- Japan

- /

- Commercial Services

- /

- TSE:4771

F&MLtd (TSE:4771) Margin Expansion Surpasses Bullish Narratives, Puts Spotlight on Valuation Premium

Reviewed by Simply Wall St

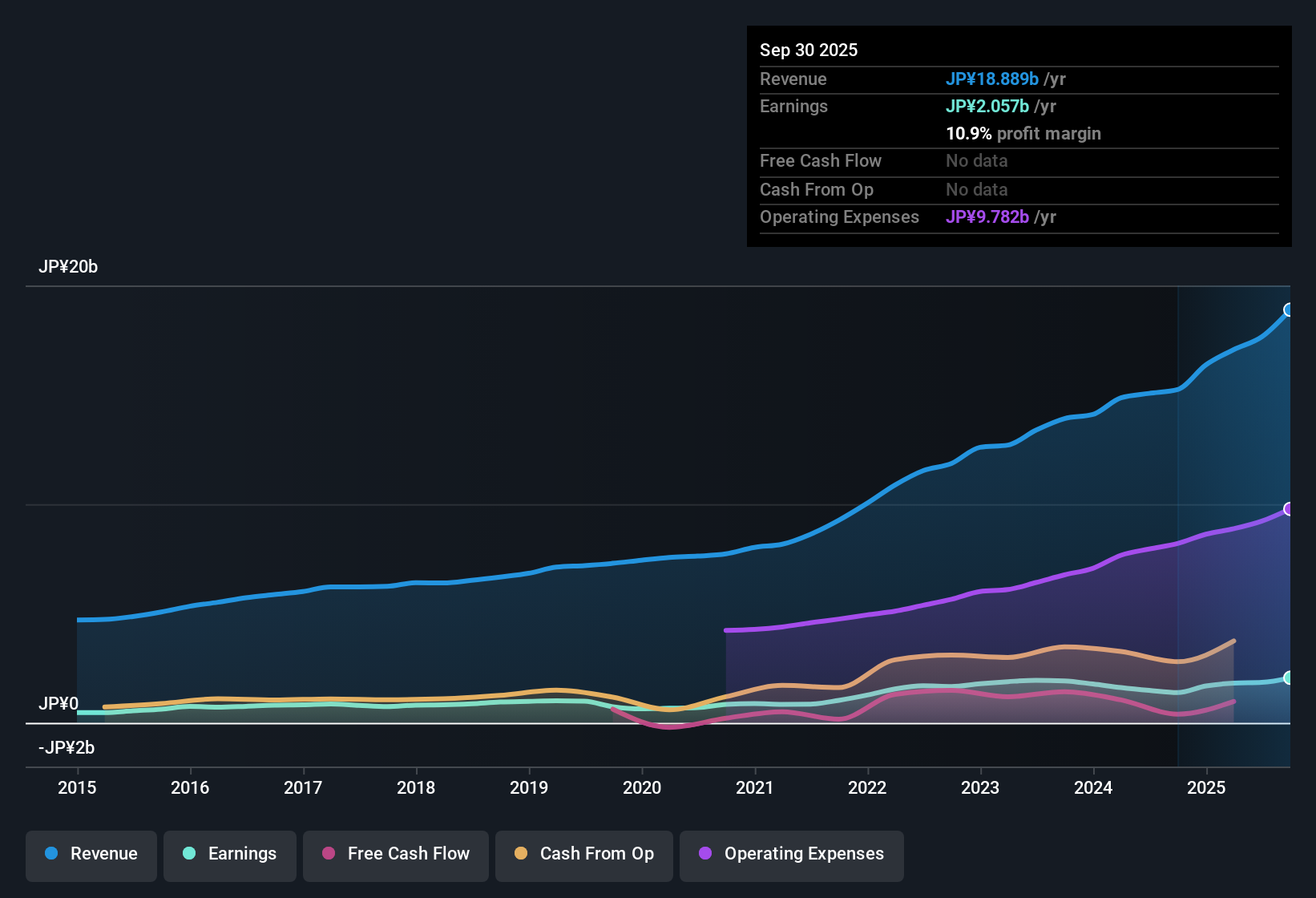

F&MLtd (TSE:4771) delivered a net profit margin of 10.9% this year, up from 9% last year, with annual earnings surging 49.2%. This growth rate is well ahead of its five-year compound annual rate of 13.3%. Over the past five years, earnings have grown at 13.3% per year, with the latest results highlighting a track record of high-quality profitability.

See our full analysis for F&MLtd.Next, we will measure these headline numbers against the prevailing narratives for F&MLtd. Some expectations may be confirmed, while others might be met with surprise.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Outpace Five-Year Trend

- The net profit margin reached 10.9%, moving above last year’s 9% and topping the five-year trend of stable, high-quality earnings growth at 13.3% annualized rates.

- Momentum behind these margin gains, as described in prevailing market analysis, heavily supports the positive narrative that F&MLtd’s profitability remains high quality even as earnings scaled up quickly.

- Sustained expansion in margins, alongside strong earnings growth, anchors confidence among optimistic investors looking for durable efficiency improvements.

- Critics, though, will watch to see if the above-trend margin holds as the company grows further in the coming periods.

Trading at a Premium to Peers

- F&MLtd’s price-to-earnings ratio sits at 19.2x, standing well above the peer average of 14.8x and the sector average of 13.2x.

- Prevailing market perspective notes this premium multiple signals significant investor expectations for future growth, but also heightens sensitivity to any growth slowdown.

- While strong past earnings growth justifies some valuation stretch, the gap to sector benchmarks means the market is betting on outperformance continuing.

- Any unexpected moderation in profit momentum could trigger rapid re-rating toward peer multiples.

Market Price Exceeds DCF Fair Value

- Current share price of ¥2,666 trades above the DCF fair value estimate of ¥2,286.35, indicating a market premium of about 16.6% over the company’s modeled intrinsic value.

- The prevailing market view highlights this as a signal of strong investor confidence in near-term delivery, though it introduces debate on whether such optimism is priced too far ahead.

- Some investors may view this premium as justified by recent growth, but value-focused buyers could consider waiting for a pullback closer to fair value.

- With no new risks flagged in filings, focus turns to how robustly F&MLtd can maintain the growth that is being priced in by the market.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on F&MLtd's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite robust recent earnings, F&MLtd’s shares now trade at a notable premium to both intrinsic value and peer companies. This increases vulnerability if profit momentum slows.

For investors who want to avoid paying over the odds, focus on these 836 undervalued stocks based on cash flows to uncover companies trading below fair value with room for meaningful upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4771

F&MLtd

Provides management support and accounting services for medium and small businesses, and individual business owners.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives