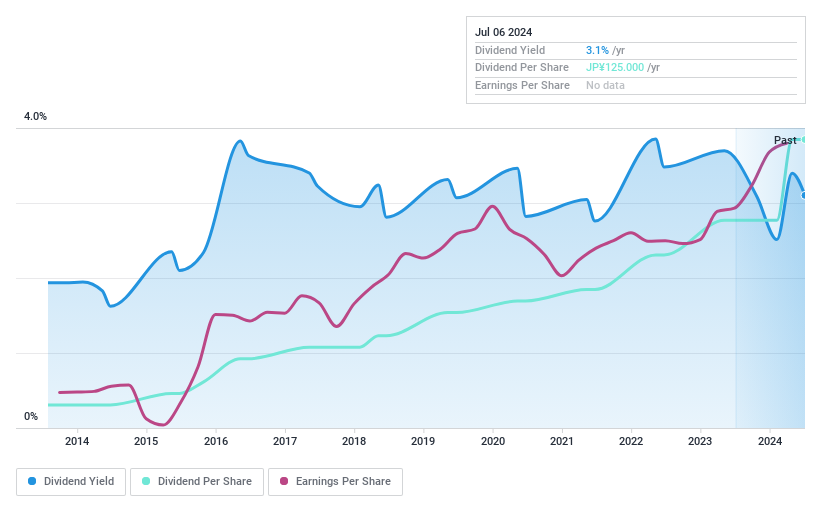

Ryoyu Systems (TSE:4685)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ryoyu Systems Co., Ltd. offers IT solutions across multiple industries in Japan and has a market capitalization of ¥26.39 billion.

Operations: Ryoyu Systems Co., Ltd. generates revenue primarily through its Information Service segment, which accounted for ¥38.43 billion.

Dividend Yield: 3%

Ryoyu Systems' dividend yield of 3.07% is below the top quartile in Japan, and its dividend history has been volatile over the past decade. Despite this, dividends are well-covered by earnings and cash flows, with payout ratios of 16.7% and 23.3%, respectively. The stock trades significantly below estimated fair value, while recent earnings growth of 38.9% suggests potential for future stability in payouts despite past inconsistencies.

- Unlock comprehensive insights into our analysis of Ryoyu Systems stock in this dividend report.

- Our valuation report here indicates Ryoyu Systems may be undervalued.

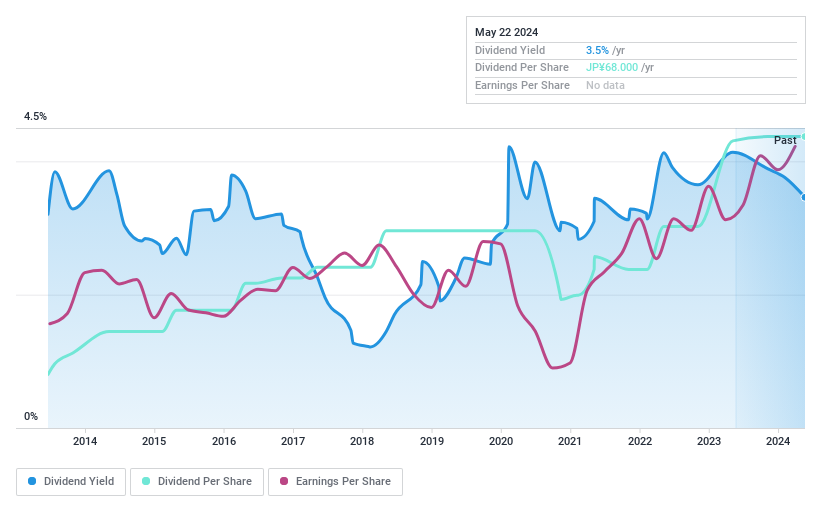

YAMADA Consulting GroupLtd (TSE:4792)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: YAMADA Consulting Group Co., Ltd. offers a range of consulting services across Japan, Asia, the United States, and internationally, with a market cap of ¥42.79 billion.

Operations: YAMADA Consulting Group Ltd. generates revenue from its Consulting segment, amounting to ¥18.88 billion, and its Investment Segment, contributing ¥5.15 billion.

Dividend Yield: 3.4%

YAMADA Consulting Group's dividend yield of 3.39% falls short of the top quartile in Japan, and its dividends have been volatile over the past decade, with notable annual drops. However, dividends are well-covered by earnings and cash flows, with payout ratios of 36.9% and 24.8%, respectively. Despite recent guidance indicating a decrease in annual dividends to ¥38 per share from ¥43 last year, earnings grew significantly by 73.6%, suggesting potential for future stability.

- Delve into the full analysis dividend report here for a deeper understanding of YAMADA Consulting GroupLtd.

- In light of our recent valuation report, it seems possible that YAMADA Consulting GroupLtd is trading behind its estimated value.

Next Steps

- Explore the 2022 names from our Top Dividend Stocks screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4792

YAMADA Consulting GroupLtd

Provides various consulting services in Japan, Asia, the United States, and internationally.

Excellent balance sheet with proven track record and pays a dividend.