- Japan

- /

- Professional Services

- /

- TSE:4194

Asian Growth Companies With High Insider Ownership To Watch

Reviewed by Simply Wall St

As global markets grapple with concerns over AI valuations and economic uncertainties, Asia's vibrant economies continue to offer intriguing opportunities for investors. In this environment, growth companies with high insider ownership can be particularly appealing, as they often signal strong internal confidence and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| UTI (KOSDAQ:A179900) | 25.2% | 110.4% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 79.4% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 31.1% |

| Fulin Precision (SZSE:300432) | 11.6% | 55.2% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 30.3% |

Let's take a closer look at a couple of our picks from the screened companies.

Synspective (TSE:290A)

Simply Wall St Growth Rating: ★★★★★☆

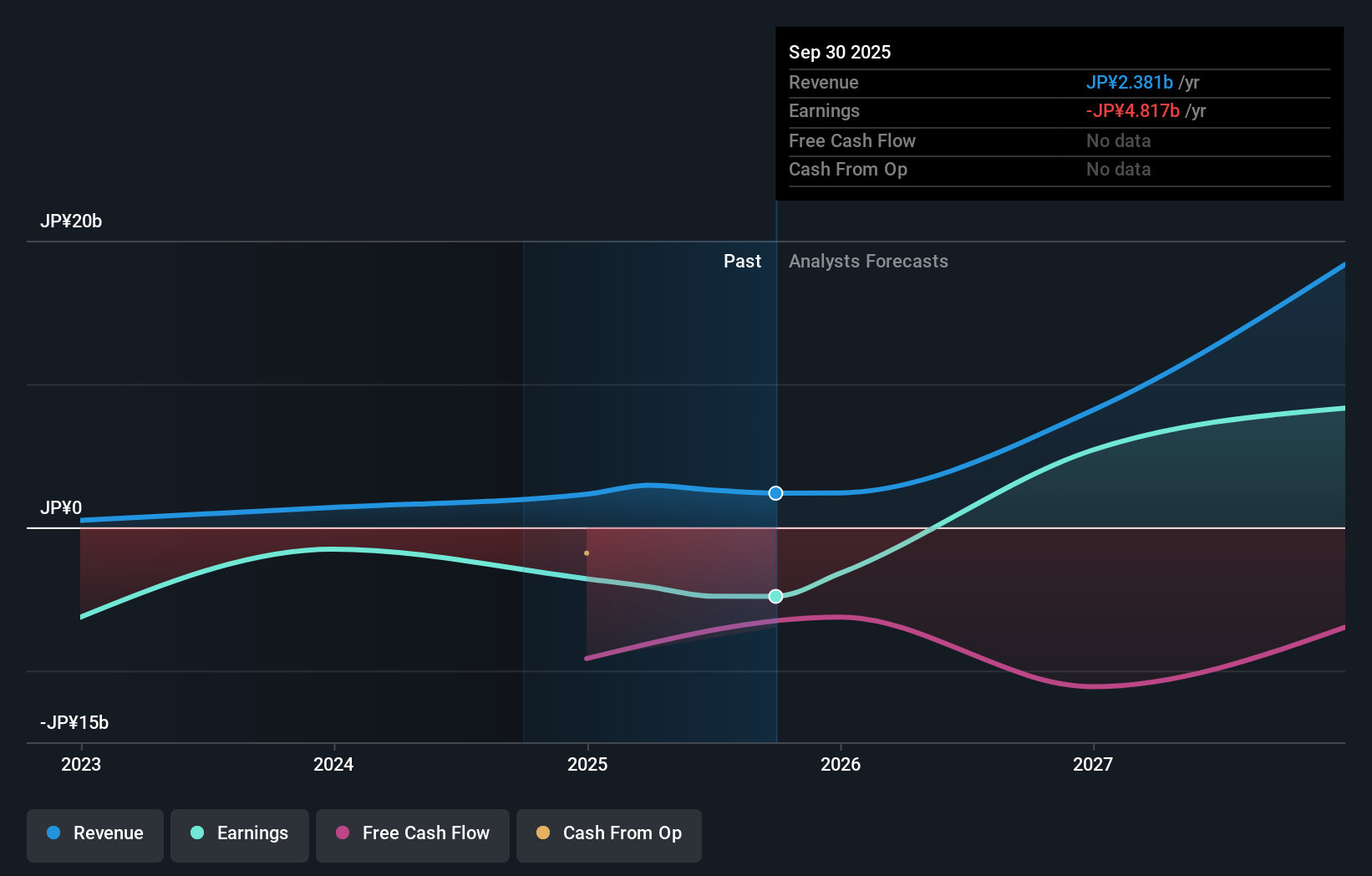

Overview: Synspective Inc. designs, builds, and operates synthetic aperture radar satellites to detect and understand changes, with a market cap of ¥126.80 billion.

Operations: The company's revenue is primarily derived from its Satellite Data Business, which generated ¥2.38 billion.

Insider Ownership: 11.3%

Revenue Growth Forecast: 50.9% p.a.

Synspective Inc. is experiencing significant growth, with revenue forecasted to increase by 50.9% annually, outpacing the Japanese market's average of 4.5%. The company expects to achieve profitability within three years, surpassing typical market growth rates. Recent developments include a private placement raising ¥4.51 billion and the successful deployment of its seventh SAR satellite, enhancing Earth observation capabilities. Despite high insider ownership and strategic advancements, share price volatility remains a consideration for investors.

- Click to explore a detailed breakdown of our findings in Synspective's earnings growth report.

- Our comprehensive valuation report raises the possibility that Synspective is priced higher than what may be justified by its financials.

Visional (TSE:4194)

Simply Wall St Growth Rating: ★★★★☆☆

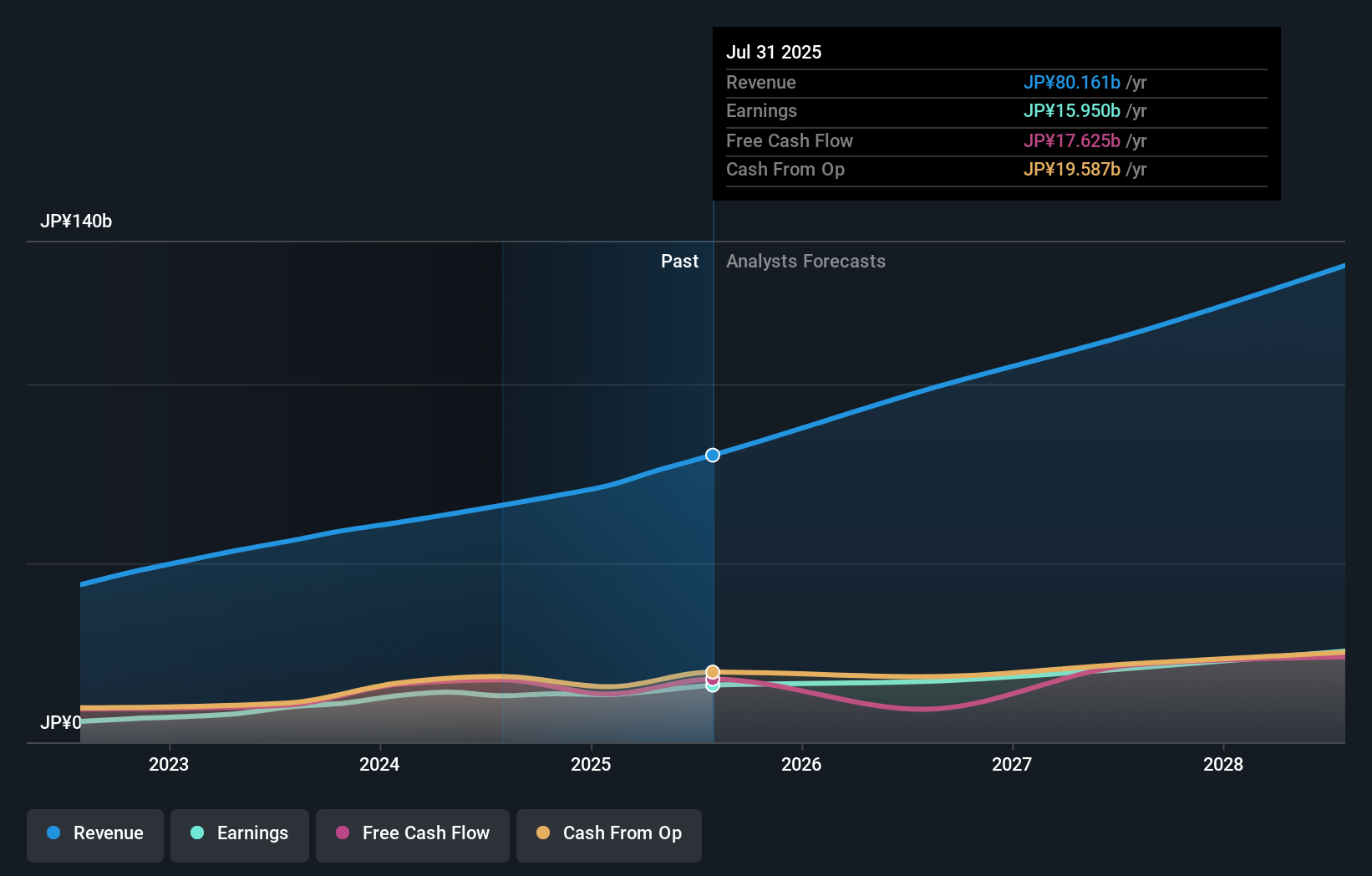

Overview: Visional, Inc., along with its subsidiaries, offers human resources platform solutions in Japan and has a market cap of ¥419.82 billion.

Operations: Visional generates revenue through its human resources platform solutions in Japan.

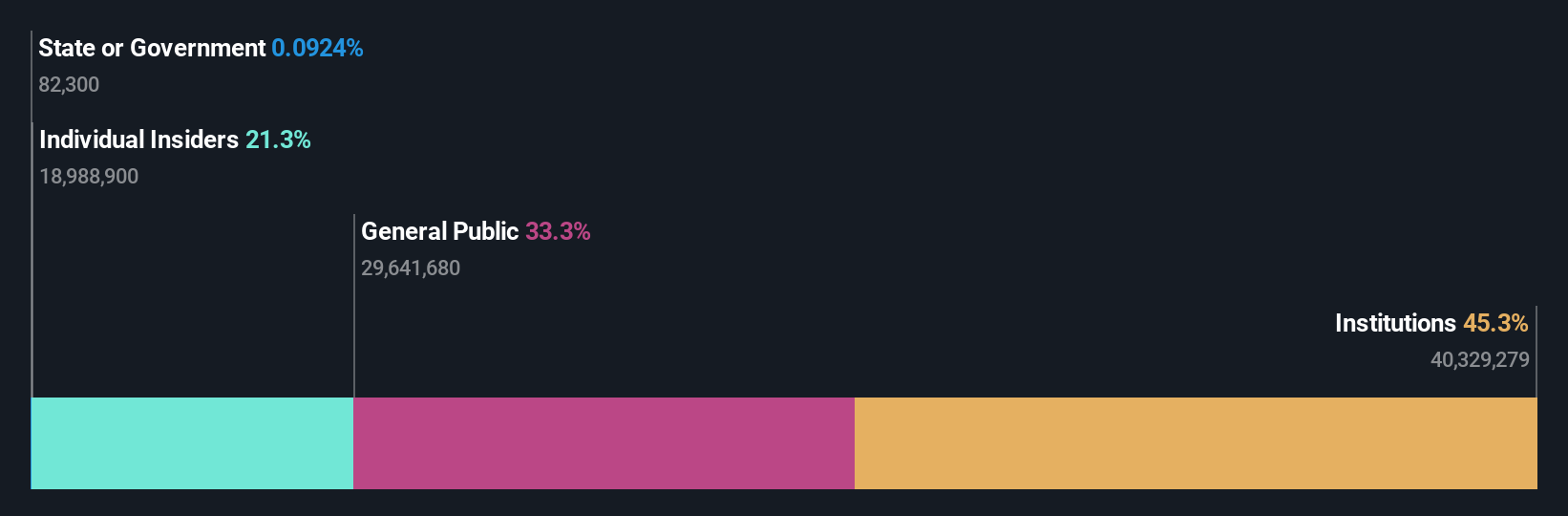

Insider Ownership: 36.5%

Revenue Growth Forecast: 13.8% p.a.

Visional's inclusion in the FTSE All-World Index highlights its growing prominence. The company forecasts revenue growth of 13.8% annually, outpacing Japan's market average, with earnings projected to rise 14% per year. Despite trading significantly below fair value estimates, insider transactions remain stable over recent months. Visional anticipates net sales of ¥99.2 billion and an operating profit of ¥23.1 billion for the fiscal year ending July 2026, reflecting strong financial expectations amidst high insider ownership levels.

- Delve into the full analysis future growth report here for a deeper understanding of Visional.

- Our valuation report here indicates Visional may be undervalued.

Japan Elevator Service HoldingsLtd (TSE:6544)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Japan Elevator Service Holdings Co.,Ltd. specializes in providing repair, maintenance, and modernization services for elevators and escalators in Japan, with a market cap of ¥347.77 billion.

Operations: The company's revenue is primarily derived from offering repair, maintenance, and modernization services for elevators and escalators within Japan.

Insider Ownership: 21.4%

Revenue Growth Forecast: 13.1% p.a.

Japan Elevator Service Holdings Ltd. anticipates net sales of ¥56.5 billion and an operating profit of ¥10.6 billion for the fiscal year ending March 2026, reflecting robust growth potential with earnings expected to increase significantly by over 20% annually, surpassing the Japanese market average. While insider trading activity remains stable, the company revised its dividend forecast to ¥19 per share post a two-for-one stock split in October 2025, aligning with its strategic focus on maintaining stable dividends amidst evolving business conditions.

- Unlock comprehensive insights into our analysis of Japan Elevator Service HoldingsLtd stock in this growth report.

- Upon reviewing our latest valuation report, Japan Elevator Service HoldingsLtd's share price might be too optimistic.

Key Takeaways

- Gain an insight into the universe of 631 Fast Growing Asian Companies With High Insider Ownership by clicking here.

- Want To Explore Some Alternatives? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4194

Solid track record with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success